Most bank analysts are projecting a modest upside for gold this year. Some are a bit more bullish (but not much) because of no meaningful cut in the US government’s gargantuan debt.

"Trump's election win in November has provided one of the most favourable scenarios for gold, due to the likelihood of elevated US fiscal spending and increased geopolitical uncertainty. – Mike Haigh, Head of Commodities Research, SoGen bank, Jan 6, 2025.

Mike certainly sounds positive, but he’s only forecasting a move to $2900 for gold, and most bank analysts seem to be targeting only the $2700 to $2800 zone.

Ironically, this modest upside scenario could provide an incredibly favourable set-up for gold miners and silver bullion.

A range trade for gold could see the miners and silver stage numerous 20% surges in 2025. Compounded, investor profits from the action could be stunning!

What about the dollar and Trump administration policy? Gold just surged from $1810 to $2790… and did it while the dollar went nowhere against a basket of competitor fiats.

The bottom line is that for trade, Trump is focused on the dollar versus other fiats, not on gold. He wants businesses and consumers to trade in US fiat, but he needs to have a weak dollar to help manage the country’s enormous trade deficit.

The entire workforce of America is only about 170 million people. That’s tiny compared to China and India. Without the use of the dollar in global trade, the US economy would collapse under the weight of its government’s debt, and the rest of the world would trade happily amongst themselves in the decades that followed. It’s arguably only a matter of time before this occurs.

The US rates chart. Western money managers focus on the fact that COMEX gold contracts pay no interest to the gamblers who buy them.

They like to buy gold when rates fall, but over the past year, the US government’s hideous debt has become a global focus point along with de-dollarization. Jay has cut rates, but in the free market… rates are going higher after each of his cuts!

When government debt reaches a “red line” point, rates rise and the currency falls. There’s a potential “loss of control” situation in play for the Fed.

That’s a different situation than most Western money managers are used to dealing with, and it can see them begin to focus on gold in a more sustained manner. America is likely on the cusp of this scenario today.

The daily chart for gold. There’s bull triangle “action” in play. Also, note the fresh buy signal for the Stochastics oscillator (14,7,7 series) at the bottom of the chart.

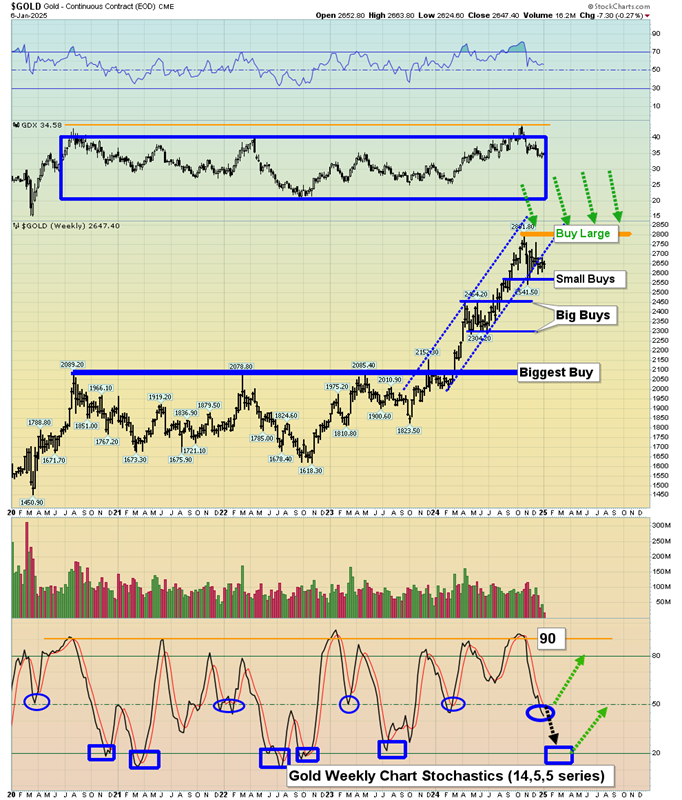

A look at the weekly chart. The 14,5,5 series Stochastics oscillator is in a zone where numerous momentum-oriented rallies have begun in the past.

While gold looks and feels incredibly solid here, it’s silver bullion and the mining stocks where the big profits can be made in a relatively short period of time.

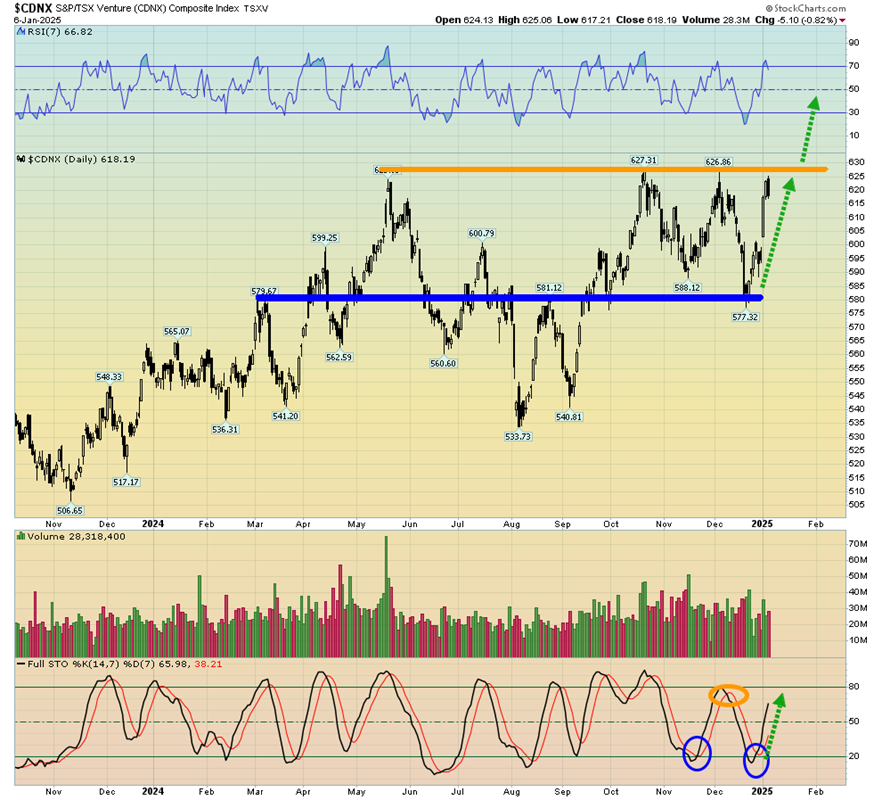

The interesting CDNX chart. A breakout over the 630-640 zone looks imminent and that’s likely to see this key junior resource stocks index rocket to 1000!

Junior miners aren’t for all investors, but a major bull run for them is almost certain to be accompanied by an awesome surge for intermediates and seniors too. The CDNX is, almost literally, the canary in the gold mine!

A look at silver, the nice-looking silver chart. The oscillators are bullish, and there’s a large bull wedge in play. A surge to $35 is likely to be the next big action for the price.

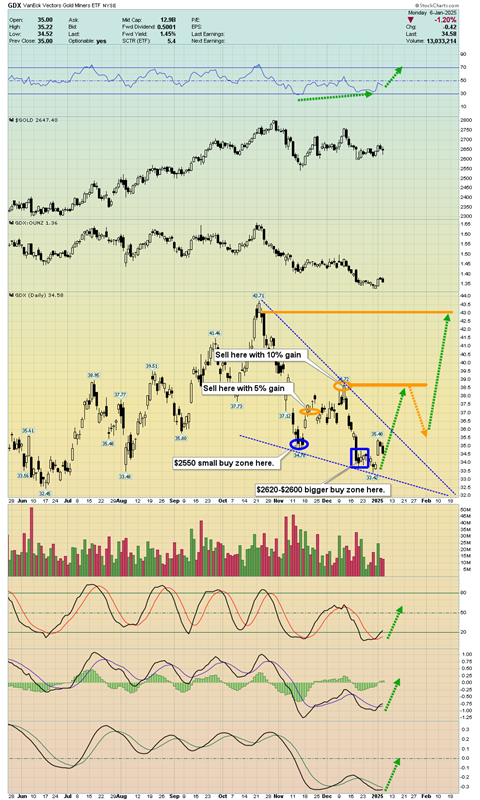

The fabulous GDX (NYSE:GDX) daily chart. The current situation is vastly more bullish than it was in mid-November.

Then, I urged gold stock investors to focus on booking 5%-10% gains from the buy zone at gold $2550. That’s because I wasn’t happy with the weekly charts of most senior and intermediate producers.

Now I am very happy with those charts, and to view one for GDX. A massive inverse H&S pattern is in play, and…

Stochastics is now the third most oversold in five years.

A rally to $43 looks to be next, and after a pause, there should be a “historic” breakout that should see GDX surge to its all-time high!