Gold Non-Commercial Speculator Positions:

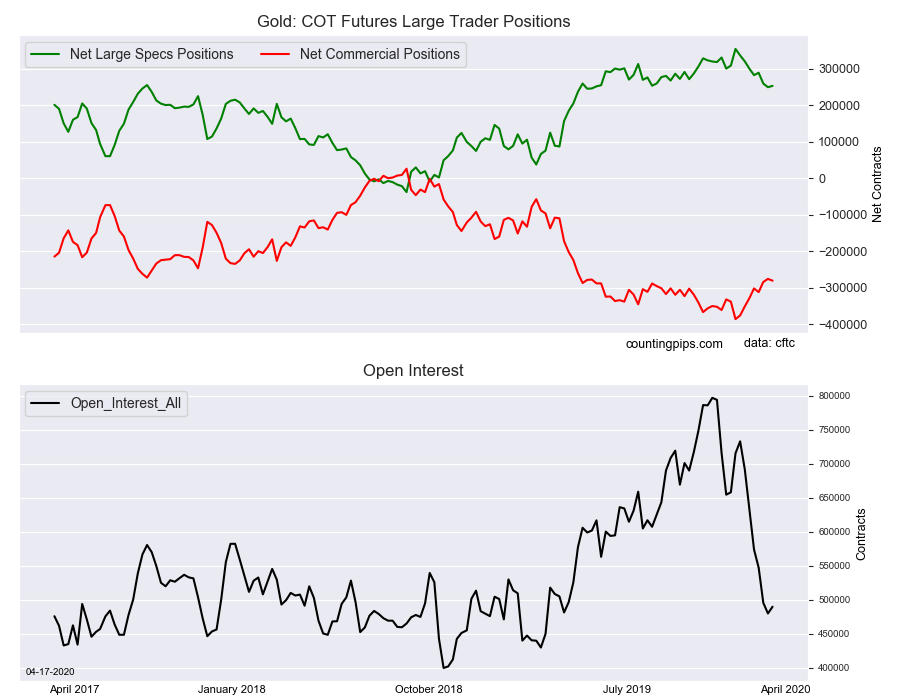

Large precious metals speculators advanced their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 252,501 contracts in the data reported through Tuesday April 14th. This was a weekly gain of 3,559 net contracts from the previous week which had a total of 248,942 net contracts.

The week’s net position was the result of the gross bullish position (longs) ascending by 6,737 contracts (to a weekly total of 286,617 contracts) while the gross bearish position (shorts) rose by a lesser amount of 3,178 contracts for the week (to a total of 34,116 contracts).

Gold speculative bullish positions rose following two down weeks and lower positions in six out of the previous seven weeks. Positions have been on the downswing since hitting an all-time record high bullish position of +353,649 contracts on February 25th. The current overall position of +252,501 contracts, despite the recent down-streak, remains well above the 2019 weekly average of +197,440 contracts.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -280,408 contracts on the week. This was a weekly shortfall of -4,797 contracts from the total net of -275,611 contracts reported the previous week.

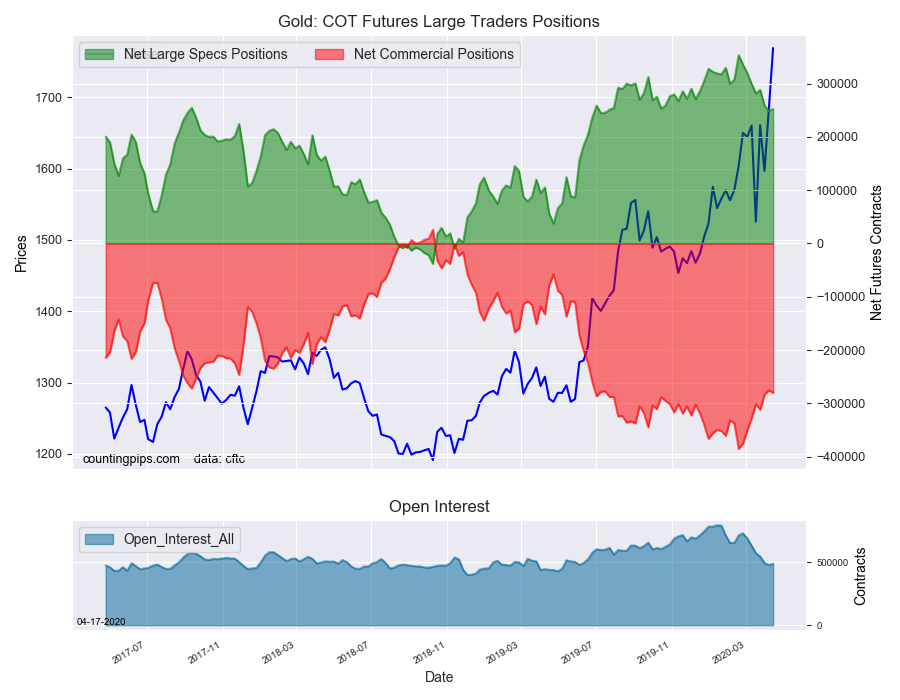

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1768.90 which was an increase of $85.20 from the previous close of $1683.70, according to unofficial market data.