Today we’ll discuss which gold companies have prospered most from the gold price surge over the past year

SmallCapPower | August 23, 2019: On August 13, the gold price hit a six-year high, reaching US$1,533/ounce, likely driven by several factors including unrest in Hong Kong, a plummet in the Argentine peso, and the flattening of the yield curve. Many investors of late have been fleeing from riskier assets, such as bonds and stocks, and buying gold, which is viewed as a safe haven in times of political and economic uncertainty. When the market price of gold goes up, companies that mine for gold prosper as the product they sell increases in value. But which gold stocks are benefiting most from this surge?

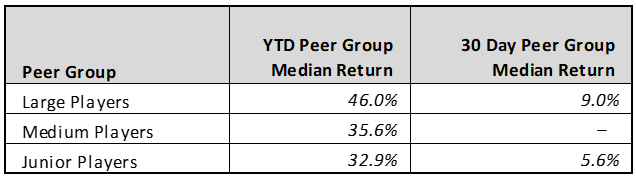

As a result of the rising gold price we have noticed, perhaps not surprisingly, that capital has been injected primarily into the larger gold companies throughout the world and is beginning to trickle down into the smaller players.

Some of the larger Canadian gold companies that have surged recently include Kirkland Lake Gold Ltd (TSX:KL) and Kinross Gold Corp (TSX:K), which have realized year-to-date returns of 64.6% and 44.1%, respectively.

Kirkland Lake Gold is a Canadian, U.S., and Australian-listed gold producer that owns five underground mining operations in Canada and Australia. These mines include:

Kirkland Lake Gold produced 723,701 gold ounces in 2018 and is targeting production of 950,000-1,000,000 ounces in 2019. On August 22, Kirkland Lake Gold announced that it has acquired 2,000,000 units of Bonterra Resources Inc by way of private placement financing and by share purchase for a total cash payment of $5M.

Kinross Gold is a Canada-based senior gold mining company with mines and projects in the United States, Brazil, Russia, Mauritania, Chile and Ghana. The Company’s operational mines include: Fort Knox, an open-pit gold mine located in Alaska; Round Mountain and Bald Mountain, open-pit mines both located in Nevada; Paracatu, a gold mine located in Brazil; Maricunga, an open-pit mine located in Chile; The Kupol Gold mine located in Russia; The Tasiast mine located in Mauritania; and the Chirano mine located in Ghana. On July 31, Kinross Gold Corporation announced an agreement with N-Mining Limited to acquire Chulbatkan, a heap-leach development project, for a total fixed consideration of $283M ($113M in cash and $170M in Kinross shares).

The spot price of gold per ounce ending Wednesday’s trading session at US$1,502.67.