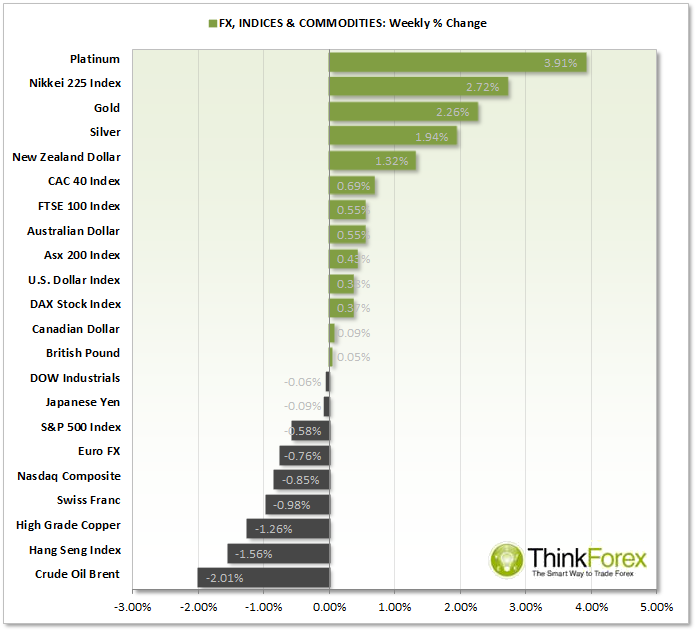

Market Snapshot:

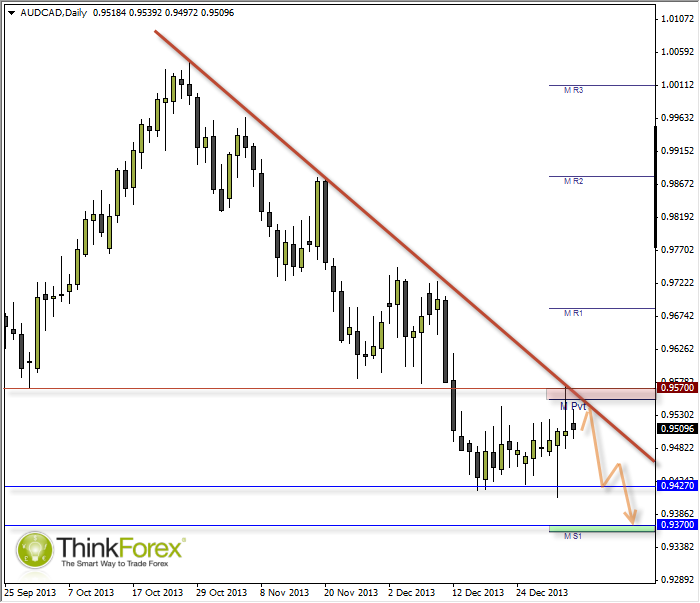

AUD/CAD

Following up from Thursday's Analysis I believe we are in a better position for the setup. Not long after the analysis was sent out, price broke to the downside only to retrace back into the pattern.

This is exactly the reason I prefer to enter after breakouts as I personally find FX to be rife with 'Fakeouts'. Additionally we have now formed an even better resisting trendline and pivotal resistance zone.

As long as this level holds it also increases the potential reward/risk ratio (assuming it does not break to the upside).

Take note of the support around 0.9420 as this has been tested several times, however even if this was an initial target the R/R could still be over 1:1 and allow you to move your stop to break-even before targeting the preferred target around 0.937.

Equally a break above 0.957 could signify a change in sentiment and provide buying opportunities. However until such an event the bearish setup is the preference.  AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="452" height="632">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="452" height="632">

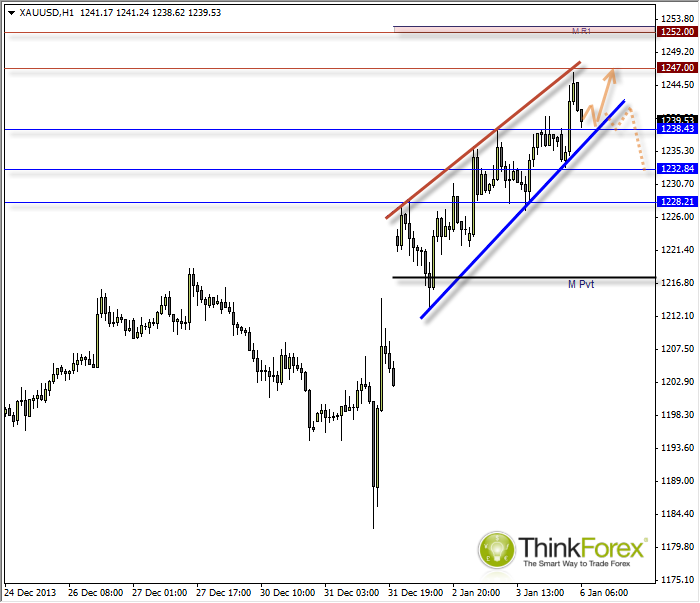

GOLD: One more push towards 1247 and 1250 looking?

Gold continues to favour the intraday traders at present by providing clear levels of support and resistance to trade to and from. The pattern I have highlighted is sitting between a bullish channel and a bearish wedge - it really could turn out to be either...

So a simple way of looking at this is to stay bullish as long as we trade above the blue trendline and turn bearish if we trade beneath it.

My preferred approach is to try and trade it one leg higher towards 1247 and maybe even 1250 before re-assessing price action.

In the event we do break beneath the blue trendline there are many levels of support which may initially reduce any momentum, so this is something to consider before trying to pick any tops. Until we break beneath 1215 it is hard to imagine any bearish move with any sustained momentum, due to the potential levels of support between current price and 1215.

However, there are other considerations with the higher timeframes. Firstly the Weekly chart has produced a bullish pattern, the Morning Star Reversal. Coupled with the fact that both Gold and Silver have rejected their recent swing lows then this does add to the argument of further gains ahead.  XAU/USD Hour Chat" title="XAU/USD Hour Chat" width="452" height="632">

XAU/USD Hour Chat" title="XAU/USD Hour Chat" width="452" height="632">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Sitting Between Bullish Channel And Bearish Wedge

Published 01/06/2014, 03:24 AM

Updated 08/22/2024, 06:01 PM

Gold Sitting Between Bullish Channel And Bearish Wedge

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.