Gold Non-Commercial Speculator Positions:

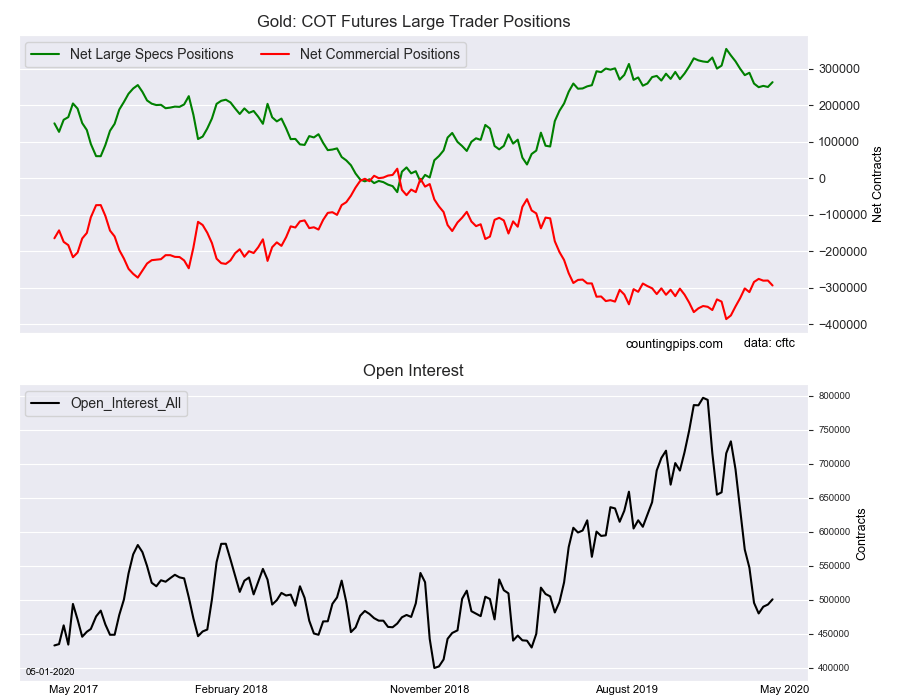

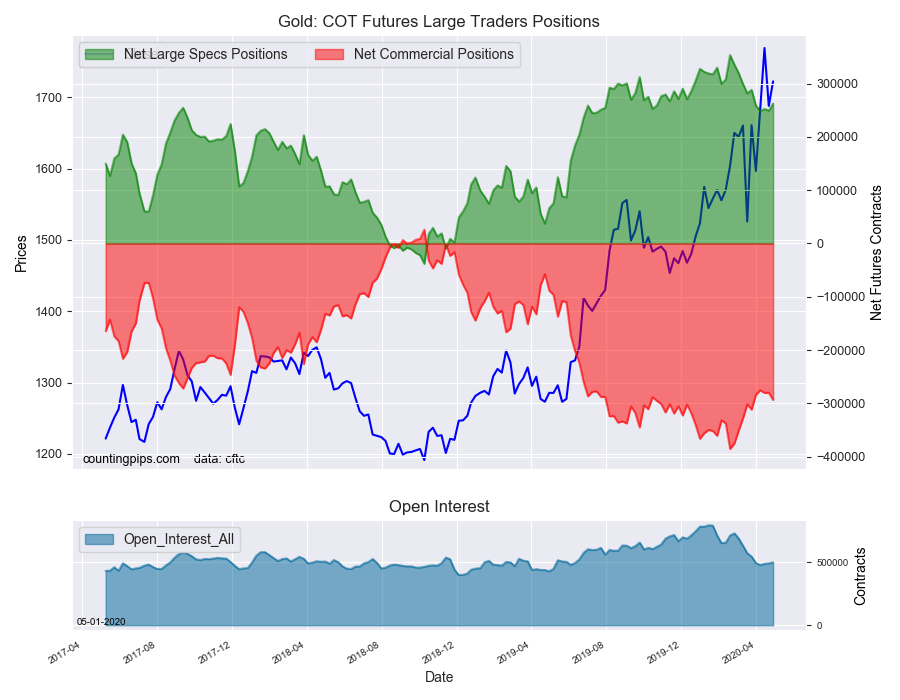

Large precious metals speculators lifted their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 262,729 contracts in the data reported through Tuesday, April 28th. This was a weekly change of 13,158 net contracts from the previous week which had a total of 249,571 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 5,119 contracts (to a weekly total of 287,382 contracts) while the gross bearish position (shorts) fell by -8,039 contracts for the week (to a total of 24,653 contracts).

Gold speculative positions gained by over +10,000 contracts this week for the first time since February 18th. The gold position has now risen for two out of the past three weeks following a pattern of lower levels in six out of the previous seven weeks (from Feb. 25th to April 7th). This week’s boost brings the overall bullish level to the highest standing in the past six weeks although the current level remains far below the 2020 speculator position weekly average of 296,985 contracts.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -293,629 contracts on the week. This was a weekly decrease of -13,556 contracts from the total net of -280,073 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1722.20 which was a gain of $34.40 from the previous close of $1687.80, according to unofficial market data.