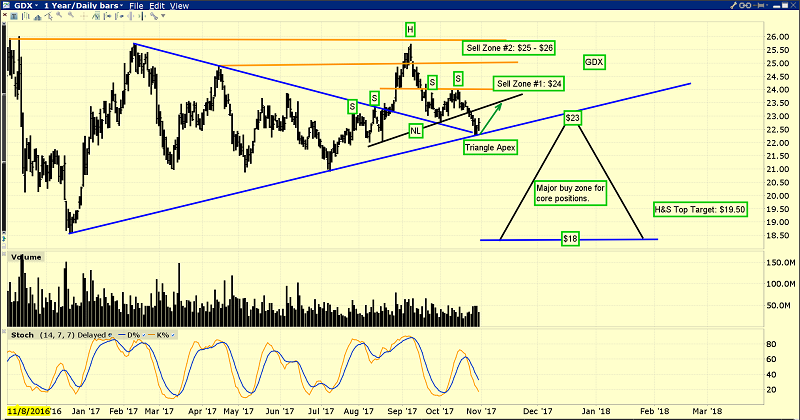

I’ve suggested that investors may need to look beyond the head and shoulders top formations that recently appeared on bullion and many precious-metal stocks.

This is the daily gold chart. Intermediate uptrends often consist of three legs. In 2017, gold has had two legs up.

The next US jobs report is scheduled for release on Friday. Will it be the catalyst that launches a third leg higher for gold? I’m not sure, but I am sure of what’s important for gold, which is that it is generally very well supported here, both technically and fundamentally.

The bottom line: Gold held in ETFs is quite steady. China’s economy has softened, but only modestly. That light softness is almost certainly related to the government’s action taken to reduce pollution.

Chinese mine production has fallen as excessively polluting operations have been shut down. That’s adding support to the gold price.

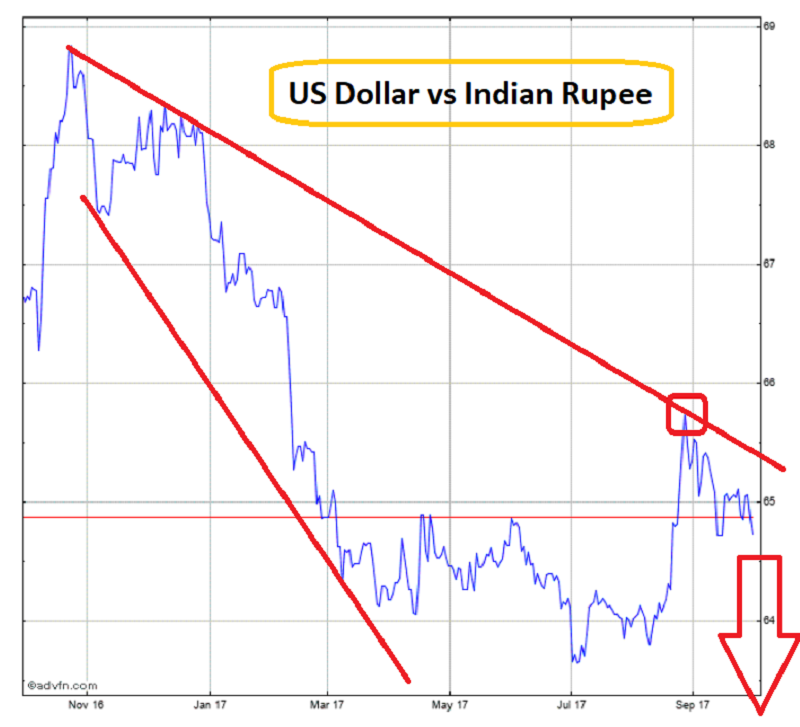

In India, the economic growth has slowed more noticeably than in China, and that does have an effect on gold demand. This growth slowdown has been mitigated by a rise in the rupee against the dollar, which lowers the cost of gold for Indians.

Along with commercial traders on the LBMA and the COMEX (aka “the banksters”), Indian buyers are the most eager buyers when the gold price drops.

The US Treasury wants India’s central bank to reduce its purchases of US dollars.

As India recovers from the disastrous demonetization program that pounded the nation’s GDP growth, the dollar could enter the “meat and potatoes” zone in a major bear market against the rupee.

That would put gold on sale in a major way for Indians, and demand could surge.

The dollar looks like a train wreck against the rupee on this one-year chart, and that happened with the Indian central bank buying the dollar aggressively!

What happens if US government pressure works, and the Indian central bank pares back its dollar buying?

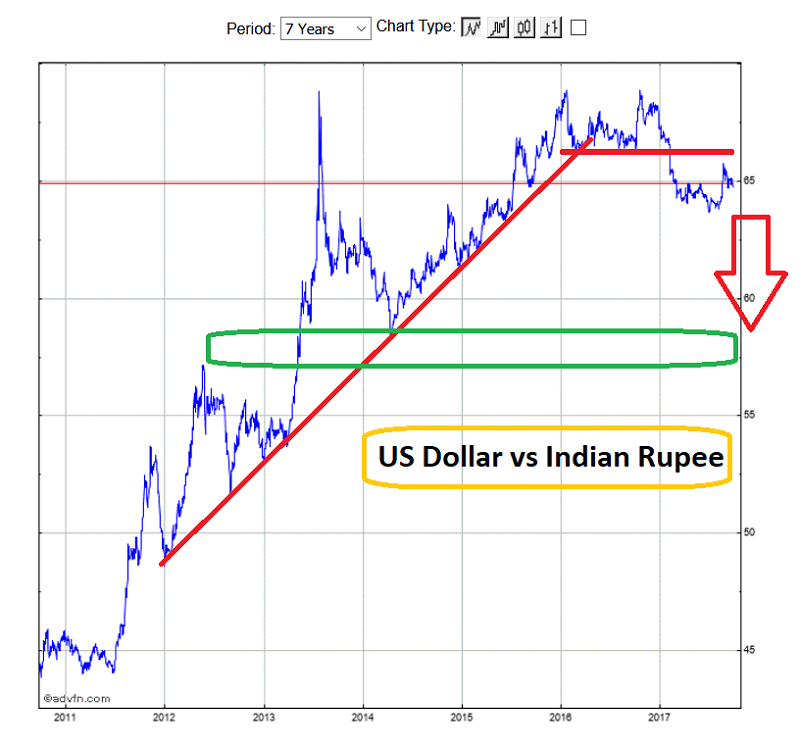

This seven-year chart shows how strong the dollar was against the rupee from 2011 - 2016.

The dollar has now started what is likely to be a multi-decade bear market against the rupee. This should add significantly to the (already relentless) growth in Indian citizen demand for gold.

In America, most analysts predict there will be only a few rate hikes in the 2018 – 2019 time frame. In contrast, the US central bank predicts seven. Goldman Sachs' (NYSE:GS) top economist predicts nine.

I predict there will be six. Regardless of what the exact number turns out to be, if its six or more, American M2 money velocity should begin a major bull cycle. Of the three main money velocity measurements used by the Fed, M2V tends to correlate best with the action of gold stocks versus bullion. A major bull cycle in M2V would blast gold stocks higher in a bull cycle with intensity that has not been seen since the 1970s.

The St. Louis Fed has stated that the US inflation rate would have reached 33% as a result of QE, if money velocity had not collapsed. A more relentless pattern of rate hikes and accelerated QT will almost certainly create a surge in M2 velocity.

I think most of the world will be stunned by what happens with inflation over the next 24 months. That’s because the QE “money ball” that is only inflationary potential energy becomes kinetic energy as it is flushed out of government and central banks and into the fractional reserve banking system.

Trump’s tax cuts against a background of rising government debt should ice that inflationary cake in a very big way.

GOAU is a relatively new gold stocks ETF.

I like the fact that about 60% of the holdings are in Canada, which is arguably the best mining jurisdiction in the world, and certainly one of them. I’m a buyer on every 50 cents price decline until the price rises to $20. I would urge all gold stock enthusiasts to check out the main holdings in this ETF carefully, and eagerly!

This is the key GDX chart. GDX is bouncing from an important triangle apex point. It’s unknown whether the bounce will fail in the neckline area of the head and shoulders top pattern.

What is known is that investors need to be focused on a major worldwide transition from QE, low rates and deflation to QT, higher rates and inflation.

Bullion has outshined the miners for twenty years, and now it’s becoming time for the miners to lead, and lead for a very long period of inflationary time!

Thanks

Cheers

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?