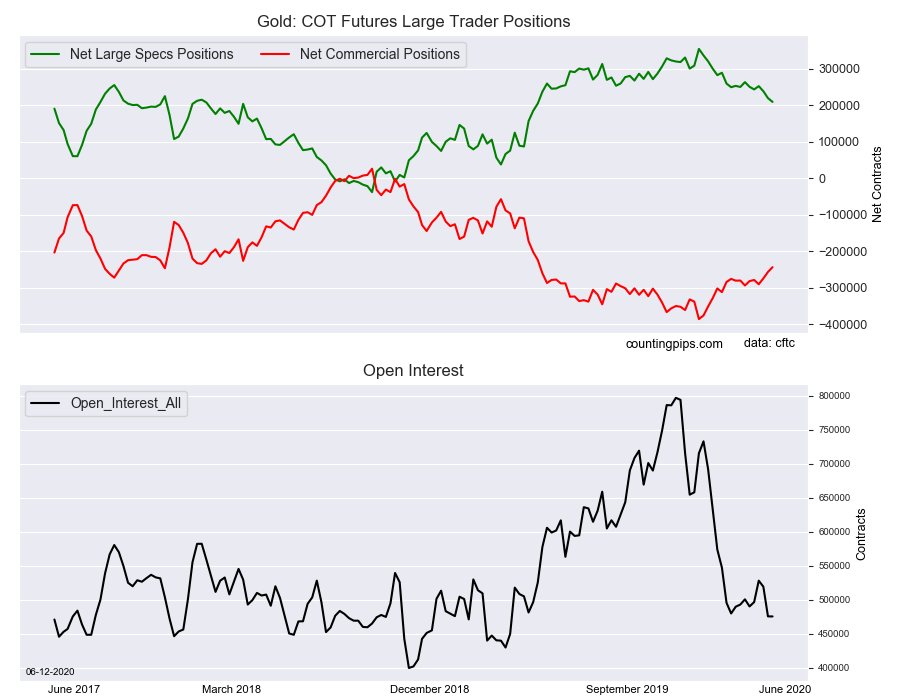

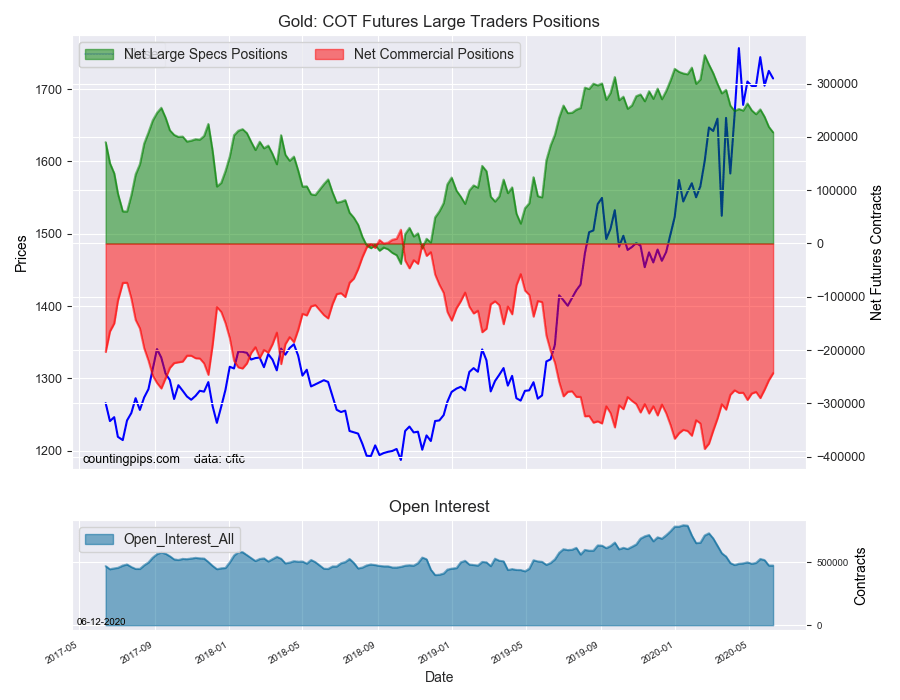

Gold Non-Commercial Speculator Positions:

Large precious metals speculators lowered their bullish net positions in the Gold futures markets once again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 208,613 contracts in the data reported through Tuesday, June 9th. This was a weekly shortfall of -10,421 net contracts from the previous week which had a total of 219,034 net contracts.

The week’s net position was the result of the gross bullish position (longs) sinking by -8,224 contracts (to a weekly total of 263,972 contracts) combined with the gross bearish position (shorts) gaining by 2,197 contracts for the week (to a total of 55,359 contracts).

Gold speculators continued to decrease their bullish bets for a third straight week this week. Speculative positions have now declined twelve times put of the past sixteen weeks and have fallen to the least bearish level since June 18th of 2019 (a span of 51 weeks). Despite the speculator positioning, the gold price has remained bid and continues to trade at the top of its range above the $1,700 per ounce level.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -243,457 contracts on the week. This was a weekly advance of 13,166 contracts from the total net of -256,623 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1714.70 which was a loss of $-10.50 from the previous close of $1725.20, according to unofficial market data.