Since we called for a bottom a few weeks ago, gold and gold stocks have tested that call.

Gold and gold stocks rebounded but then appeared to begin another leg lower. This week had some optimism, but Thursday’s decline erased the optimism.

Traders and analysts (uh, me) are getting whipsawed.

The gold stocks are oversold enough and corrected enough for a bottom to form, but ultimately, only price action can confirm.

If it continues for several days, Thursday’s decline could lead to a “V” type of rebound, but from lower levels.

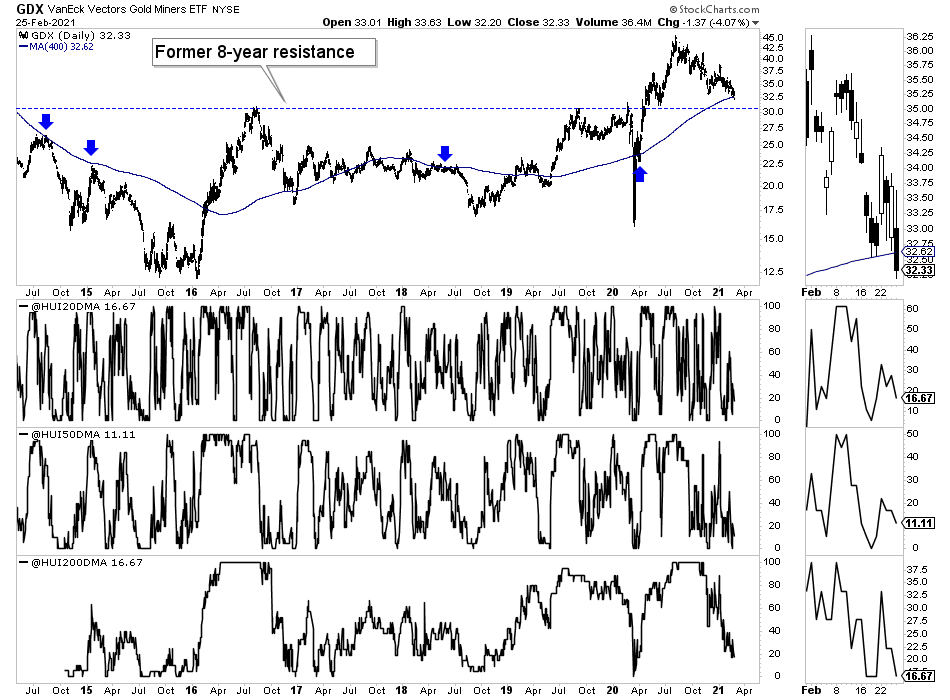

GDX had been holding its 400-day moving average until Thursday, when it plunged to $32.33. It could test its former resistance just below $31. The monthly chart shows support at $29.80.

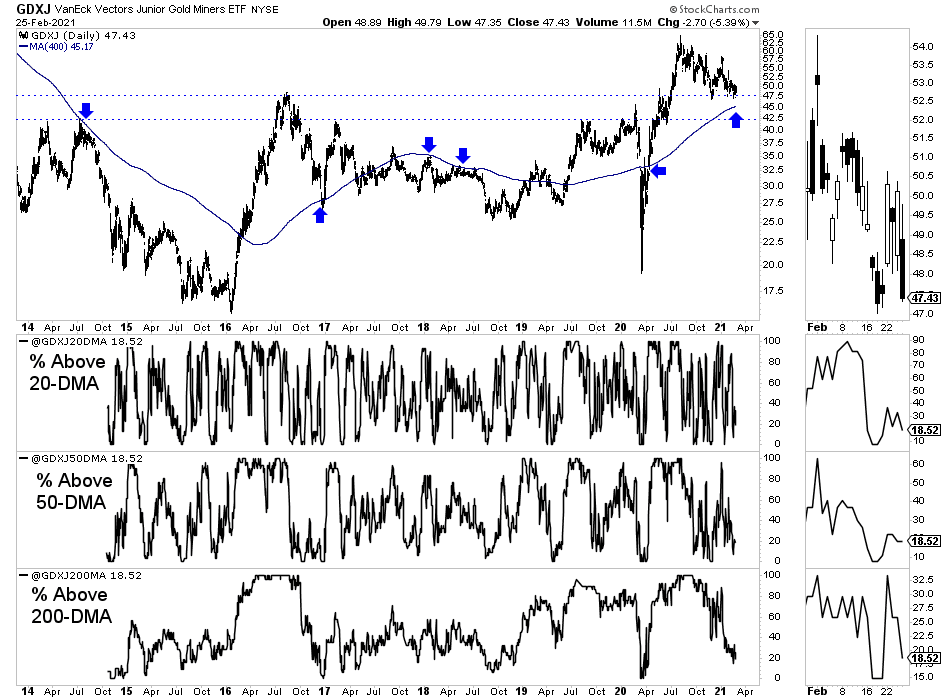

GDXJ had been holding above its former 8-year resistance (~$47), but Thursday’s decline puts that in jeopardy. GDXJ should test its 400-day moving average at $45 and also has a confluence of support at $42, which would be a 10% decline.

As you can see, the breadth indicators for both GDX and GDXJ are very oversold. A little more selling could push those readings to or below 10%, which would mark an extreme.

The gold stocks have struggled to find a bottom in recent weeks, and therefore they may need a quick puke to flush out the weak hands and bring in the bottom fishers and value buyers. The same may be true for gold, so keep an eye out for a major confluence of support at $1690 to $1700, should Gold falter here.

Stepping back from the minutiae of trying to spot an exact bottom, I want to note the larger picture and what is important.

Successful investing requires few decisions and quite a bit of inaction.

Back in late summer and early fall, we noted it was a time to do nothing. The sector was overbought and needed to correct in price and time.

This is a time to buy.

We could get a bit more selling or a flush, but we are fairly close to what should be a significant low.

High-quality junior gold companies are down 30% and 40% from their recent peaks in a few cases. Some companies that are a step or two lower on the quality scale are down as much as 60%.

The value now is dramatically better than two months ago and especially seven months ago.

It’s time to accumulate juniors to put yourself in a position to capitalize on the next big breakout, which would take gold from nearly $2,100 towards $3,000.