Are gold miners poised to begin a long period of outperformance against gold?

I’ve argued that most gold stocks peaked against gold bullion in 2006. VanEck Vectors Gold Miners ETF (NYSE:GDX) $31 and VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) $46 are my “launchpad” numbers for a major new bull run, a run that could last for decades.

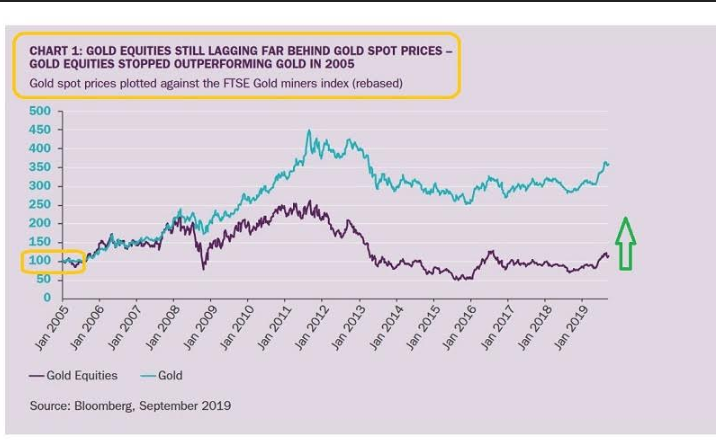

Schroders (LON:SDR) fund manager James Luke believes the miners peaked in 2005.

He argues that the company managers and directors believed the “hubris” of much higher gold price predictions that were made in 2010-2011. They spent too much money on expansion while cash flow cratered.

My view is that gold was heading to their projected prices, but a sudden Indian import duty ramp-up was unforeseeable and halted the rally. The duty hikes crushed gold demand and economic growth in the world’s most important physical gold market.

Conspiracy buffs would also argue that the “banksters” on the COMEX stopped gold from going to the higher prices that company managers were projecting.

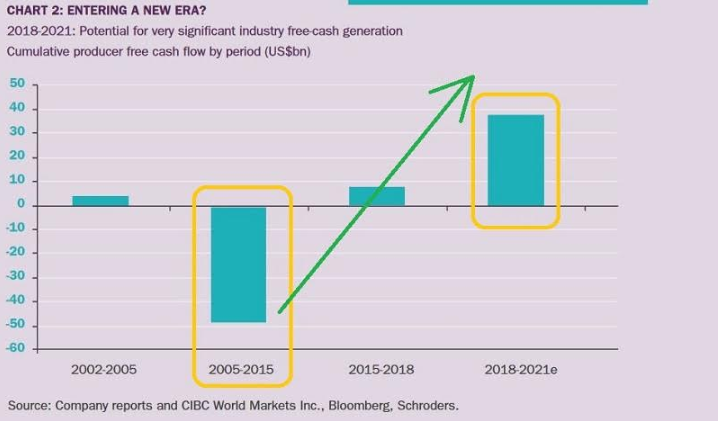

Regardless, free cash flow is the focus of most institutional investors. Cash flow bottomed in 2015 and is now rising steadily.

James makes a strong case that “Opex” deflation is going to fuel a gold stocks bull run against bullion. He argues that stagnation in global growth is creating lower operating costs for miners.

I’ll note that AISC (all-in sustaining costs) numbers are now generally dropping or rising less quickly than the price of bullion.

The “Sleigh Ride” chart.

The Dow peaked against GDX in 2018, and it has been in a horrifying downtrend since then. Interestingly, most analysts have spent the past few years bragging about how “mighty and awesome” the US stock market is, but against gold stock ETFs like GDX (NYSE:GDX) GDX and GOAU, the Dow’s performance is sickening.

On the weekly chart, the price action is even more disturbing. The bottom line:

The Dow appears to have completed a massive H&S top pattern against GDX (NYSE:GDX). It looks ready to drop “into the abyss”.

“Coronavirus will likely become a pandemic, warns ex-FDA commissioner Scott Gottlieb” – CNBC News, Feb 3, 2020.

US stock market investors are trying to maintain morale as their “poster boy” stock market craters against GDX (NYSE:GDX) and the Corona virus threatens to create a global economic growth implosion.

A double top pattern may be forming on the Dow.

Double tops occur when investor greed is at high levels. The ensuing declines tend to be emotionally destructive. Stock picking will become much more important if the general market begins a major swoon.

US government debt and spending are at all-time highs, but since it is “Trump debt” and “Trump spending”, all is supposedly well, according to most republicans. Clearly, all is not well.

Goldman analysts predict that Corona will hammer an already pathetic US GDP growth rate. Total American GDP growth was generally estimated to increase by about $400 billion in 2020, with government debt set to rise by a whopping $1 trillion… and that was before Corona arrived!

Is it any wonder that the Dow versus GDX (NYSE:GDX) sleigh ride charts look as horrific as they do?

A global growth meltdown will only spur analysts like James Luke at Schroders (LON:SDR) SDR) to increase their free cash flow projections at key gold mining companies. Since Corona appeared, operational cost deflation for the miners is accelerating dramatically!

The exciting GOAU ETF chart. For mainstream investors, a portfolio of 50% fixed income, 30% stock market ETFs, and 20% gold stock ETFs… is probably ideal.

For gold bugs, the allocation to gold stocks can be much higher. GOAU is the newest and most exciting gold stock ETF. I’m a light buyer at $16.50, and a much bigger buyer at $15.

Breakout enthusiasts need to watch the $18 area carefully. It is similar to the key “lines in the bull era sand” at $31 for GDX (NYSE:GDX) GDX and $46 for GDXJ. Investors are on the cusp of a gold bull era that will be dominated by a mining stock free cash flow surge!