Gold Non-Commercial Positions:

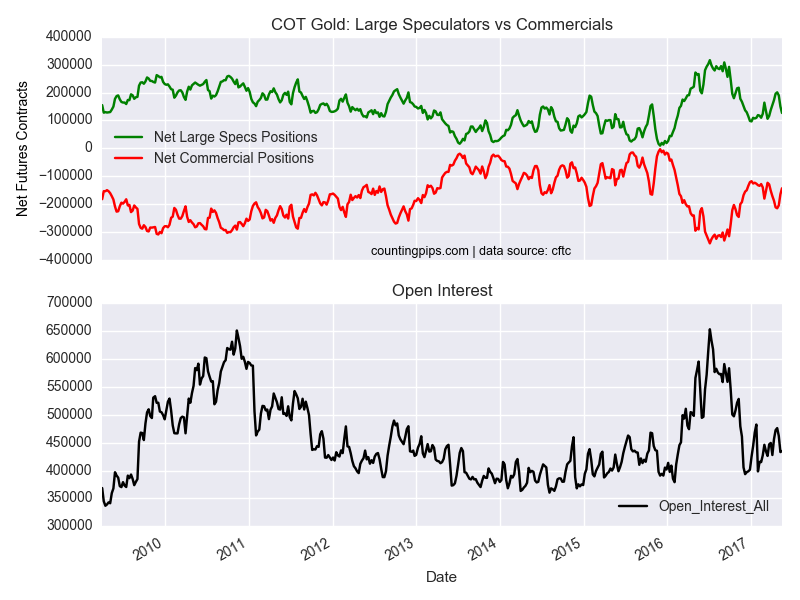

Large speculators continued to sharply cut back on their bullish net positions in the gold futures markets for a third straight week and brought the overall level to the lowest standing in eight weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of 126,724 contracts in the data reported through May 16th. This was a weekly drop of -23,282 contracts from the previous week which had a total of 150,006 net contracts.

Speculators have now reduced their bullish positions by over -70,000 contracts in the past three weeks which followed a streak of six straight weekly gains.

Gold Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -142,859 contracts last week. This was a weekly gain of 21,563 contracts from the total net of -164,422 contracts reported the previous week.

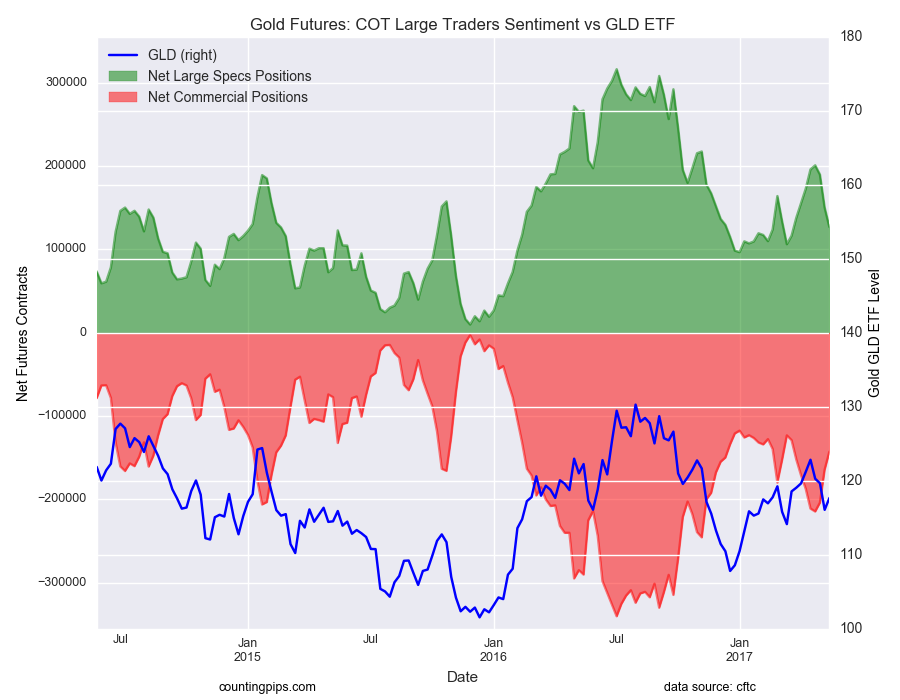

Gold ETF (NYSE:GLD):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $117.65 which was a rise of $1.60 from the previous close of $116.05, according to ETF financial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the previous Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Article by CountingPips.com