Gold Non-Commercial Speculator Positions:

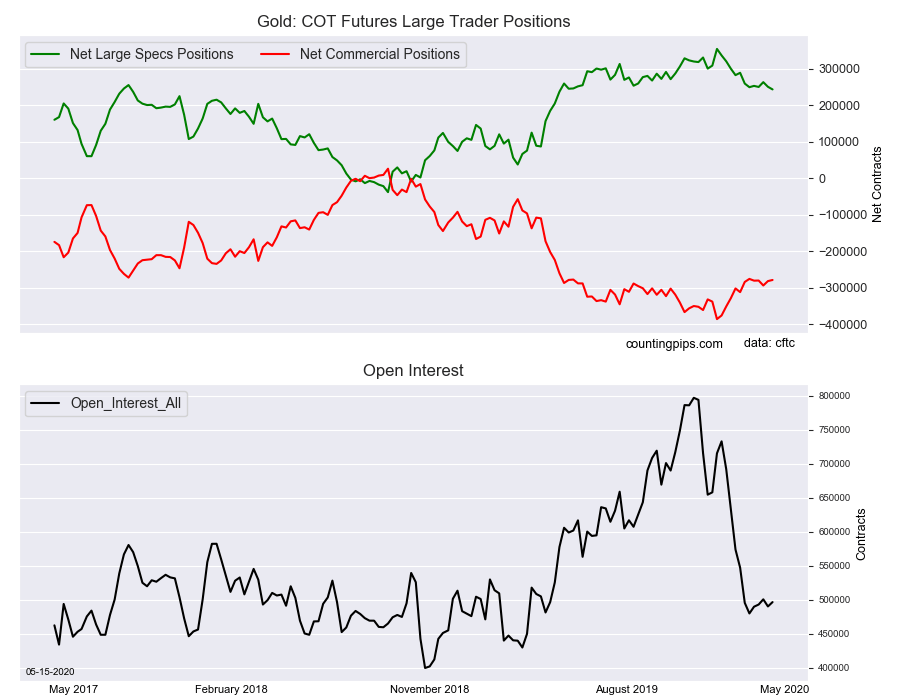

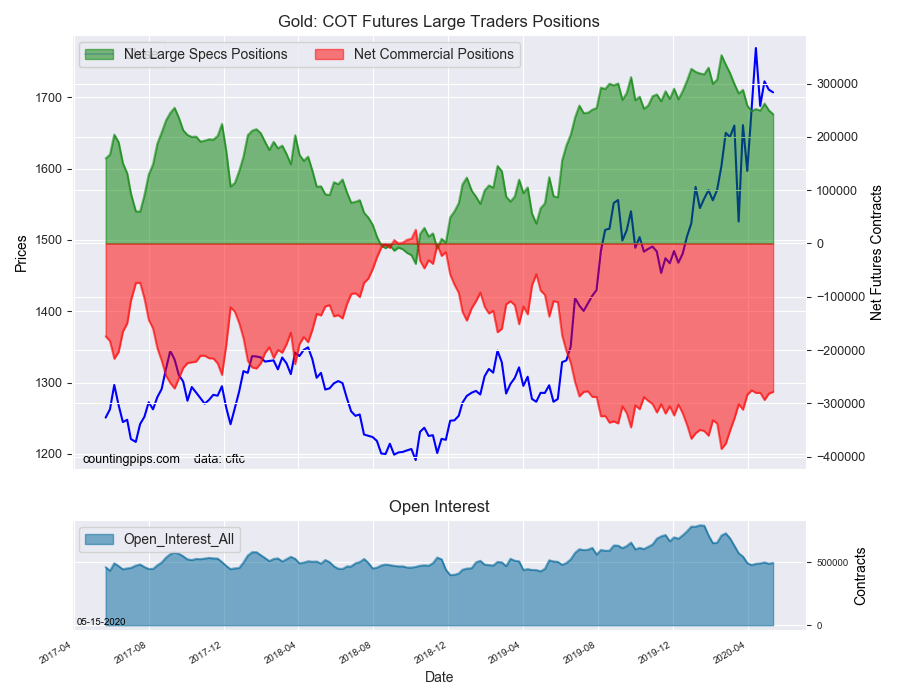

Large precious metals speculators lowered their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 242,828 contracts in the data reported through Tuesday, May 12th. This was a weekly decline of -7,176 net contracts from the previous week which had a total of 250,004 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 2,200 contracts (to a weekly total of 277,771 contracts) while the gross bearish position (shorts) gained by a larger amount of 9,376 contracts for the week (to a total of 34,943 contracts).

Gold speculative positions once again dipped this week for the second straight week and for the third time in the past four weeks. These decreases have brought the current bullish position down to the lowest level of the past forty-six weeks, dating back to June of 2019. Gold positions have now shed a total of -110,821 contracts since hitting an all-time bullish high of +353,649 contracts on February 18th. Despite the recent declines in bullish bets by the speculators, the gold price has continued to be very strong with a close this week above $1,756 per ounce.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -278,533 contracts on the week. This was a weekly increase of 3,103 contracts from the total net of -281,636 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1706.80 which was a loss of $-3.80 from the previous close of $1710.60, according to unofficial market data.