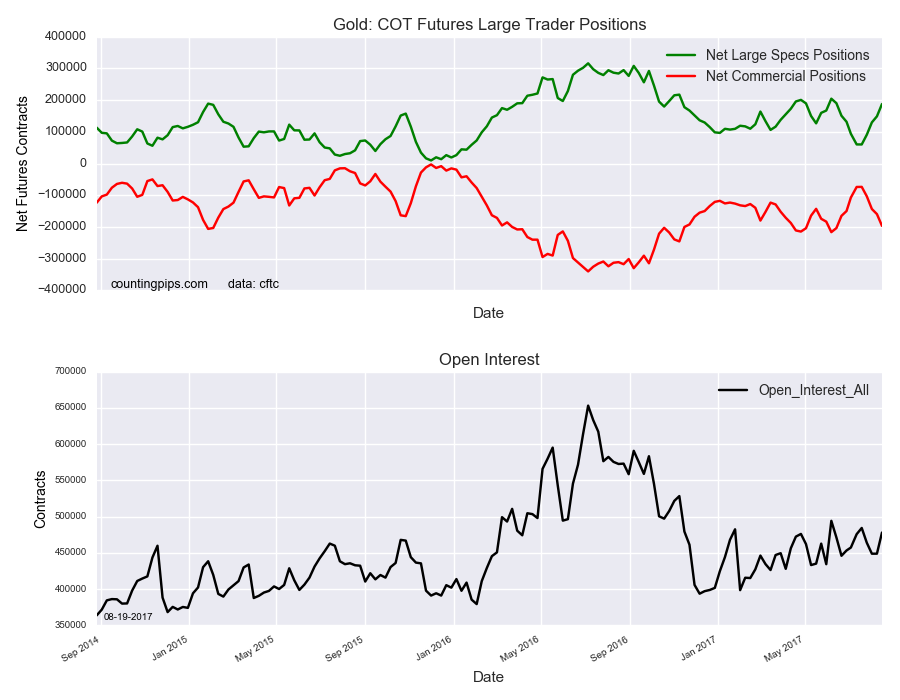

Gold Non-Commercial Speculator Positions:

Large speculators continued to push their bullish net positions higher in the gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of gold futures, traded by large speculators and hedge funds, totaled a net position of 187,734 contracts in the data reported through Tuesday August 15th. This was a weekly boost of 38,897 contracts from the previous week which had a total of 148,837 net contracts.

Gold speculative bets have now gained by +127,596 net contracts in just the past four weeks alone and the current level is now the best standing since June 13th when net positions totaled +190,274 contracts.

Gold Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -196,631 contracts on the week. This was a weekly loss of -37,120 contracts from the total net of -159,511 contracts reported the previous week.

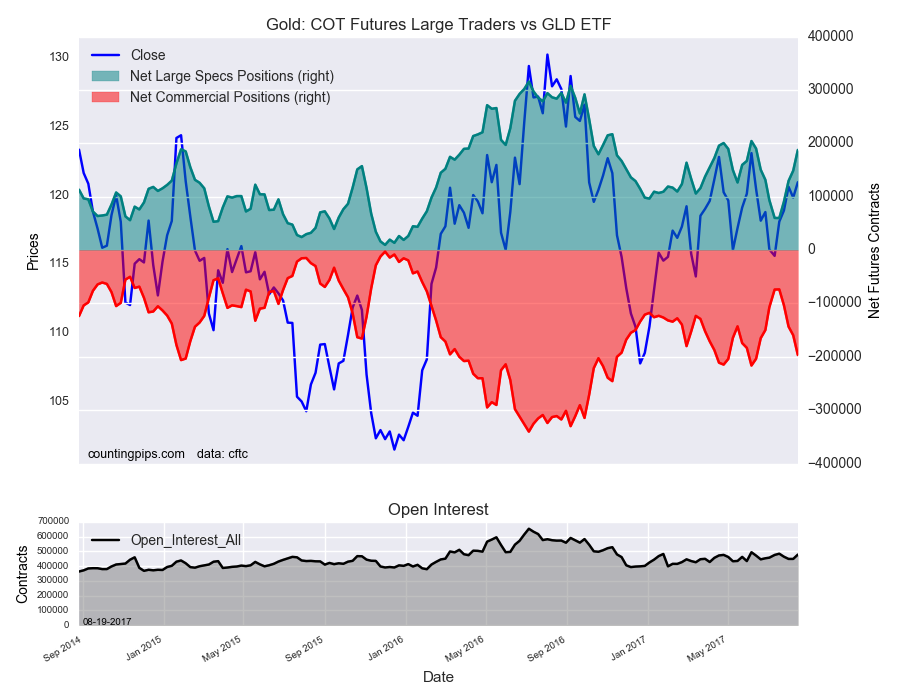

GLD (NYSE:GLD) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $120.98 which was a boost of $1.12 from the previous close of $119.86, according to unofficial market data.