The past few weeks have been rough for precious metals. Gold had climbed all the way to $1297/oz but the other parts of the sector (silver and the gold stocks) failed to confirm the move. They have since fallen off a cliff. Over the past 14 days, VanEck Vectors Gold Miners (NYSE:GDX) has lost 15% while VanEck Vectors Junior Gold Miners (NYSE:GDXJ) has declined 20%. Silver during that span has declined every day. Yes, silver has declined 14 consecutive days. Gold still has some “catching down” to do (with the rest of the sector) but the gold stocks and silver are oversold and nearing a bounce.

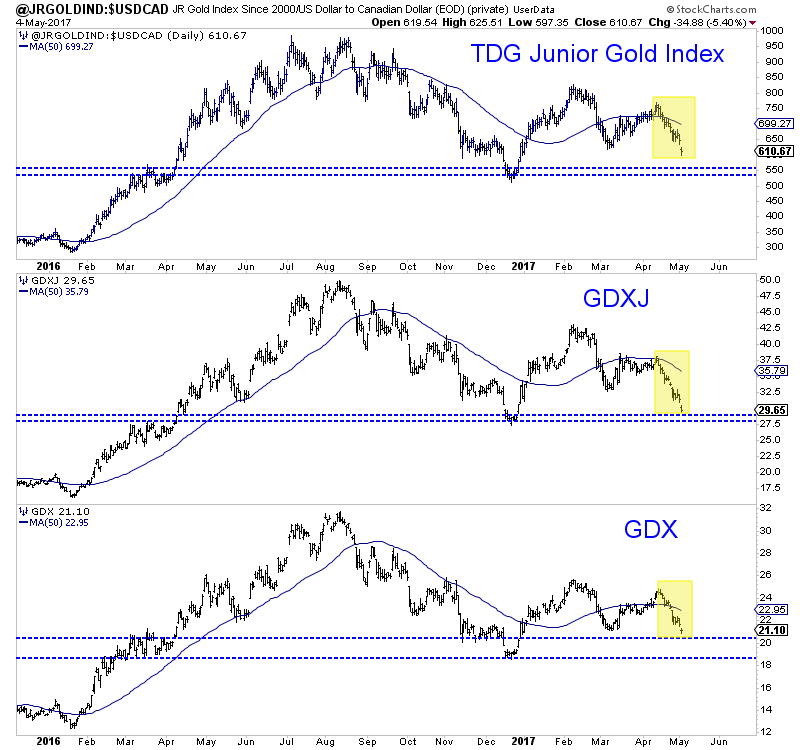

We plot the daily bar charts of our in-house junior gold index and GDXJ below along with GDX. The junior sector has been hit especially hard partly due to news that GDXJ, because of massive inflows will be cutting its stake in various juniors and investing in larger companies. Regardless of the why, the charts are the charts and much damage has been done. However, both junior indices have a bit more downside potential before testing strong support. GDX has good support roughly 4% below Thursday’s close.

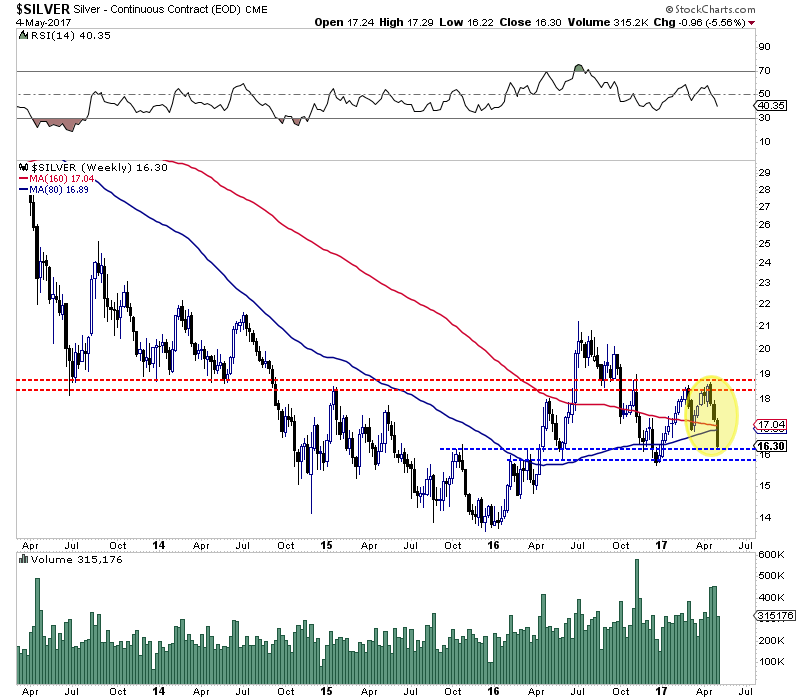

Silver, as we noted, is down 14 consecutive trading days and nearly 13% over that period. This week silver has lost 5.6% and sliced below key long-term averages. While the broader trend is lower, silver is very close to testing strong short-term support from $15.90 to $16.13. That is another 1%-2% lower for silver, which could then face resistance from $16.90 to $17.20.

Overall, both the gold stocks and silver are oversold and nearing a bounce. We say nearing because another day or two of selling is possible before a bounce. Gold meanwhile, has key support at $1220/oz but the gold stocks have already priced in sub $1200/oz gold. Although the gold stocks are setup to bounce this month and we see a few opportunities, we expect another opportunity and a better one in the middle of summer.