Gold is trading at USD 1,757.10, EUR 1,272.60, GBP 1,097, JPY 137,126, CHF 1,546.20 and AUD 1696.30 per ounce.

Gold’s London AM fix this morning was USD 1,732.50, GBP 1,083.69 and EUR 1,257.25 per ounce.

Yesterday's AM fix was USD 1,731.00, GBP 1,081.27 and EUR 1,257.35 per ounce.

Cross Currency Table

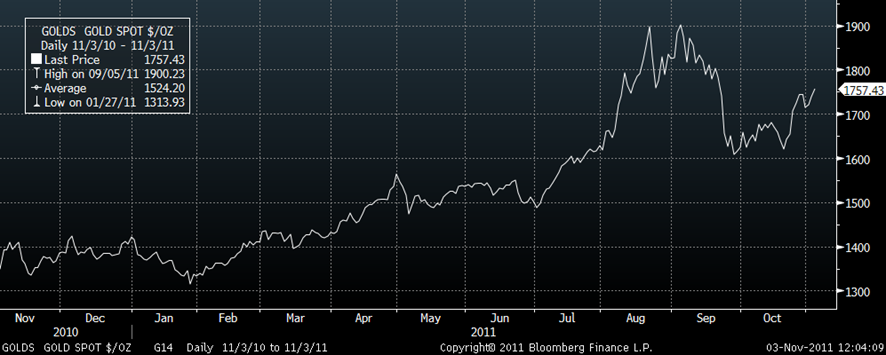

Gold has spiked higher in all currencies in recent minutes and has recovered from lows seen in late Asian, early European trading. Gold continues to consolidate between $1,700 and $1,750. Support is at $1,680/oz and resistance at $1,750/oz is being challenged today.

Given the scale of the European and global debt crisis, the slowing US and global economy and heightened macroeconomic, monetary and systemic risk – a move back to $1,800 seems likely – possibly in November.

Gold in USD - 3 Months (Daily)

$1,800/oz is just 4% below today’s price and any negative news event could lead to a quick spike to over $1,800 again.

Yesterday’s headlines regarding Israel considering attacking Iran militarily have been ignored for now but such geopolitical risk remains ever present and negative news in this regard could see gold rise rapidly again.

Physical demand is nowhere near the levels seen in August when gold spiked to $1,900/oz but remains robust at these levels due to the near unprecedented level of risk seen in international markets today. More investors are choosing to take delivery of their bullion and there is an increasing preference for allocated storage.

The majority of demand is coming from precious metal investors adding to allocations and the Eurozone and global debt crisis has not led to any mass influx of ‘Joe Public’ buying bullion.

Gold’s fundamentals remain very sound due to the very high level of macroeconomic, systemic and monetary risk and now the technical picture has turned positive after a higher monthly close in October and last week’s higher weekly close.

fundamental driver of gold’s bull market is negative real interest rates in major economies and this is set to continue.

Bernanke and the Federal Reserve left the federal funds rate in a range of 0% to 0.25% yesterday. Ultra loose monetary policies continue with a de facto zero interest rate policy continuing for nearly 3 years now - since December 2008.

The ECB’s new chief Mario Draghi, at his first meeting, is likely to forgo any interest rate cut, despite the eurozone debt crisis teetering on the brink of contagion. Draghi is expected to leave eurozone interest rates at 1.5% possibly for some time despite inflation beginning to take hold in many Eurozone economies.

Italian 10-yr yields are trading at 6.3%, edging ever-closer to that 7% threshold that saw Ireland & Portugal frozen out of credit markets. This is despite the support of the ECB – with continuing reports from traders that the ECB are buying Italian bonds.

Italian PM Berlusconi failed to push through a round of systemic reforms ahead of today’s G20 summit, fuelling fears that Italy could be the next major casualty of the sovereign debt crisis.

Contagion is happening in European financial markets and there is a continuing failure to see the wood from the trees.

There is now no easy fiscal or monetary policy solution to this crisis and investors should be becoming prepared for the ramifications of financial contagion. There is the real possibility of the economic collapses akin to that seen in Russia and Argentina happening again in various countries in the coming months.

The degree of denial regarding the ramifications of the crisis is very akin to that seen prior to the bursting of the property bubble in 2007.

Much of the non specialist financial press have lulled many investors into a false sense of security by continually downplaying the risks confronting them and suggesting that policy makers would find a solution.

The majority of investors appear to believe that things can only get better. However, the reality of the situation is that things can only get worse (at least in the short term and maybe longer) and further currency debasement, a currency crisis, “bank holidays” (as warned of by Paul Krugman yesterday), capital and exchange controls seem increasingly likely.

Investors should prepare by becoming globally diversified and having an allocation to gold and silver bullion. Given the degree of risk, there is a strong argument for taking delivery of some of your bullion and the rest should be stored in allocated accounts with the safest international counterparties.

SILVER

Silver is trading at $34.52/oz, €25.07/oz and £21.54/oz

PLATINUM GROUP METALS

Platinum is trading at $1,631.20/oz, palladium at $664.50/oz and rhodium at $1,525/oz.

Gold’s London AM fix this morning was USD 1,732.50, GBP 1,083.69 and EUR 1,257.25 per ounce.

Yesterday's AM fix was USD 1,731.00, GBP 1,081.27 and EUR 1,257.35 per ounce.

Cross Currency Table

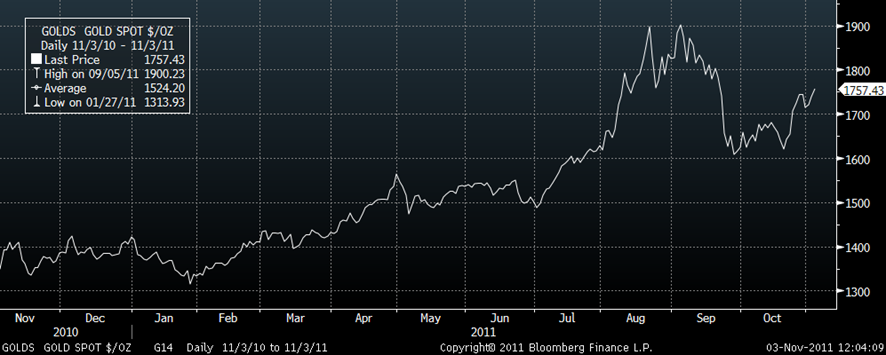

Gold has spiked higher in all currencies in recent minutes and has recovered from lows seen in late Asian, early European trading. Gold continues to consolidate between $1,700 and $1,750. Support is at $1,680/oz and resistance at $1,750/oz is being challenged today.

Given the scale of the European and global debt crisis, the slowing US and global economy and heightened macroeconomic, monetary and systemic risk – a move back to $1,800 seems likely – possibly in November.

Gold in USD - 3 Months (Daily)

$1,800/oz is just 4% below today’s price and any negative news event could lead to a quick spike to over $1,800 again.

Yesterday’s headlines regarding Israel considering attacking Iran militarily have been ignored for now but such geopolitical risk remains ever present and negative news in this regard could see gold rise rapidly again.

Physical demand is nowhere near the levels seen in August when gold spiked to $1,900/oz but remains robust at these levels due to the near unprecedented level of risk seen in international markets today. More investors are choosing to take delivery of their bullion and there is an increasing preference for allocated storage.

The majority of demand is coming from precious metal investors adding to allocations and the Eurozone and global debt crisis has not led to any mass influx of ‘Joe Public’ buying bullion.

Gold’s fundamentals remain very sound due to the very high level of macroeconomic, systemic and monetary risk and now the technical picture has turned positive after a higher monthly close in October and last week’s higher weekly close.

fundamental driver of gold’s bull market is negative real interest rates in major economies and this is set to continue.

Bernanke and the Federal Reserve left the federal funds rate in a range of 0% to 0.25% yesterday. Ultra loose monetary policies continue with a de facto zero interest rate policy continuing for nearly 3 years now - since December 2008.

The ECB’s new chief Mario Draghi, at his first meeting, is likely to forgo any interest rate cut, despite the eurozone debt crisis teetering on the brink of contagion. Draghi is expected to leave eurozone interest rates at 1.5% possibly for some time despite inflation beginning to take hold in many Eurozone economies.

Italian 10-yr yields are trading at 6.3%, edging ever-closer to that 7% threshold that saw Ireland & Portugal frozen out of credit markets. This is despite the support of the ECB – with continuing reports from traders that the ECB are buying Italian bonds.

Italian PM Berlusconi failed to push through a round of systemic reforms ahead of today’s G20 summit, fuelling fears that Italy could be the next major casualty of the sovereign debt crisis.

Contagion is happening in European financial markets and there is a continuing failure to see the wood from the trees.

There is now no easy fiscal or monetary policy solution to this crisis and investors should be becoming prepared for the ramifications of financial contagion. There is the real possibility of the economic collapses akin to that seen in Russia and Argentina happening again in various countries in the coming months.

The degree of denial regarding the ramifications of the crisis is very akin to that seen prior to the bursting of the property bubble in 2007.

Much of the non specialist financial press have lulled many investors into a false sense of security by continually downplaying the risks confronting them and suggesting that policy makers would find a solution.

The majority of investors appear to believe that things can only get better. However, the reality of the situation is that things can only get worse (at least in the short term and maybe longer) and further currency debasement, a currency crisis, “bank holidays” (as warned of by Paul Krugman yesterday), capital and exchange controls seem increasingly likely.

Investors should prepare by becoming globally diversified and having an allocation to gold and silver bullion. Given the degree of risk, there is a strong argument for taking delivery of some of your bullion and the rest should be stored in allocated accounts with the safest international counterparties.

SILVER

Silver is trading at $34.52/oz, €25.07/oz and £21.54/oz

PLATINUM GROUP METALS

Platinum is trading at $1,631.20/oz, palladium at $664.50/oz and rhodium at $1,525/oz.