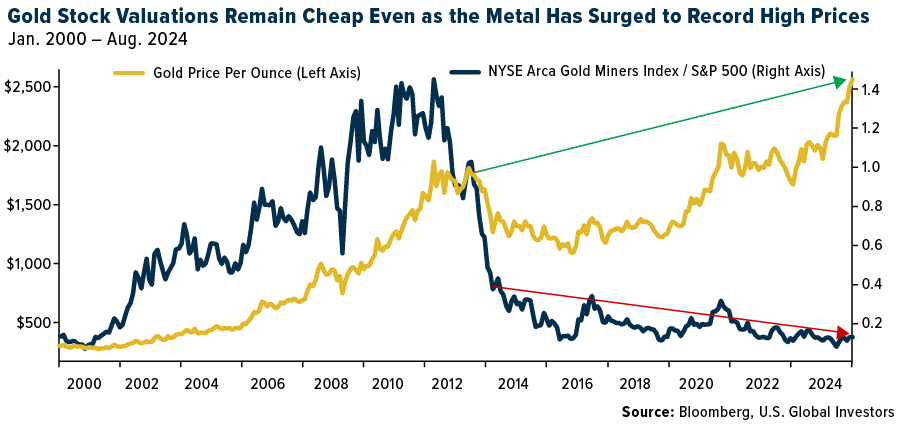

As I write this, gold is trading just under $2,500 an ounce after surging past the psychologically important level for the first time ever in mid-August. For seasoned gold mining investors, this should be a moment of validation. After all, the yellow metal has long been seen as the ultimate hedge against economic uncertainty.

And yet, despite the bull run, gold stocks—those companies that mine, process and sell the metal—are trading at historically low valuations relative to the market.

This apparent disconnect offers contrarian investors an extraordinary opportunity.

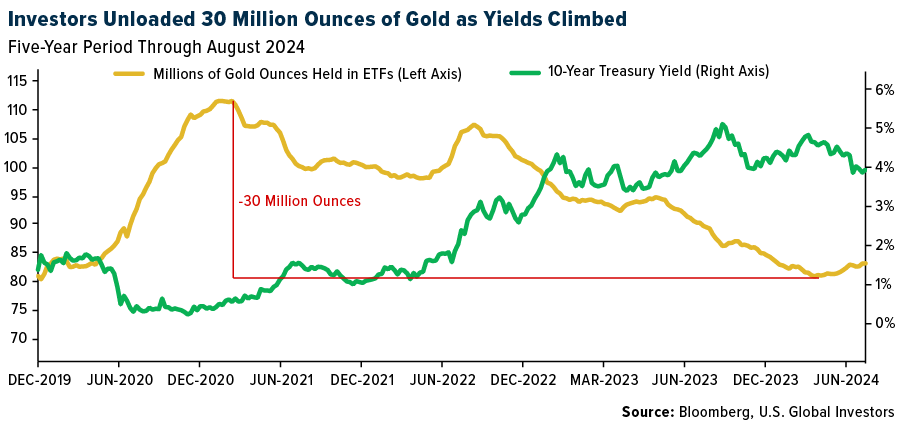

Rising Yields and the Gold Selloff Explained

But first, why is this happening? The primary culprit for this disparity, I believe, lies in the impact of interest rates and central banks’ gold-buying spree. The real, inflation-adjusted 10-year Treasury yield rose from a low of around -1.2% in August 2021 to nearly 2.5% in October 2023, and for many investors, particularly those in Western countries, rising yields are a signal to sell non-interest-bearing gold.

That's exactly what happened. From the end of 2020 to May 2024, exchange-traded funds (ETFs) backed by physical gold shed approximately 30 million ounces, over a quarter of their total holdings, as yield-seeking investors pared back their positions.

What some investors may have overlooked, I’m afraid, is the long-term potential of the very assets they were letting go of. Gold stocks, unlike the physical metal, offer not just a hedge but also a means of participating in the upside of gold prices. Put another way, when gold prices have gone up, gold stocks have historically tended to rise even more.

Right now, I believe these stocks are offering an unprecedented combination of low valuations and high potential returns.

A Contrarian Take on Gold Stocks

As contrarians, we understand that the best time to invest is often when sentiment is at its lowest. And sentiment around gold equities is pretty low right now.

But history tells us that this could be the perfect time to buy. As you may be able to tell in the chart above, we’re seeing a reversal of the gold ETF selloff. Since mid-May, investors have added about 2.3 million ounces of gold, according to Bloomberg data; holdings now stand at their highest level since February of this year.

This could be just the beginning. If real interest fall substantially, the tide could turn in favor of gold and gold equities.

$3,000 Gold by Mid-2025?

Historically, gold’s biggest gains have occurred when the Federal Reserve cuts interest rates amid economic uncertainty. Although there’s no obvious crisis on the horizon, markets are pricing in a 25-basis point cut at each of the next two Fed meetings in September and November, with a larger cut expected in December.

If the Fed follows through, we could see gold prices not only maintain their current levels but soar to new heights. UBS is calling for $2,700 gold by mid-2025; Citigroup, Goldman Sachs and Bank of America all see the metal hitting $3,000.

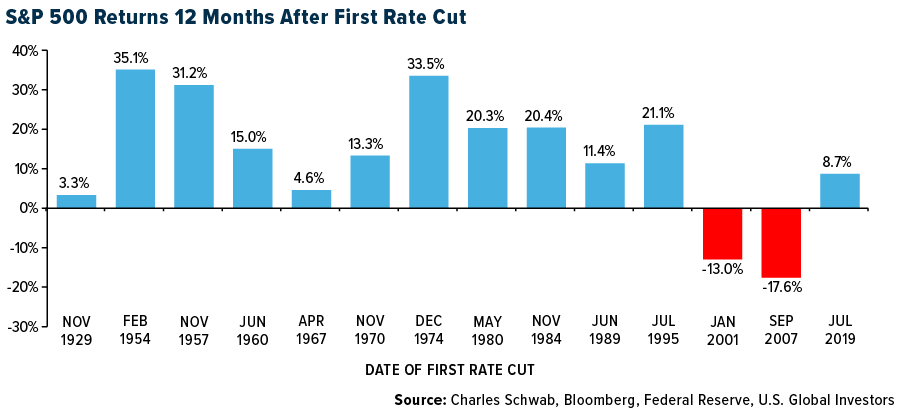

Stock Market Trends After the First Fed Rate Cut

That’s not to say you should dump all your equities in favor of gold, especially as the Fed is on the verge of easing. Charles Schwab recently showed what stocks did in the past when rates fell, and investors may want to take note.

The stock market traded up 12 out of 14 times—or 86% of the time—a year after the Fed made its initial cut in a new easing cycle. Schwab points out that the two back-to-back negative periods were predicated on extraordinary circumstances: the dotcom bubble in 2001 and the housing crisis in 2007. Past performance is no guarantee of future results, but it’s worth considering.

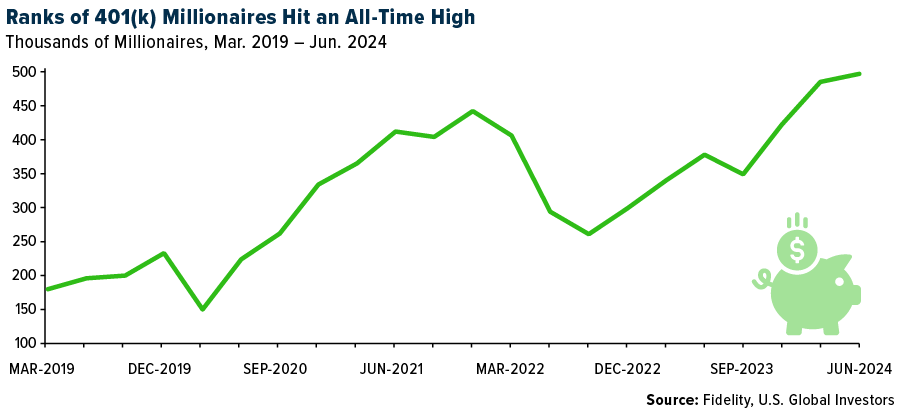

This is excellent news for general investors, including the record number of “401(k) millionaires”—investors who have $1 million or more in their retirement accounts. According to Fidelity, there are now almost half a million such millionaires… and growing!

As always, I encourage you to do your own research, consider your risk tolerance and consult with your financial advisor. But from where I stand, the opportunity in gold equities is one that should not be overlooked.