Gold Non-Commercial Positions:

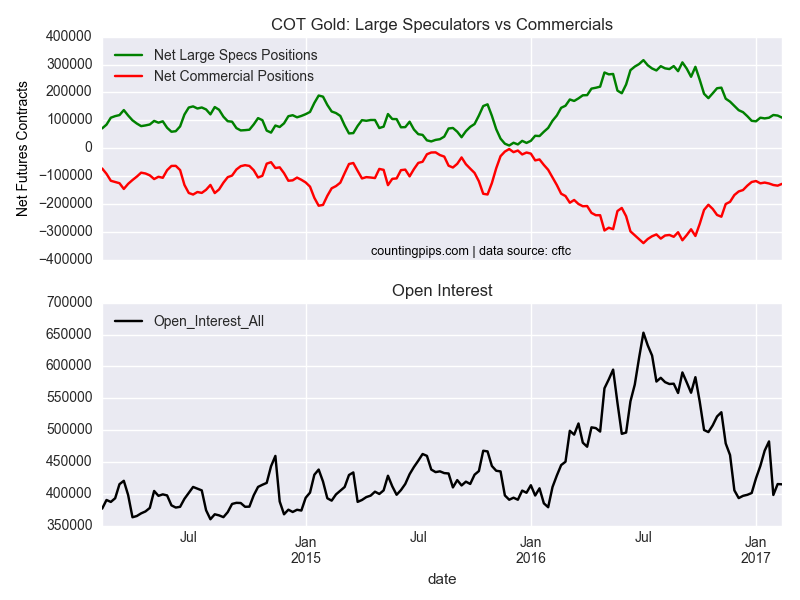

Large speculators and traders reduced their bullish net positions in the gold futures markets last week for a second consecutive week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of 109,752 contracts in the data reported through February 14th. This was a weekly change of -7,397 contracts from the previous week which had a total of 117,149 net contracts.

Gold speculative positions, despite two weekly declines, remain above the +100,000 net bullish level for the sixth consecutive week after falling below this threshold for two weeks in late December and early January.

Gold Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -127,788 contracts last week. This is a weekly increase of 6,358 contracts from the total net of -134,146 contracts reported the previous week.

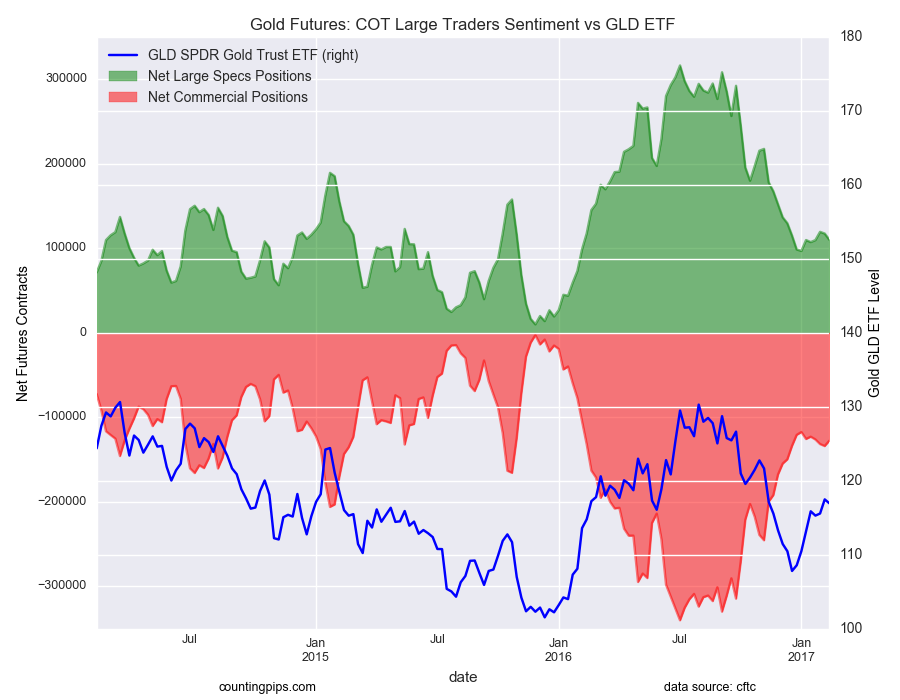

Gold ETF (NYSE:GLD):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $116.93 which was a shortfall of $-0.53 from the previous close of $117.46, according to ETF financial market data.