Gold Non-Commercial Speculator Positions:

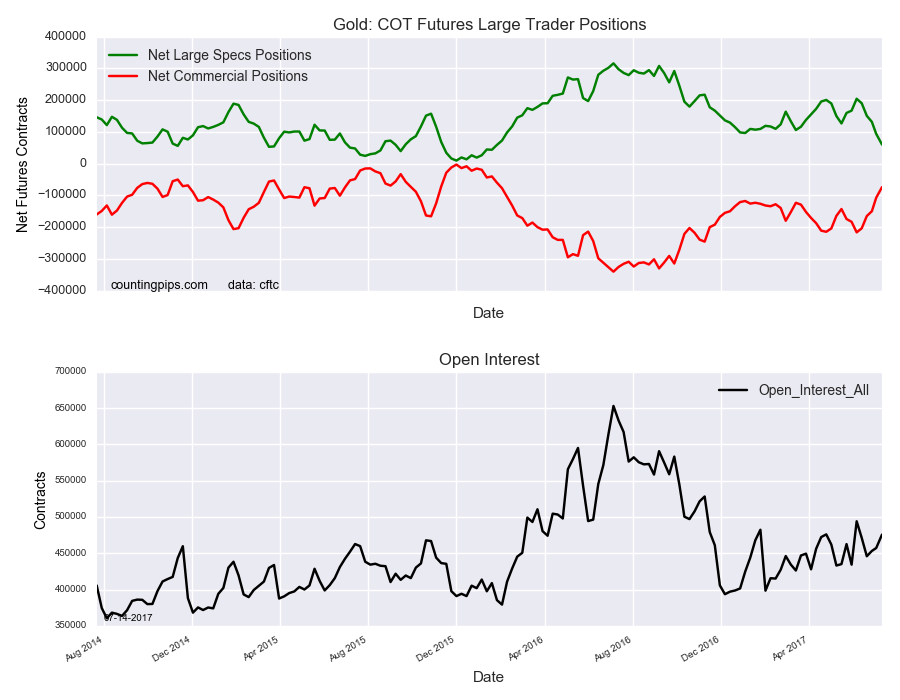

Large speculators sharply cut back on their bullish net positions in the gold futures markets this week for a fifth consecutive week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 60,260 contracts in the data reported through Tuesday July 11th. This was a weekly reduction of -33,539 contracts from the previous week which had a total of 93,799 net contracts.

Gold speculators have now decreased their bullish net positions by a whopping -144,205 over the past five weeks. The current level is at the lowest point for net positions since January 26th of 2016 when the positions totaled +59,040 contracts.

Gold Commercial Positions:

Meanwhile, the commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -73,916 contracts on the week. This was a weekly advance of 33,310 contracts from the total net of -107,226 contracts reported the previous week.

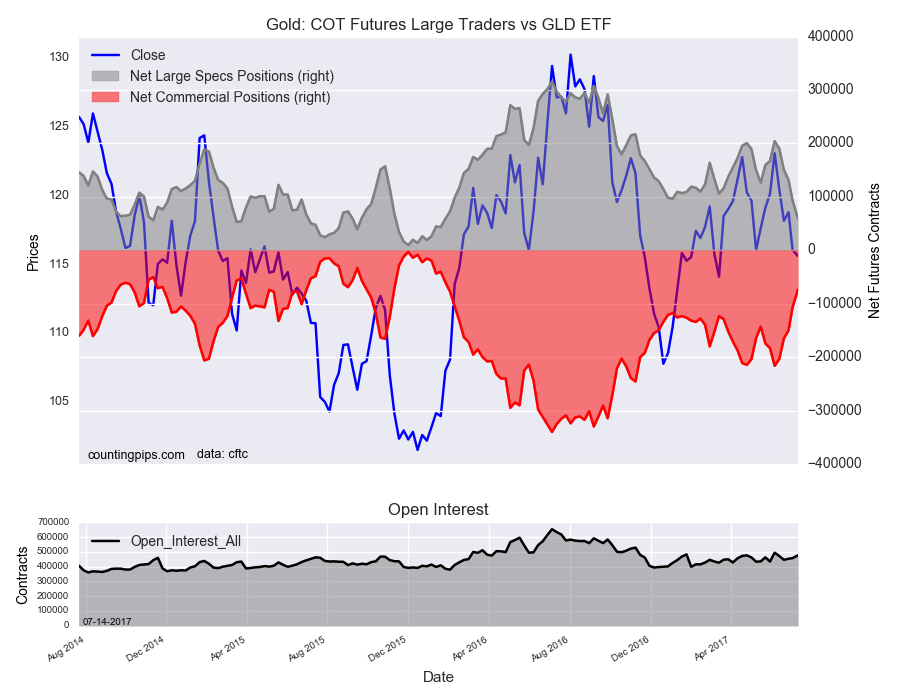

GLD (NYSE:GLD) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $115.62 which was a loss of $-0.47 from the previous close of $116.09, according to unofficial market data.