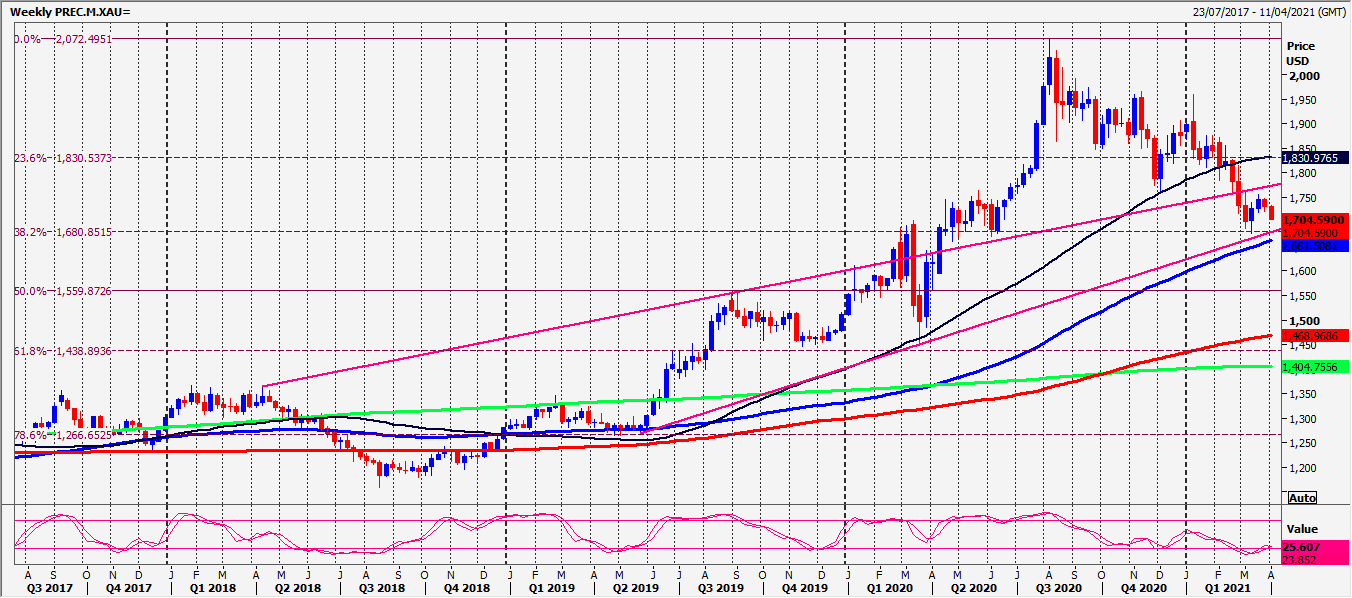

Gold Spot trades between support at 1795/90 and first resistance at 1812/15.

Silver Spot bearish engulfing candle turns the outlook negative as we test the only important support at 2580/2570.

WTI Crude August bearish engulfing candle in overbought conditions was a sell signal. We topped just 6 ticks from resistance at 7490/7500 and shorts worked perfectly if you managed to sell with a near 300 tick drop.

Today’s Analysis

Gold was seeing minor resistance at 1812/15 today. A break above 1817 is another buy signal initially targeting 1832/35.

First support at 1795/90. Longs need stops below 1785. A break lower can target 1779/77 and 1770/68.

Silver crashed below strong support at 2635/25 leaving the outlook negative. The only important support is at 2580/2570. A break lower is a sell signal. A break below the June low at 2555/50 is another sell signal.

Gains are likely to be limited with strong resistance at 2625/30 and again at 2670/80. WTI Crude topped exactly at resistance at 7490/7500 and broke best support at 7340/20 for another sell signal targeting 7220/00, perhaps as far as strong support at 7120/00.

We bottomed exactly here. Longs need stops below 7050. A break lower targets 6950/6900. Gains are likely to be limited with first resistance at 7265/95. Stop above 7320. Strong resistance at 7400/40. Stop above 7480.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realized. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.