Investing.com’s stocks of the week

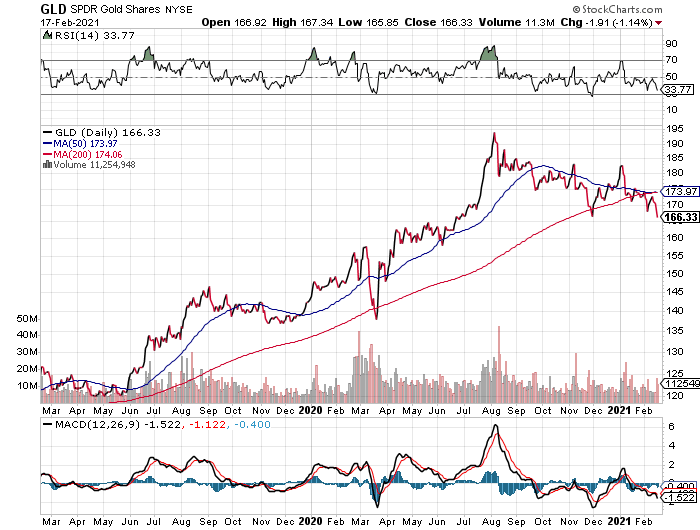

Gold Slides to 3-month Low

Gold continued to weaken during yesterday's trading, falling at one point to $1,772.80 an ounce (spot price for Feb. 17), trading near the lowest levels since November. The weakness pulled the 50-day average for SPDR Gold Shares (NYSE:GLD), a proxy for the metal, under its 200-day average for the first time in two years—a bearish signal.

According to Edward Moya, a senior market analyst at Oanda Corp.:

“A runaway rally in global bond yields has delivered a fatal blow to gold. Yields are rising on reflation bets, and that is triggering an unwind of many safe-haven trades.”

Lyn Alden of Lyn Alden Investment Research said:

"what gold really does is it protects you from an environment where inflation is much higher than the bond yields, and that’s what we’ve seen in 2020 is that gold over the past couple of years had a pretty big appreciation because it was protecting against that. Now, since about late summer 2020, negative real yields have been roughly flat.”

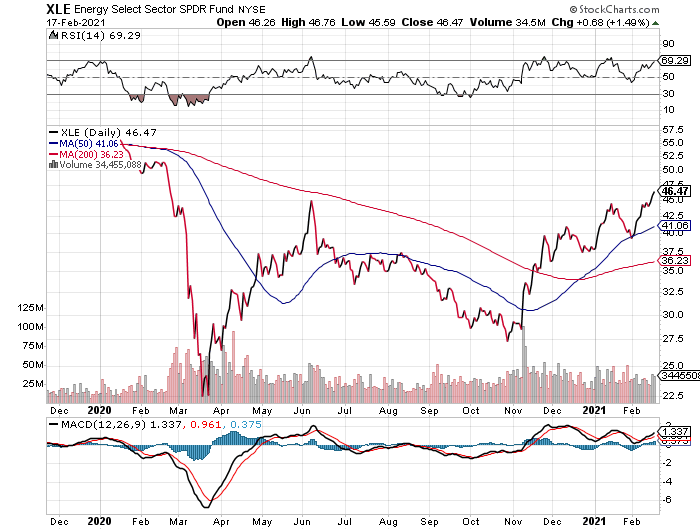

Energy Stocks Continue Rally; Goldman Bullish on Sector

Goldman Sachs (NYSE:GS) turned bullish on energy shares as Energy Select Sector SPDR (NYSE:XLE) closed at the highest level in nearly a year. Alessio Rizzi, an analyst at the investment bank, wrote that “adding energy equity exposure is attractive at this juncture, especially considering our constructive commodity view.”

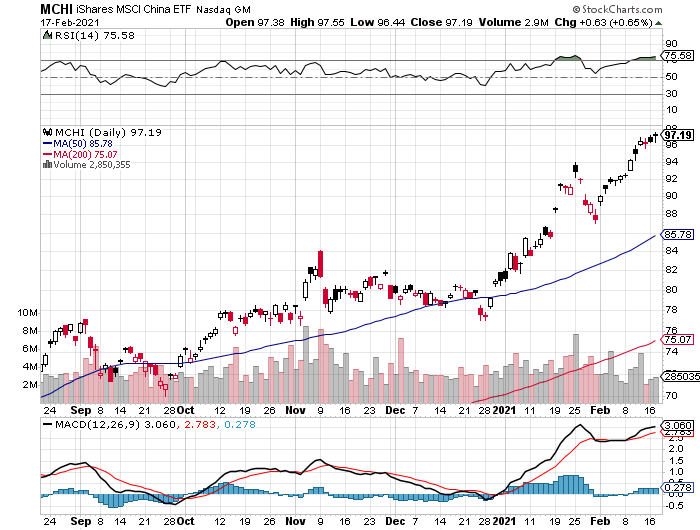

Another Record High for iShares MSCI China ETF

The iShares MSCI China ETF (NASDAQ:MCHI) ticked up to another record high Wednesday. China’s stock market “will stay bullish,” predicts Kingston Lin, managing director of the asset management department at Canfield Securities in Hong Kong. “The only matter is how much it will rise.”