Gold Non-Commercial Speculator Positions:

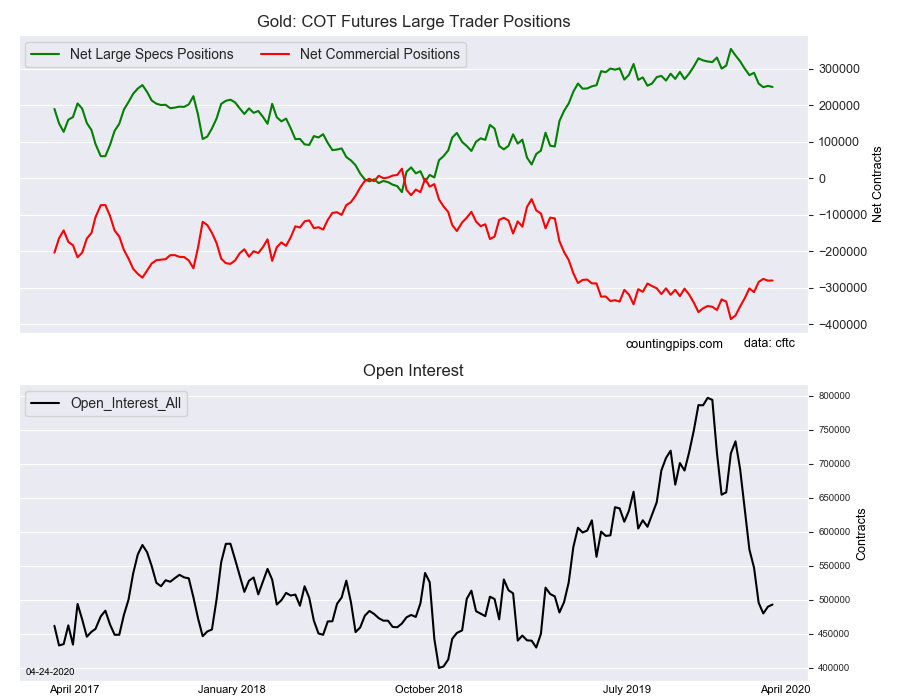

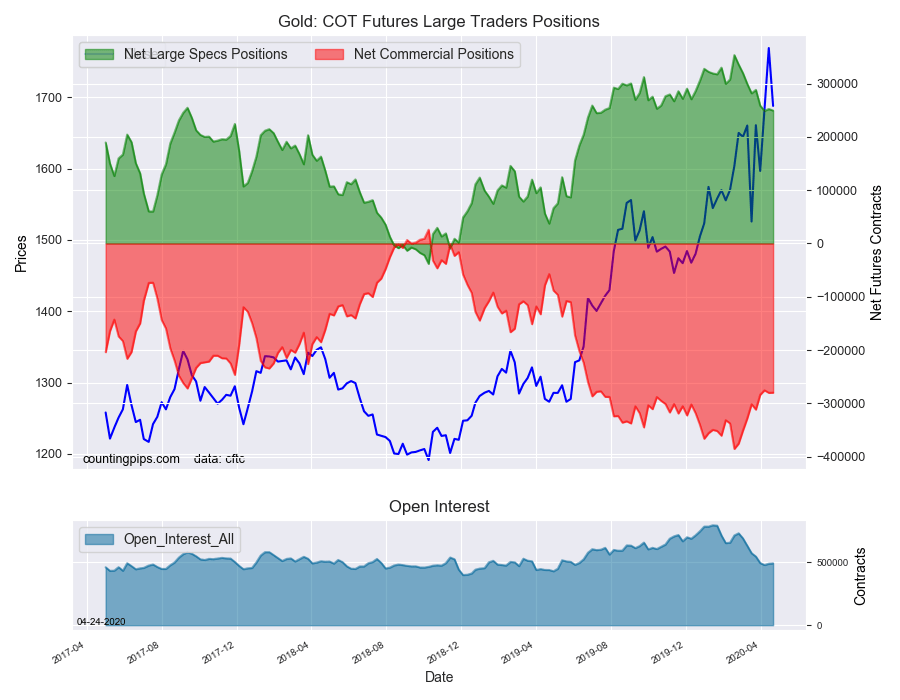

Large precious metals speculators cut back on their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 249,571 contracts in the data reported through Tuesday, April 21st. This was a weekly decrease of -2,930 net contracts from the previous week which had a total of 252,501 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -4,354 contracts (to a weekly total of 282,263 contracts) while the gross bearish position (shorts) fell by a lesser amount of -1,424 contracts for the week (to a total of 32,692 contracts).

Gold net speculative positions dipped this week for the third time in the past four weeks and also for the seventh time in the past nine weeks. The overall speculator level has now fallen by -104,078 contracts since reaching an all-time record high of +353,649 contracts on February 18th. Despite the spec sentiment declines, the gold price has had a bullish impulse over the last five weeks with this week’s close above the $1,725.00 per ounce level.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -280,073 contracts on the week. This was a weekly uptick of 335 contracts from the total net of -280,408 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1687.80 which was a decline of $-81.10 from the previous close of $1768.90, according to unofficial market data.