After surging about 50% from my $1810 buy zone in October of last year, gold is finally getting some mainstream media attention.

Does the arrival of Main Street herald a peak for gold and a pullback of significance?

There’s no question that on this important weekly chart, gold is technically overbought, basis the key Stochastics and RSI oscillators.

Having said that, Main Street “price chasers” often tend to see fast gains after their initial buy. That gives them confidence, so they buy again, and it’s generally from the area of their secondary buys (made with too much confidence) that significant pullbacks begin.

The price action on this weekly close chart suggests that the above scenario is exactly what lies ahead for gold.

A surge to the $3000-$3300 target zone would generate much more mainstream coverage than exists now… especially if the rally happens while the US stock market’s recent stagnant action becomes a significant swoon.

It’s quite possible that the US stock market is forming some kind of “super top” in the tail end of an ominous Elliott wave five.

Regardless, I’ve urged stock market investors to be in sell mode and wait for a drop to the Dow 37,000 zone before doing any fresh buys.

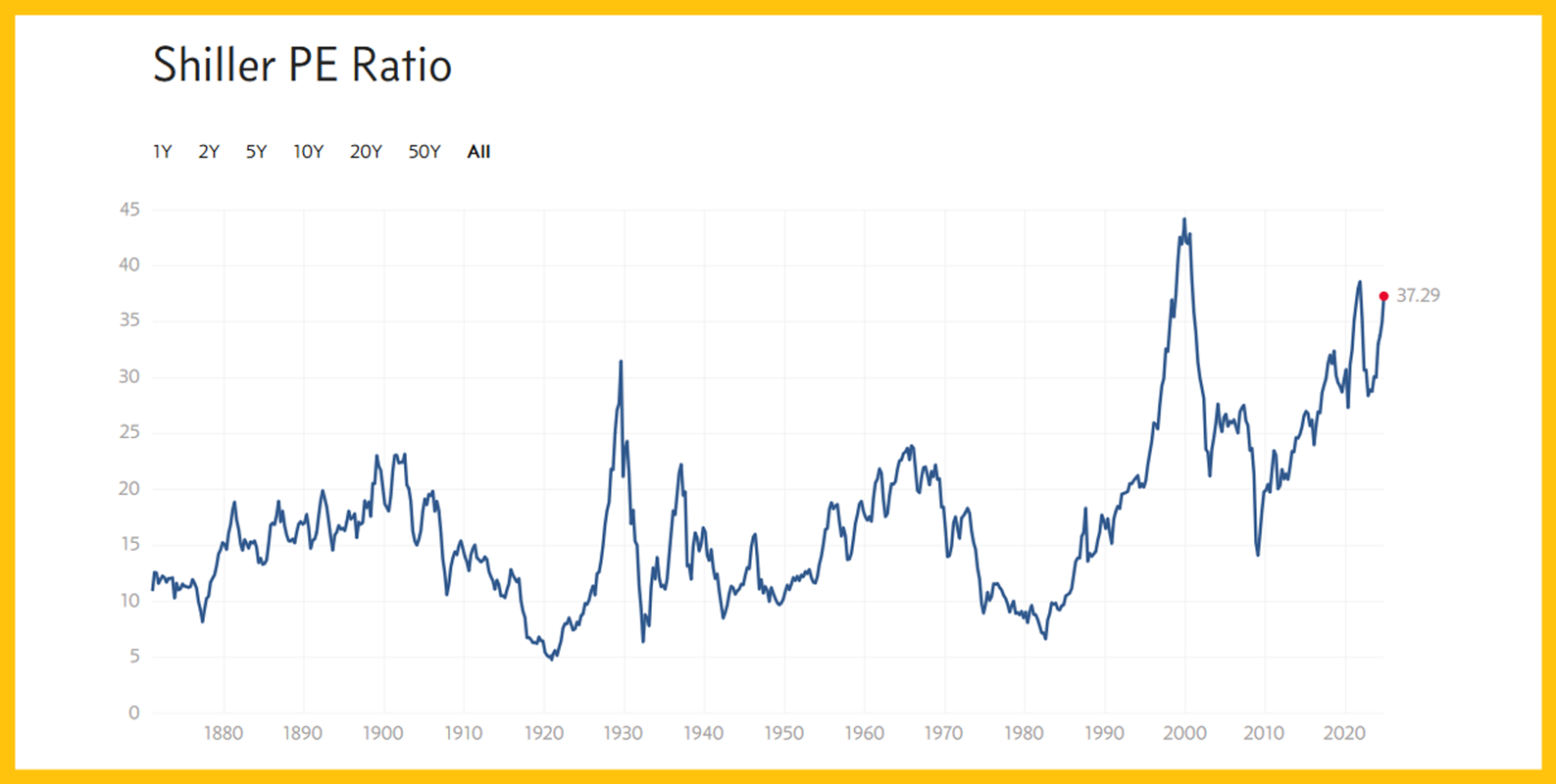

The Shiller/CAPE ratio is also outrageously high... higher than it was at the peak of the market in 1929.

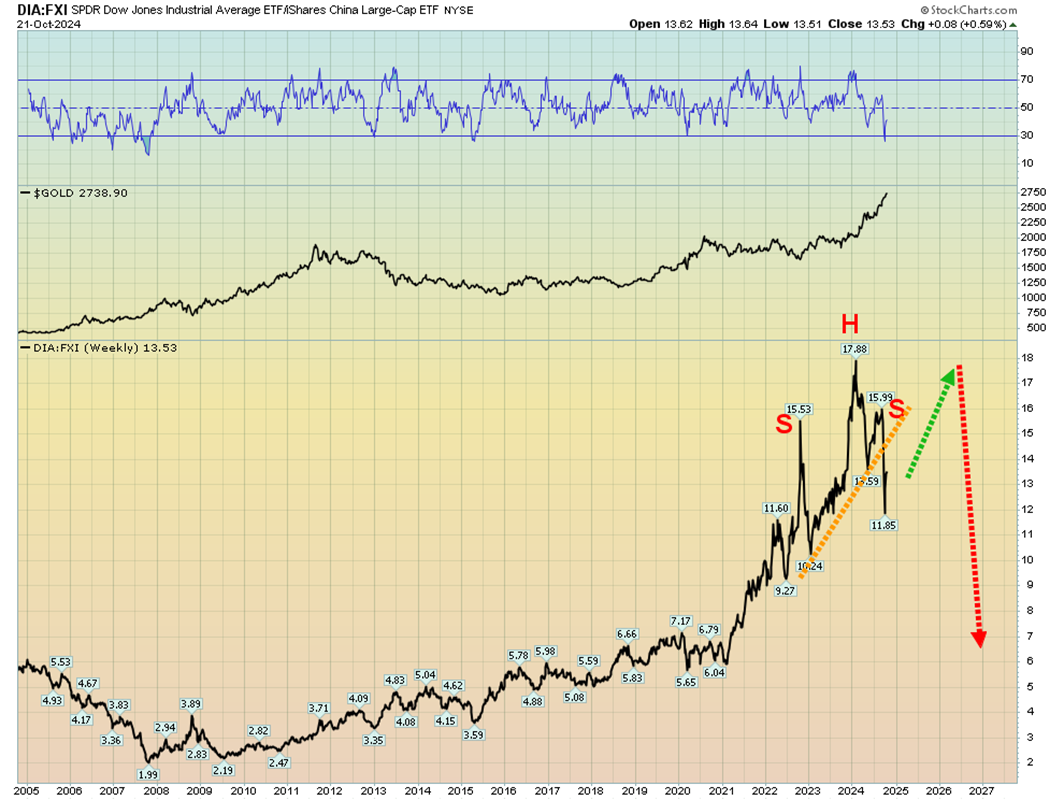

Here’s another bearish US stock market chart; against the Chinese market, the Dow has formed a lopsided H&S top and its broken through the neckline.

Here’s another bearish US stock market chart; against the Chinese market, the Dow has formed a lopsided H&S top and its broken through the neckline.

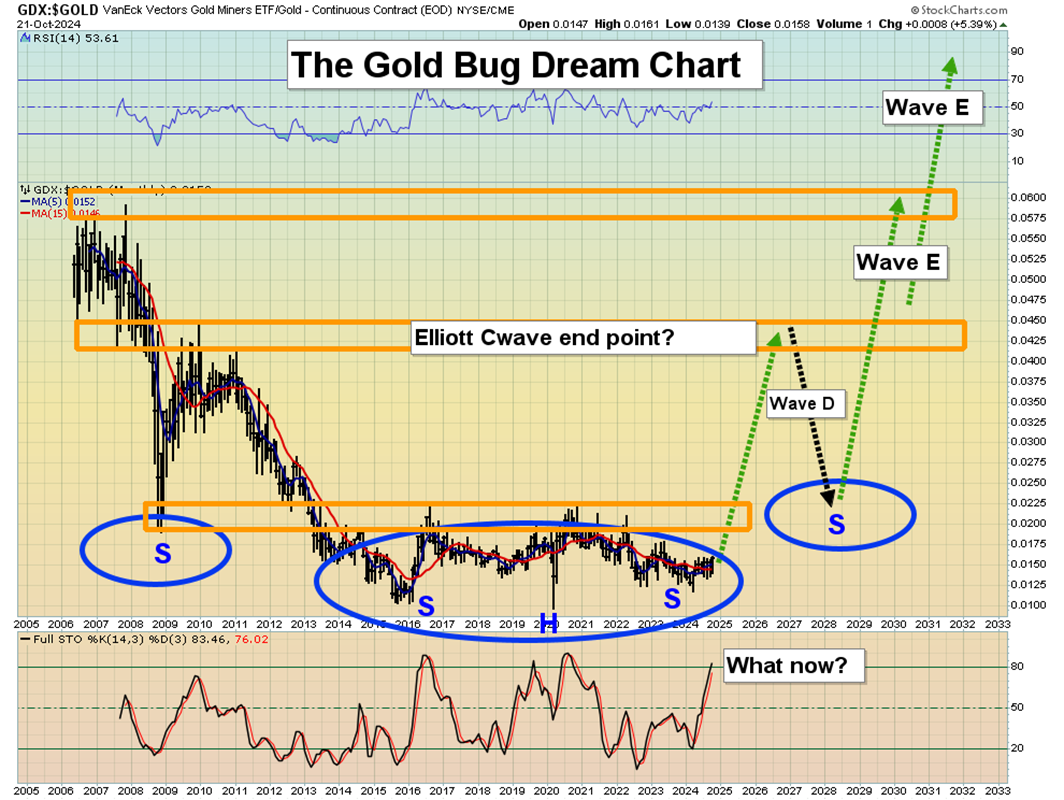

Clearly, the US stock market is vulnerable. Further weakness that occurs while gold surges could create significant mainstream money manager interest in gold and silver mining stocks. Here’s the bottom line:

Most funds don’t have a mandate to buy gold, but they can buy the miners.

Their arrival in this dramatically undervalued market would probably herald the first significant pullback for gold in a year, but it’s also likely that they endure the pain of this dip and become consistent buyers with size…

While there’s a surge in gold to $3500-$4000.

What about “Prince Hi Ho”, aka silver bullion? The short-term chart. The bull flag action indicates $35 is coming fast!

The next target is $38, and if there’s a major Elliott C wave in play, silver could be headed for $100.

Gold stocks? Well, as noted, an institutional tidal wave into gold and silver mining stocks could be the next big global market event. All investors should keep a close eye on statements about gold coming from big-name funds.

Their interest has started… and I’ll dare to suggest that it will become a tidal wave in 2025 and 2026!

Elliott C wave thunder best represents the technical reason for the coming gold stocks “rally to the stars” and there’s also massive inverse H&S action all over this chart.

For investors who want to “kick the tires,” and take a closer look at the GDX) versus gold price action. This key triangle breakout is real, and it’s almost certainly just the first of many to come!

The stunning CDNX chart. Many gold bugs have no interest in the juniors, but it’s still important to monitor the CDNX on a regular basis. Here’s why:

It’s a key indicator of the health of the general gold, silver, and mining stocks market. I call it a “Bull Era Canary in the gold mines!”. There’s a massive inverse H&S base pattern on this chart and the right shoulder itself is another inverse H&S. Note that while it’s not the exact neckline of the pattern, the main LOI (line of importance) is at the big round number of 1000.

While the US stock market experiences what could become a multi-decade bear market and gulag, a multi-decade bull run for junior, intermediate, and senior mining stocks appears set to be confirmed by a Friday close over 1000 for the wildly undervalued CDNX!