Gold Non-Commercial Speculator Positions:

Large precious metals speculators boosted their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

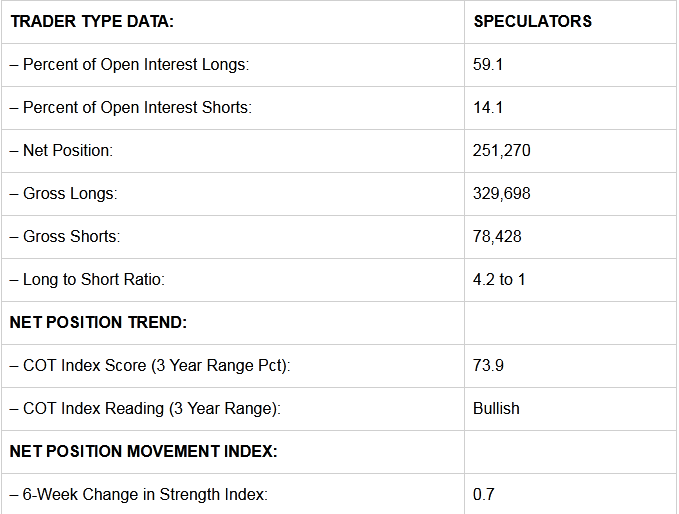

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 251,270 contracts in the data reported through November 17th. This was a weekly gain of 11,534 net contracts from the previous week which had a total of 239,736 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 11,182 contracts (to a weekly total of 329,698 contracts) while the gross bearish position (shorts) declined by -352 contracts for the week (to a total of 78,428 contracts).

Gold speculators sharply raised their bullish bets this week the most of the past seven weeks. Previously, bullish bets had fallen for three straight weeks but this week’s turnaround pushed the bullish position to the highest level of the past seventeen weeks. The gold speculator sentiment has continued to be strongly bullish as net positions have remained above the +200,000 contract level for seventy-five straight weeks, dating back to June of 2019.

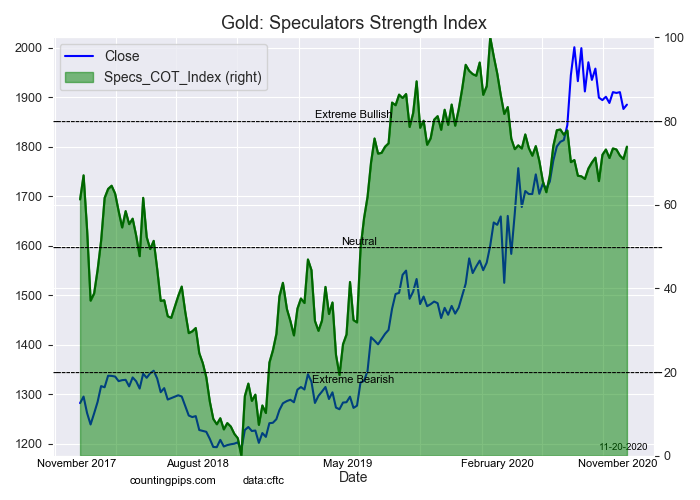

The large speculators' Strength Index level, the current score for traders compared to levels of the past three years, shows that specs are currently at a Bullish level with a score of 73.9 percent.

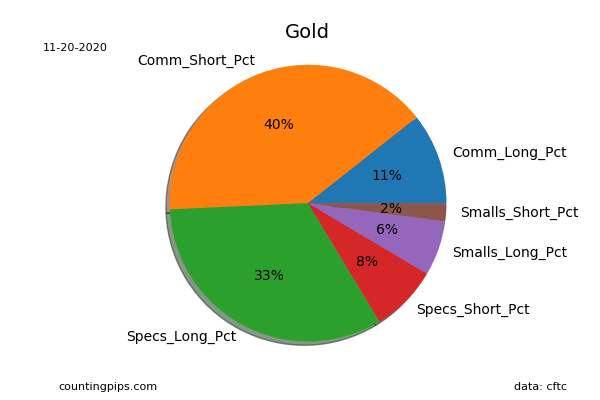

Current Trader Positions as Percent of Open Interest:

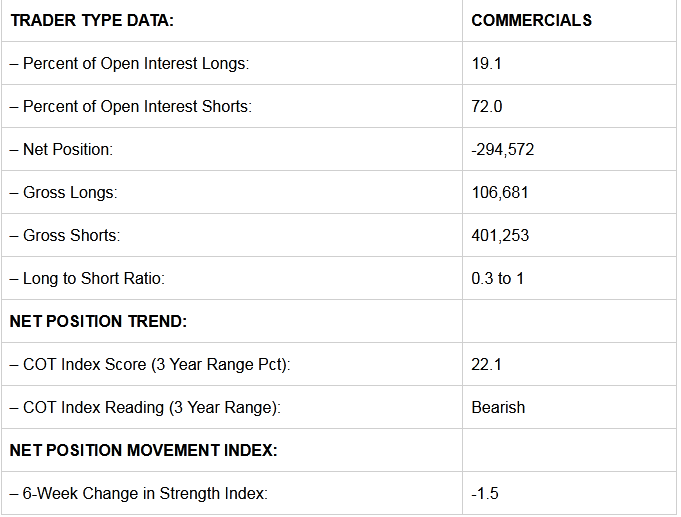

Commercial Trader Positions:

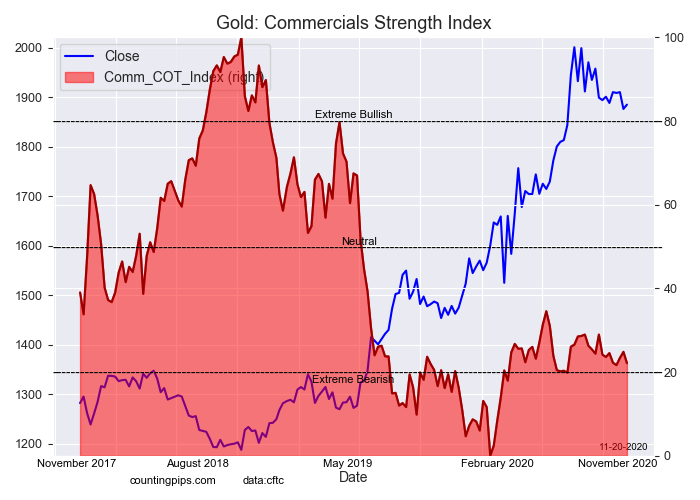

The commercial traders position this week came in at a total net position of -294,572 contracts. This was a weekly change of -11,149 contracts from the total net of -283,423 contracts reported the previous week.

The commercials Strength Index level, a score that measures the contract levels of the past three years within a range of 0 to 100, shows that Commercials are currently at a Bearish level with a score of 22.1 percent.

At the extreme levels, commercials are very important to watch as they have a tendency to be correct at the major turning points in price trends.

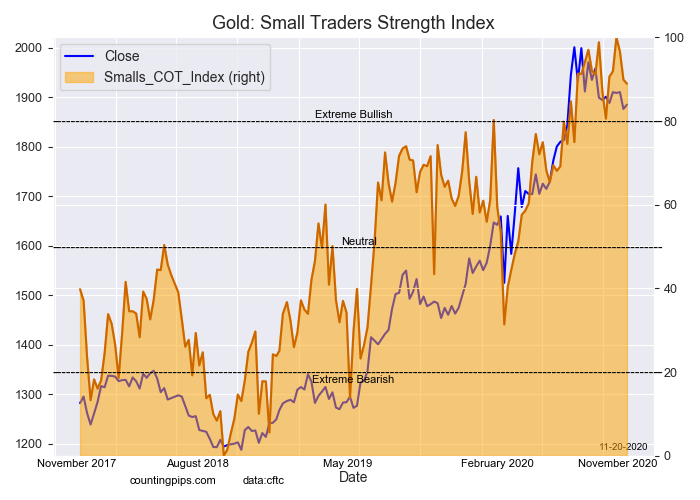

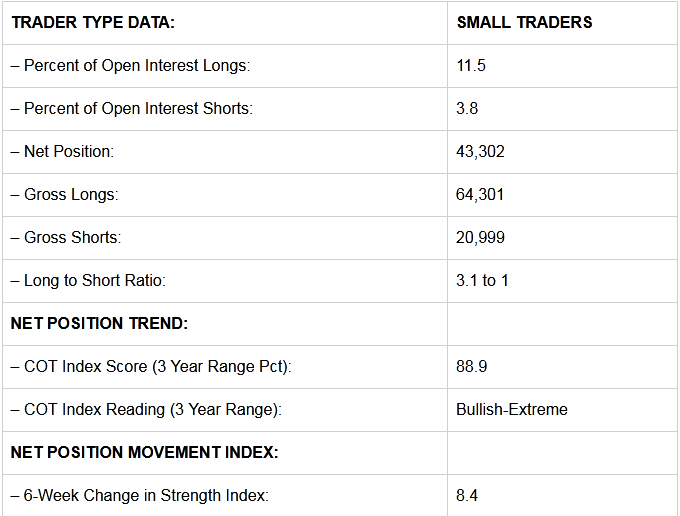

Small Trader Positions:

The small traders position this week totaled a net position of 43,302 contracts. This was a weekly change of -385 contracts from the total net of 43,687 contracts reported the previous week.

The small traders Strength Index level shows that smalls are currently at a Bullish-Extreme level with a score of 88.9 percent.

Small traders are less important to watch (in most cases) as their numbers tend to be just a small part of the total trading open interest.

Speculators are seen as trend followers and usually trade in tandem with the price direction (blue line in above chart). At the extreme levels, specs are very important to watch as they have a tendency to bet the wrong way (that the trend will continue to even more extreme levels).