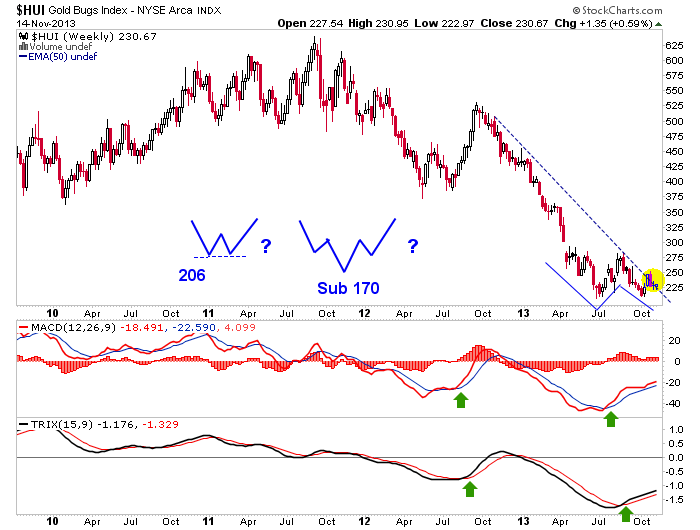

The weekly chart of the HUI Gold Bugs index asks a question we have been reviewing for some time now; is the bottoming situation implied by the up-triggered weekly MACD (and confirming TRIX) a ‘W’ bottom in the making that saw its low at 206? Or is it an Inverted Head & Shoulders (IHS), that would theoretically make a final washout below 170 as a ‘Head’ is formed?

Arguing for the ‘W’ (i.e. the bottom is in) are a growing number of gold bugs now forecasting a conspiracy-induced final harpooning of gold as the evil forces of Team Macro Manipulation destroy the last of the remaining honest money faithful. This is the psychological training that the 2+ year cyclical bear market has instilled in the average gold “community” member.

Arguing for the IHS is that as of now, monetary policy is working exactly as I would presume policy makers want it to work as inflation goes straight to the ‘right’ place on this cycle, the stock market.

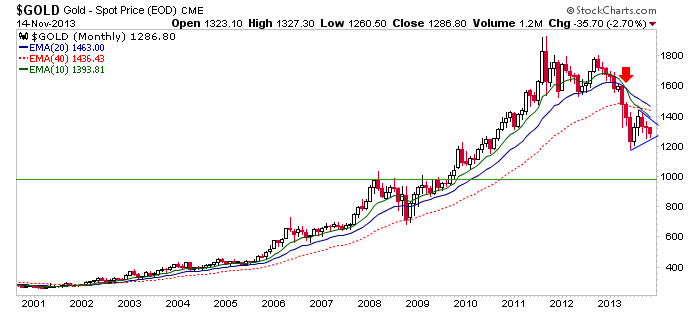

Also, there is this nagging monthly view of gold to consider.

Gold could be forming a Symmetrical Triangle, which is usually a continuation pattern. If it continues, the 1000 level is a likely destination. The 2 year long support cluster at that area (+/-) is likely to be iron clad as the energy built up during the 2008 financial market disaster was a major event. Shorter term charts say that gold can take another bounce to the top of the Triangle, but the monthly chart clearly shows that the path of least resistance is still down for the monetary metal.

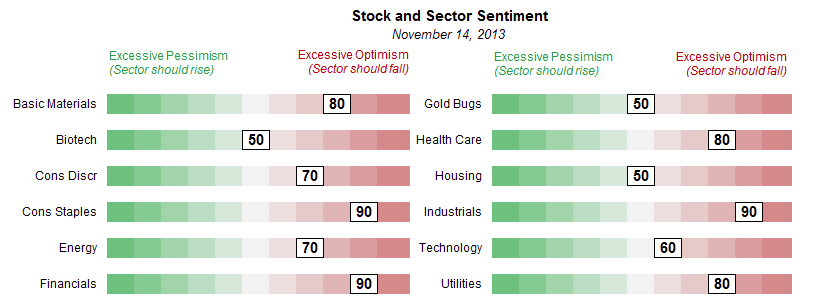

Another negative is that sentiment has been very jumpy and is no longer pinned near the former wrist-slitting level of 0 (where at times, it seemed to want to bust out the left side of the graphic) per the Sentimentrader.com aggregated data below.

There was once utter hatred of gold stocks. Now there seems to be a hair trigger mentality with people (including your writer ) scouting for the bottom every week. A tell-tale sign was back in September when the dovish FOMC rolled over and the aggregate sentiment data surged from 20% to 80% in 2 days.

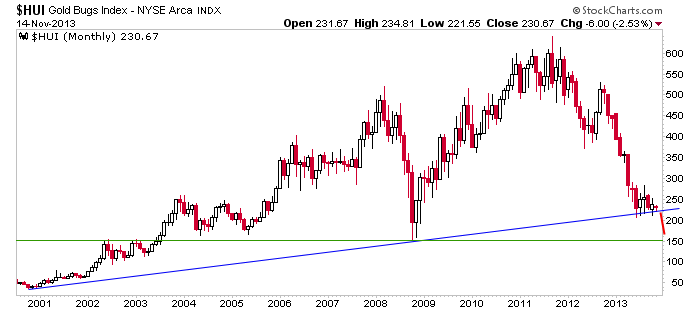

This is probably the main reason we take the IHS scenario seriously. A final dispiriting washout may be needed. Here, check out the HUI monthly chart.

Can you imagine the utter panic that would set in if the major bull market trend line (on which HUI currently sits) is broken? Can you imagine the calls for the bull market’s end by Team Trend Line? The sub-170 measurement comes from a short term pattern on a daily chart, but the point is that a ruthless bear market in the precious metals may choose to end on a final note, with everyone having given up with HUI still at a technical ‘higher low’ to 2008. That is the case for the IHS.

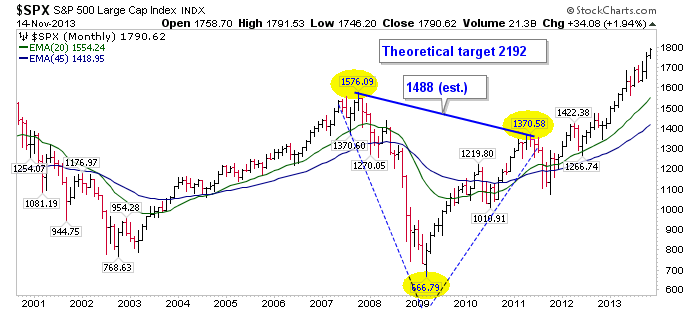

Or think of it in the context of the broad market; the gold sector is counter cyclical. Have a look around the US stock market landscape. See all those parabolic blow offs that look like silver in 2011? Could there be a final blow off in the precious metals to mark a no brainer buying opportunity as the US stock market blows off to termination? We have measured upside targets (not predictions, valid measurements) of 1378 and 2192 on the Russell 2000 and S&P 500 respectively.

Russell 2000 monthly, from NFTRH 263

Bottom Line

The June low was a valid capitulation low in the precious metals. It may end up being the final low. But there are definitely significant arguments in support of the IHS on HUI and a test of the 1000 support shelf in gold in the coming weeks or very few months. In the meantime, management of shorter term charts will help fill in the blanks on a week to week basis moving forward.

Finally, let’s review a major reason that one of the above bottoming scenarios is likely in the cards; you may recall that a negative enterprise value was posted earlier this week for an un-named gold explorer/developer: Stock Mania in the Mirror. In other words, the company’s gold in the ground is worth less than zero. Another quality junior gold miner that I know of sports a forward P/E ratio of 5.

These valuations seem to indicate that beyond the near term sentiment noise, the market does not believe gold is going to stop going down at 1000, but rather just keep on cutting through support levels to 800, 600, 500… to what, 350, where I first got on board? So while there seems to be a mania going on in the speculative end of the US stock market penthouse, there also seems to be a mania in the mirror going on in the precious metals, which are firmly in the counter cyclical outhouse.

The process is not easy, but long term players must separate themselves from the daily hype and understand that you do not invest in parabolic blow offs and you do buy value when it is utterly despised. The intention of this article is simply to delineate a couple of different levels from which value may bottom.

Now back to the shorter term picture as we manage events that are coming to a head in the broad markets and in the counter cyclical gold sector. These events could be measured in weeks or months, but changes are coming

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Stocks Bottoming Scenario - 'W' Or 'IHS'?

Published 11/17/2013, 12:13 AM

Updated 07/09/2023, 06:31 AM

Gold Stocks Bottoming Scenario - 'W' Or 'IHS'?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.