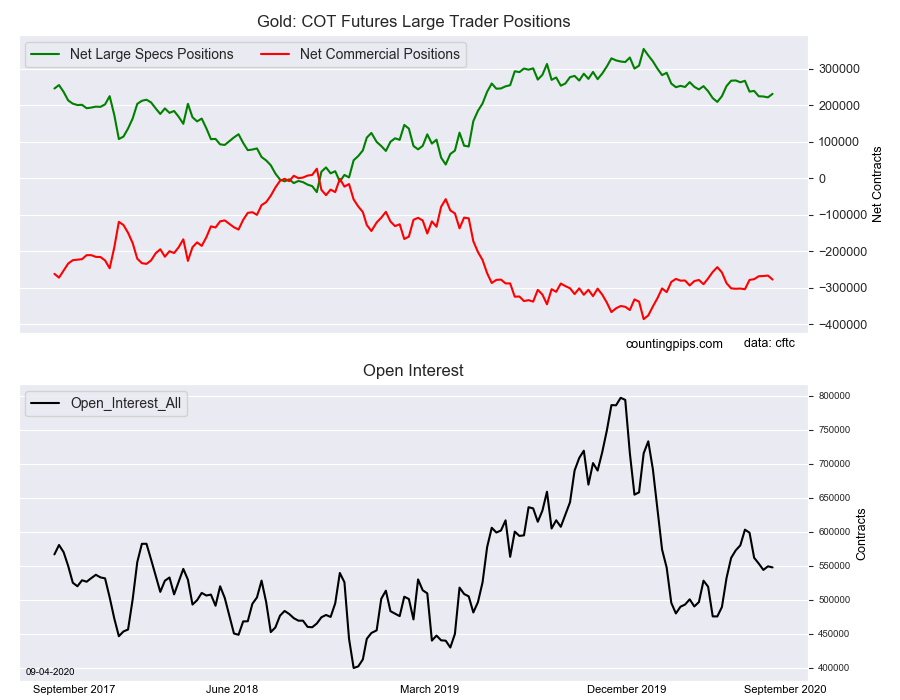

Gold Non-Commercial Speculator Positions:

Large precious metals speculator positions rebounded this in the Gold futures markets, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 230,796 contracts in the data reported through Tuesday, September 1st. This was a weekly rise of 9,758 net contracts from the previous week which had a total of 221,038 net contracts.

The week’s net position was the result of the gross bullish position (longs) growing by 4,559 contracts (to a weekly total of 306,118 contracts) while the gross bearish position (shorts) fell by -5,199 contracts for the week (to a total of 75,322 contracts).

Gold speculators raised their bullish bets higher this week following three straight down weeks that had dropped the overall bullish position to an eleven-week low. Gold bets rose by almost +10,000 contracts this week and pushed the net position back above the +230,000 net contracts for the first time since August 4th. Overall, the gold position has continued to remain strongly bullish and above the +200,000 net contract level for sixty-four consecutive weeks, dating back to June of 2019.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -277,406 contracts on the week. This was a weekly loss of -10,961 contracts from the total net of -266,445 contracts reported the previous week.

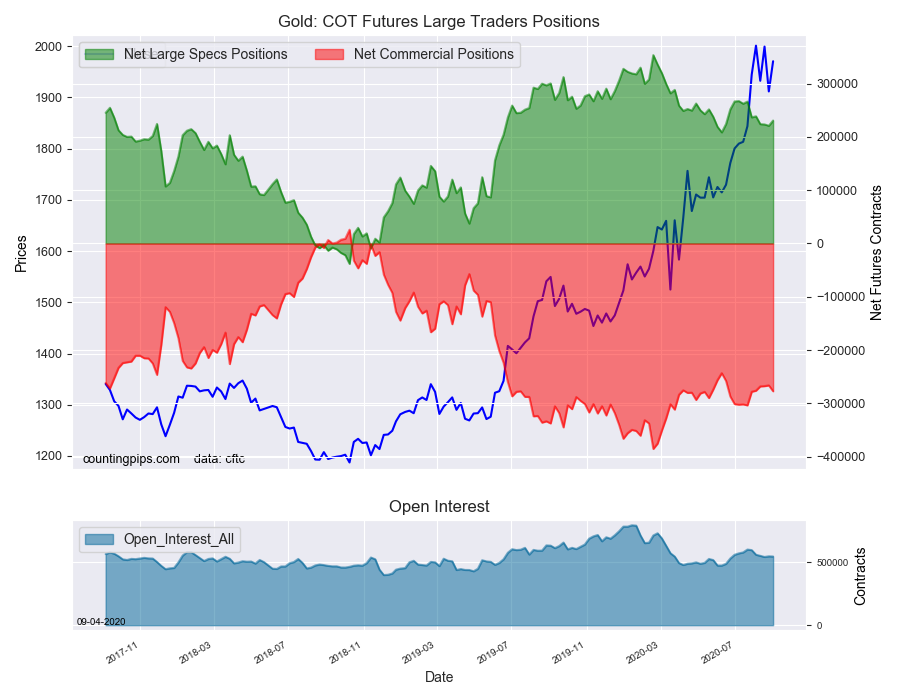

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1970.80 which was a gain of $59.0 from the previous close of $1911.80, according to unofficial market data.