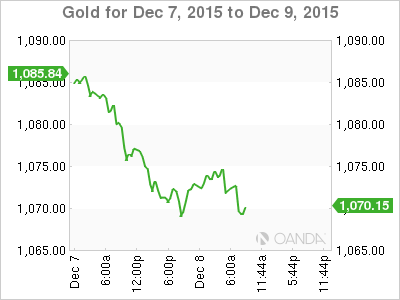

Gold prices have steadied on Tuesday, trading at a spot price of $1071.95 per ounce in the European session. After impressive gains late last week, gold has reversed directions. In economic news ,today’s key event is JOLTS Job Openings, with the markets expecting the indicator to improve to 5.59M. Earlier, the NFIB Small Business Index slipped to 94.8 points, short of expectations.

Gold posted strong gains late last week, taking advantage of the surprise ECB decision and a positive US NFP report. The metal moved higher after the ECB shocked the markets in its decision not to add further monetary stimulus to kick-start the ailing Eurozone economy. The markets had expected some significant monetary measures from Mario Draghi and company, but the head of the ECB played it safe, opting to do little more than tweak current monetary policy. The ECB announced that the interest on deposits would be lowered from -0.20 to -0.30 percent, and the QE asset purchase program of EUR 60 billion/year would be extended for an additional six months, to March 2017. Given the lethargic Eurozone economy, the markets had expected much more, such as substantial increase to the asset purchase program or reductions to other interest rates. The lack of any substantial moves by the ECB clearly caught the markets by surprise.

Monday (Dec. 8)

- 11:00 US NFIB Small Business Index. Estimate 96.6 points. Actual 94.8 points

- 15:00 US JOLTS Job Openings. Estimate 5.59M

- 15:00 US IBD/TIPP Economic Optimism. Estimate 45.2 points

*Key releases are highlighted in bold

*All release times are GMT

XAU/USD for Tuesday, December 8, 2015

XAU/USD December 8 at 13:00 GMT

XAU/USD 1071.95 H: 1075 L: 1067

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 980 | 1024 | 1043 | 1080 | 1098 | 1134 |

- XAU/USD showed limited movement in the Asian session and has posted slight losses in the European session.

- There is resistance at 1080.

- 1043 is providing strong support.

- Current range: 1043 to 1080

Further levels in both directions:

- Below: 1043, 1024 and 980

- Above: 1080, 1098, 1134 and 1151

OANDA’s Open Positions Ratio

In the XAU/USD ratio, long positions continue to maintain a solid majority (66%). This is indicative of strong trader bias towards gold prices moving to higher levels.