Most investors spend their time wondering what might be next for the price of their investments. In contrast, professionals focus on zones for buy and sell action.

Pre-planned action is the key to metals market success and once the buy zones are set, all that’s left for an investor to do is decide whether they want to buy gold, silver, or the miners in those key zones… and sometimes it’s a good idea to buy them all!

It’s the same principle on the sell side; identify the zones for action, and if the price goes there, be bold and take most or all of the action that was initially planned.

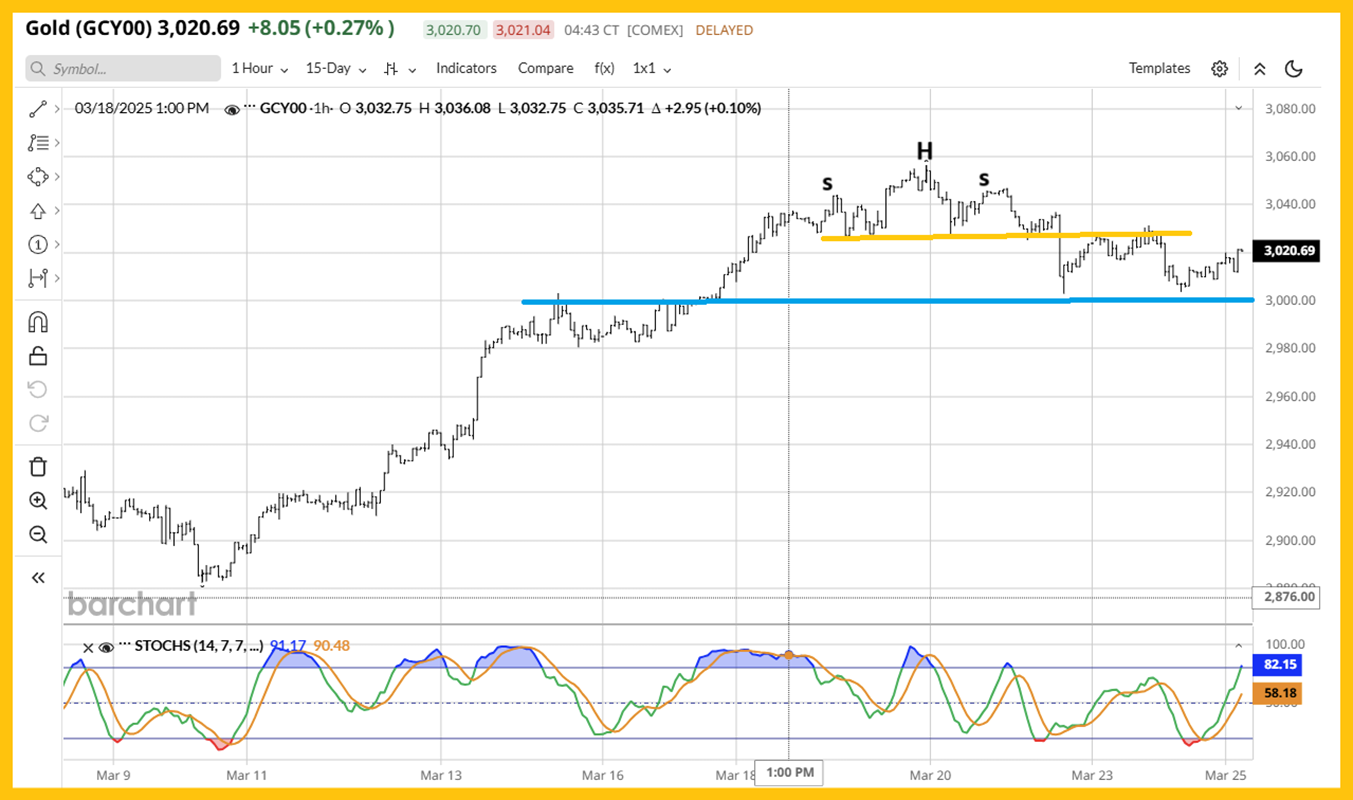

The key action zones for gold chart. The average gold market investor should have capital set aside to buy at $2956, $2880, and $2800.

Note that round numbers like $3000 can function as strong support or resistance. Investors who don’t currently have enough fiat cash to buy the above zones with relative comfort should consider booking some profits here in the $3000 area, to give themselves the ability to act when needed.

Oscillators like RSI and Stochastics can be helpful, but they are best used for tweaking what items and how much of them an investor buys in the pre-set price zones, rather than trying to use them as standalone schemes to buy or sell.

The short-term hourly gold chart. As noted, soft and toppy price action is expected and normal when gold hits a big number like $3000…

But that’s just short-term noise.

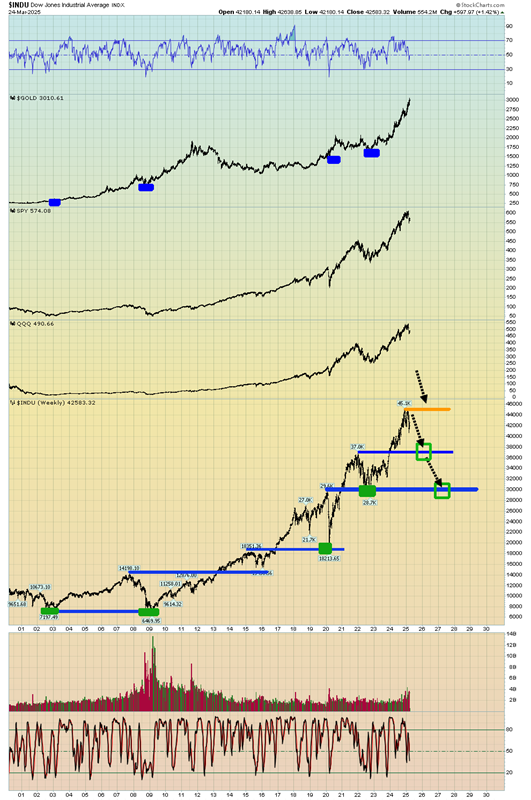

The same principle applies to stock markets; there are zones to prepare for, to buy and sell, but whether the price actually goes to those zones is mostly a guessing game.

Unfortunately, most investors take the guessing game approach; they try to forecast where the price will go and they invest based on their forecast. That approach is fraught with danger.

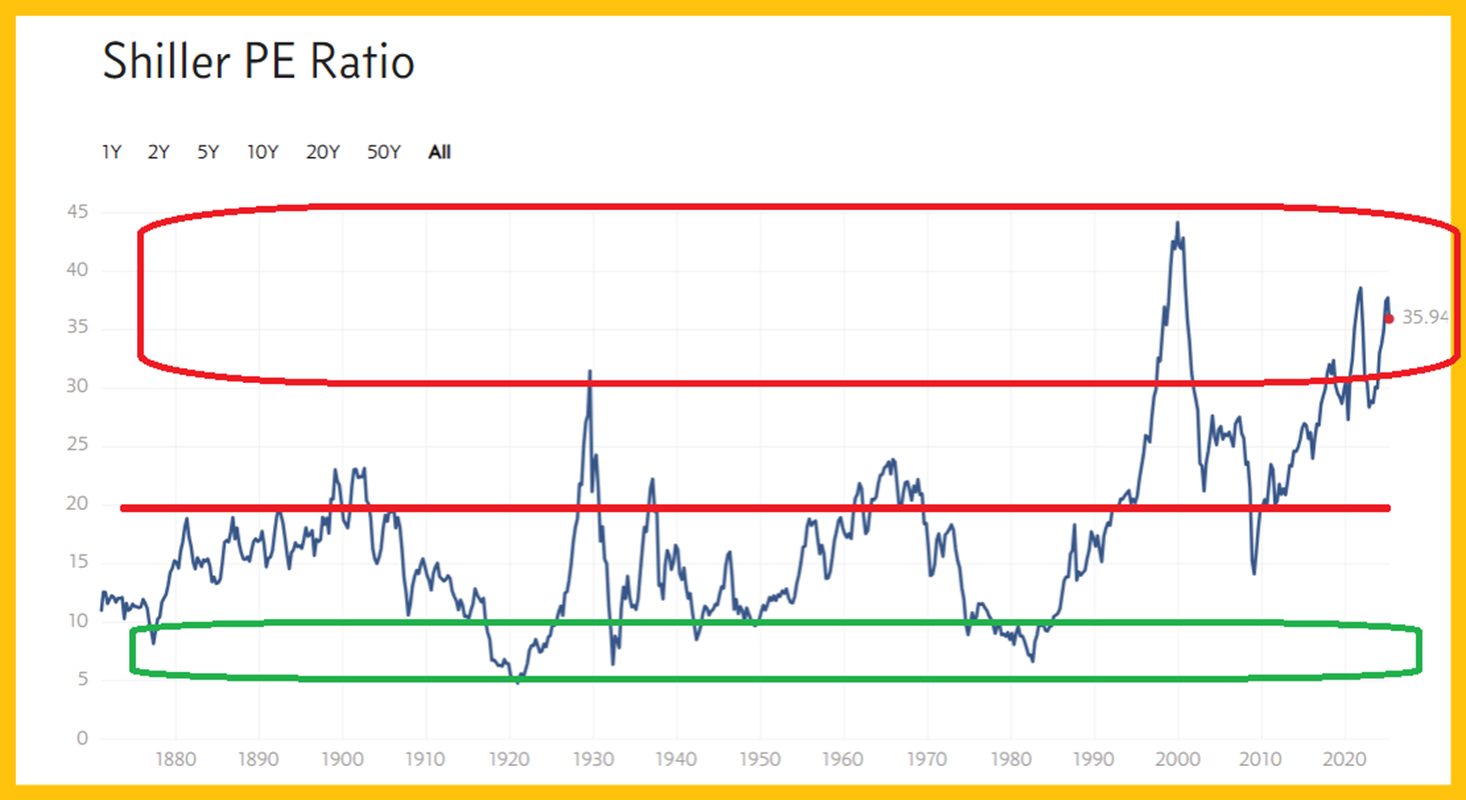

Like oscillators, valuation ratios like this Shiller/CAPE ratio can help an investor decide whether to invest heavily or lightly in a pre-set buy zone.

In the case of the US stock market, the Dow 37,000 area is a significant buy zone, but the market is so outrageously overvalued that all planned buys should be small.

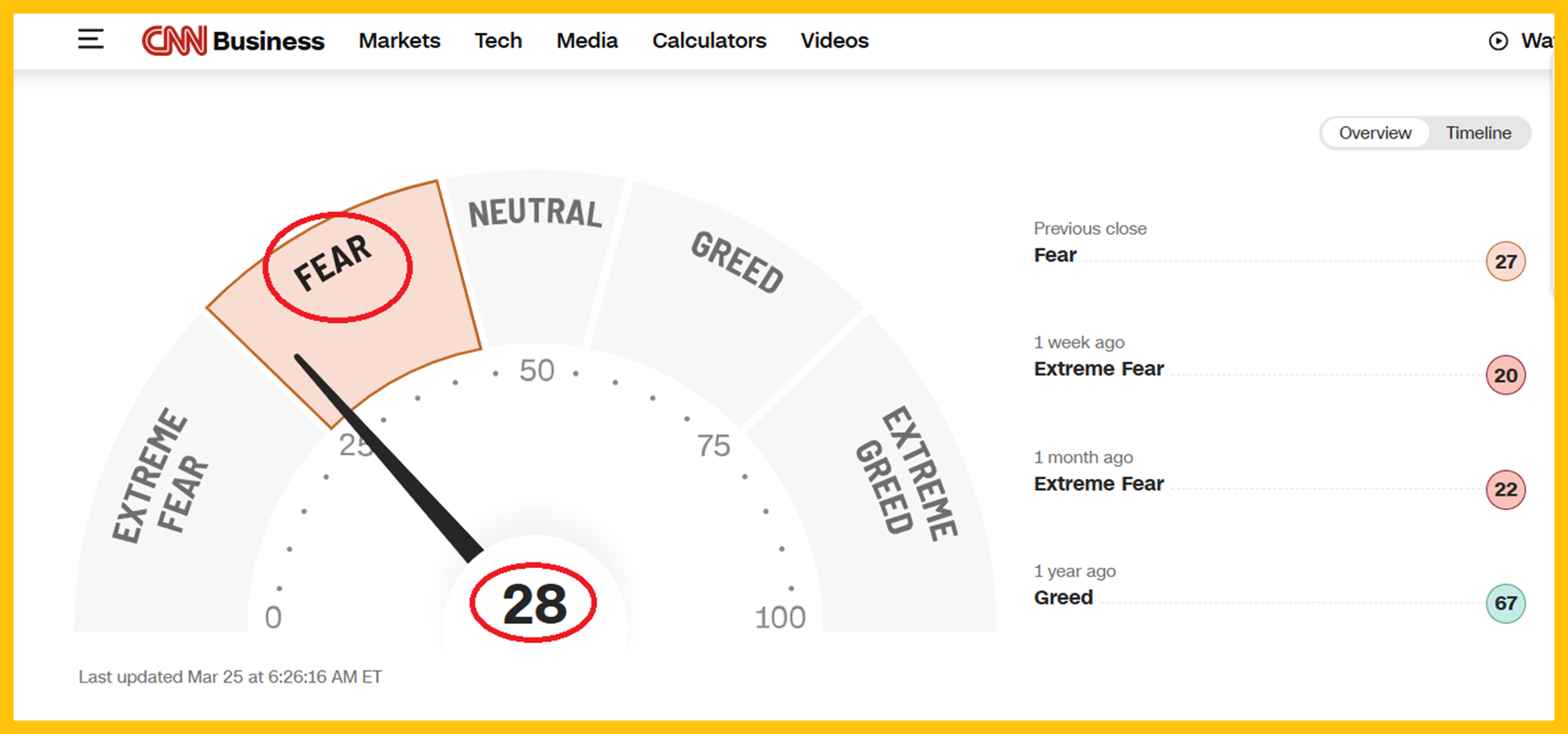

The Dow recently dipped by only about 9%, but that tiny move down put most stock market investors into a state of incredible panic!

That’s because they over-allocated to the market at a time when they should be under-allocated. Massively overvalued markets usually fall on news of significance… and that news can terrify investors.

A daily focus on the big picture is critical for investors as inflation, tariff taxes, a wildly overvalued stock market that is now on fire, debt ceiling horror, empire transition, and potential gold revaluation dominate the investing landscape.

In contrast to the stock market, gold stocks are currently the world’s most undervalued asset class.

Quite frankly, the undervaluation is so great that gold bullion could fall 50% in price while GDX (NYSE:GDX) doubled… and the miners would still be significantly undervalued!

This severe undervaluation means that investors can buy with more aggression when the price arrives in a key buy zone.

GDX is exhibiting some very positive “staircase” price action.

The pullback to the $38.50 buy zone was followed by a stunning surge to $45. That’s a 15% gain… in just two weeks!

Aggressive gold stock investors could prepare to buy at about $43-$42. Gamblers could buy right now, based on the exciting bull flag in play. The target of that flag is the round number $50.

Conservative players should wait for a bigger pullback into gold bullion buy zones like $2956, $$2880, and $2800. If that pullback occurs, they can do some gold stock buys then, and tweak the size based on oscillators, sentiment, etc.

What is clearly one of the world’s most majestic charts. While US stock market indexes have ugly bearish tops, GDX sports an unorthodox (and incredibly bullish!) cup and handle pattern.

The pattern is so bullish that the handle is inside the cup itself, opening the door to a potential flagpole surge to the target of $60! On upcoming pullbacks into key zones to buy, I’ll dare to suggest it won’t be about backing up any trucks, but it could be about loading a fleet of starships with gold, silver, and miners… for a multi-decade ride, into a much higher priced sky!