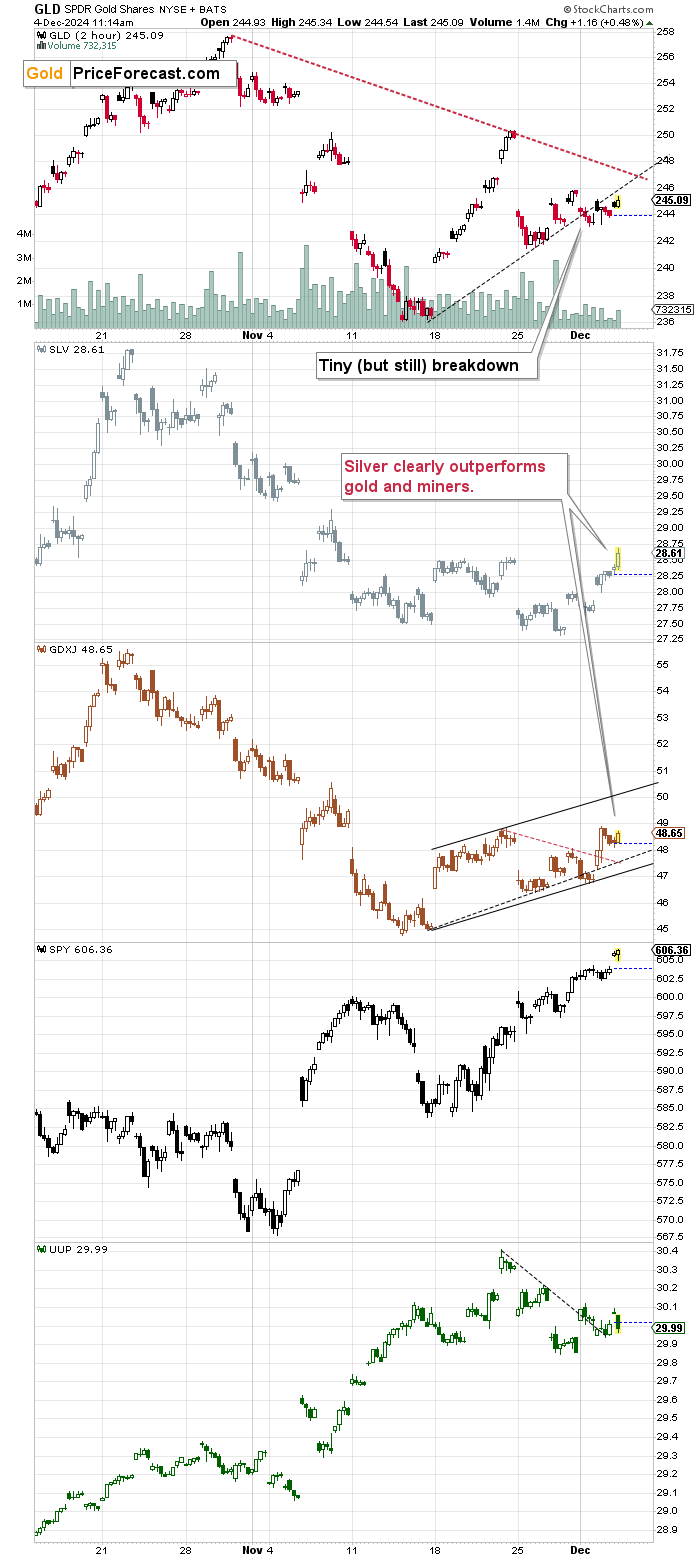

The market action suggests that the corrective upswing is maturing and likely about to end. How can we tell? Silver.

Silver is outperforming today, while miners are no longer doing so.

In yesterday’s Gold Trading Alert, I wrote about the likely reason behind the rally in silver and miners (and the same applied to the copper market):

Here’s the likely explanation. Quoting from Yahoo! Finance:

“China on Tuesday banned exports to the United States of the critical minerals gallium, germanium and antimony that have potential military applications, escalating trade tensions the day after Washington's latest crackdown on China's chip sector.”

This time, the trade war put minerals in the spotlight. This likely meant investors concerned that raw materials and commodities on general might be subject to similar actions. And if the supply of something goes down, the price for it would likely go up. For instance, silver has multiple industrial applications, so many investors might have gotten concerned and started to view silver as more valuable.

Higher prices of commodities also means that the companies mining them might be able to sell them at higher prices, this making more money. This made the share prices move higher.

But… Do those moves have merit? Will they last?

I wouldn’t say that it’s likely. Banning or limiting the export of materials needed for military applications is one thing, and applying the same measure to the other commodities based on that (especially gold) is pre-mature.

There is something called the “contagion effect”, which means that investors can panic because one market seems related to the other even though in reality it isn’t. E.g. during the crisis in Argentina many years ago, many other developing countries started to experience problems despite having no meaningful links to the Argentinian economy. Why? Because global investors incorrectly thought that there’s problem “on the emerging markets” and not just in Argentina, and thus took capital out of other countries as well, thus causing economic problems.

Similarly, a kind of contagion is likely playing out here.

I don’t think it will last long, as it’s quite clear that those are different markets – and it’s more obvious than it’s been the case with the emerging markets example.

The alternative explanation could be that the martial law was introduced in South Korea, but I do not think that the markets really believed that it was anything to really worry about. In the comment to yesterday’s Gold Trading Alert, I added:

Also, some may say that the martial law being enforced in South Korea is the reason behind today’s strength, but that’s something that would be likely to trigger a rally in gold (not gold stocks) as gold serves as the safe-haven asset. So, the odds are that it’s actually news coming from China that’s primarily moving the mining stocks today.

In other words, the lack of gold’s action called it a bluff. Indeed, the market got it right, as the martial law episode was short-lived.

While this likely (we’ll see how it all plays out in the coming days) wasn’t a big deal, let’s keep in mind that such black-swan events could happen, and this is why we’ve been suggesting keeping gold as part of one’s insurance capital (yes, it’s been there for years – it’s below the “Trading” and “Investment” parts in the summary part), and what we just saw in South Korea might serve as a reminder to make sure that this part of the portfolio is taken care of.

If you’ve been neglecting it, this might be the perfect time to tend to it. Keeping some gold in one’s physical possession is suggested as that’s the safest form, but it might also be a great idea to consider keeping some gold in one’s IRA for tax benefits. I’m no tax advisor, and that’s not investment or tax advice, but I do suggest getting a guide on that and making a choice after getting more information.

Why am I saying that this correction is likely close to its end? Just like I stated before, silver is outperforming gold, just like it did yesterday, but unlike yesterday, miners are no longer strong.

Consequently, I don’t think it would be correct to attribute today’s gains to the continuation of the “contagion effect” – if this was the case, miners would be strong today as well. If it’s not that, then it’s likely the regular silver-outperforms-close-to-the-top effect.

Bullish Sentiment May Be Misleading

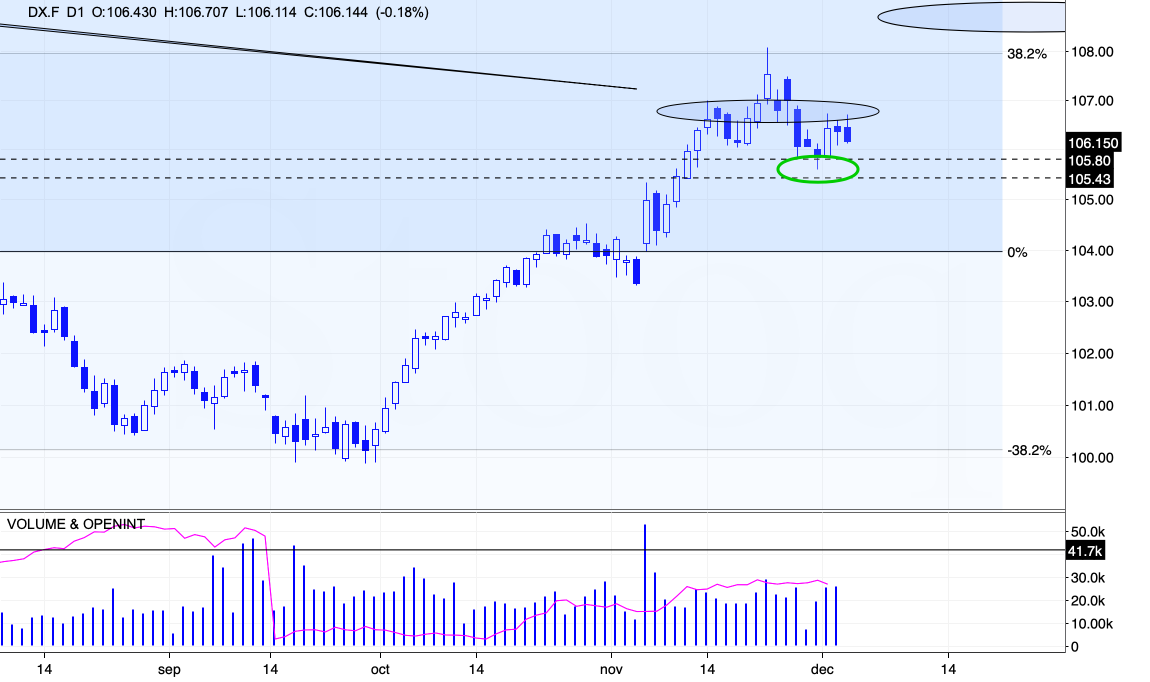

Also, you might be wondering – is the USD Index forming a head-and-shoulders top here?

That’s certainly possible, given the recent price moves, but it’s not inevitable. The US Dollar Index already corrected as much as it did previously after similarly big rallies and previous resistance was verified as support. The short-term bottom might already be in.

IF the USDX confirms the move below 105.4 or so (which is where the neck level of the pattern would be), then we might see another move lower in the USDX and a move higher in the precious metals market, but as of today, it doesn’t appear likely.

All right, enough about the trees, let’s look at the whole forest.

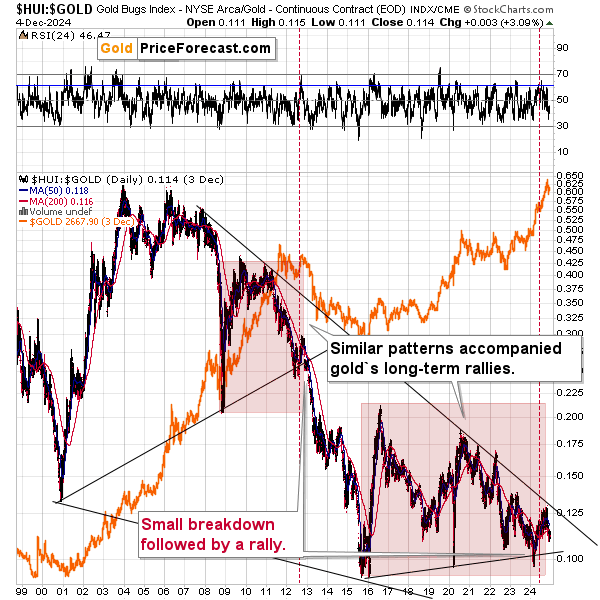

Gold stocks to gold ratio is something that does a great job at showing that’s really going on in the long run. Yes, we did have a major rally, but the ‘problem’ with it is that it looks just like what we saw after the 2011 top along with the post-top consolidation.

In early 2024, there was a fake breakdown below the rising support line, which was followed by a counter-trend rally – above the 200-day moving average. The trend has already reversed, though, and if history teaches us anything, it seems that this is the beginning of a much, much bigger downturn.

Sure, it’s difficult to believe that this is the case, as the most recent memory that we have right now is a big rally… But it was exactly the same case in 2012 and 2013 before the slide. Pretty much everyone was expecting gold and mining stocks to continue to rally as the “correction” seemed to be over. Well, that correction lasted many years.

Let’s keep the above in mind and treat the current bullish sentiment with at least some doubt.