Gold Non-Commercial Speculator Positions:

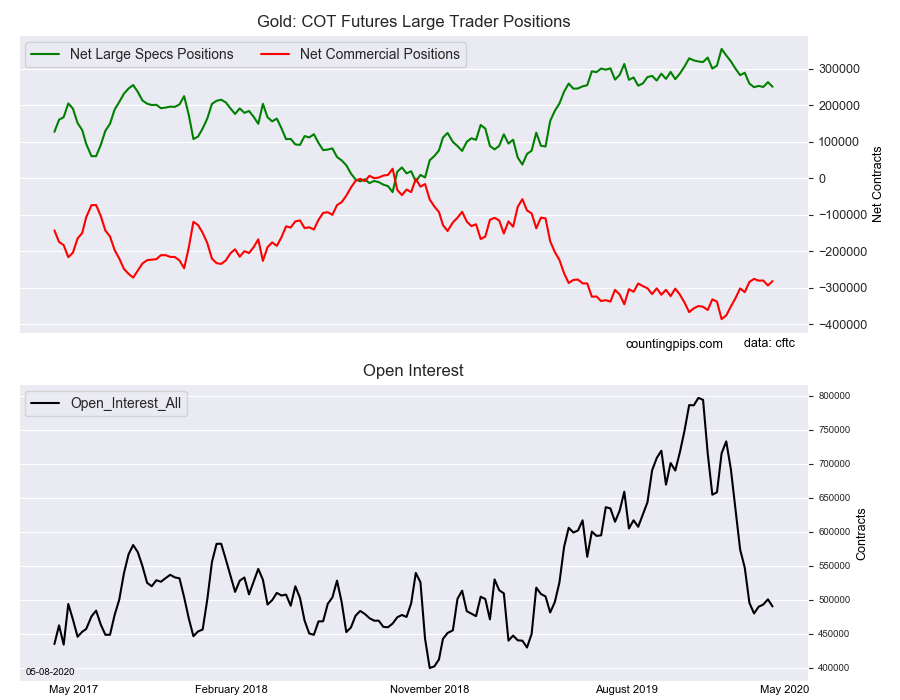

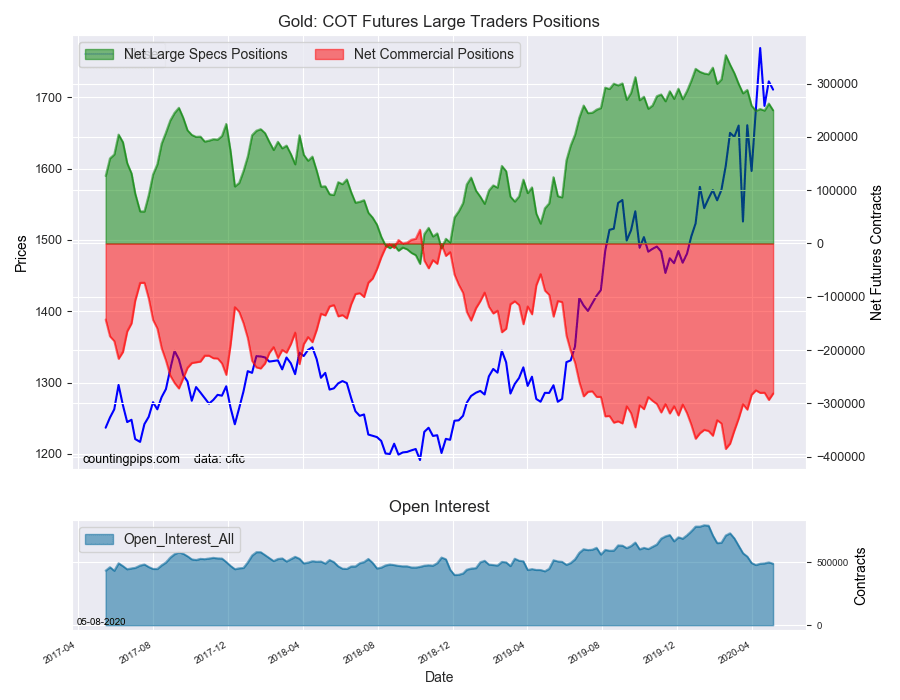

Large precious metals speculators cut back on their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 250,004 contracts in the data reported through Tuesday, May 5th. This was a weekly change of -12,725 net contracts from the previous week which had a total of 262,729 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -11,811 contracts (to a weekly total of 275,571 contracts) while the gross bearish position (shorts) rose by just 914 contracts for the week (to a total of 25,567 contracts).

Gold speculative bets fell for the second time in the past three weeks and for the fourth time in the past six weeks. Last week, speculators had boosted their bullish bets by the most in the previous ten weeks before this week’s setback. Overall, the current bullish position remains strongly bullish in the big picture but is still below the 2020 weekly average of +294,374 net contracts.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -281,636 contracts on the week. This was a weekly boost of 11,993 contracts from the total net of -293,629 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1710.60 which was a shortfall of $-11.60 from the previous close of $1722.20, according to unofficial market data.