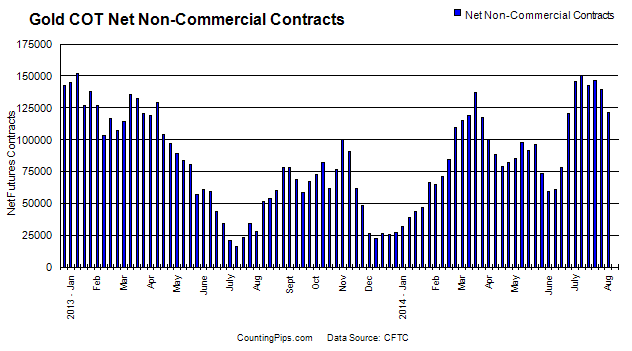

Gold market futures speculators cut back on their overall bullish bets last week for a second straight week last week and by the highest weekly amount since May, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

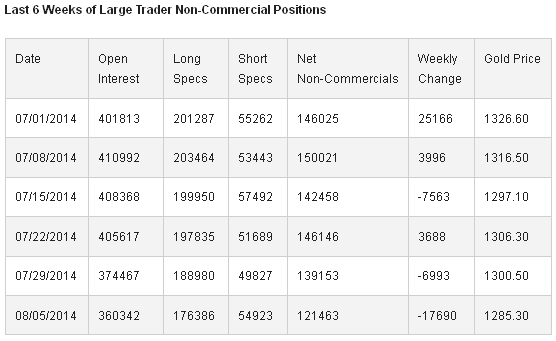

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +121,463 contracts in the data reported through August 5th. This was a weekly change of -17,690 contracts from the previous week’s total of +139,153 net contracts that was registered on July 29th.

The fall in the overall net speculator positions (-17,690) last week was due to a decrease in the weekly bullish positions by 12,594 contracts and an increase in the bearish positions by 5,096 contracts. Last week’s decline in bets marked the largest weekly shortfall for gold speculators since May 27th when positions fell by 23,100 contracts.

Over the weekly same reporting time-frame, from Tuesday July 29th to Tuesday August 5th, the gold price edged lower from approximately $1,300.50 to $1,285.30 per ounce, according to gold futures price data from investing.com.

Disclaimer: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).