Gold broke out from a 13-year cup and handle pattern earlier this year to a new all-time high and advanced to $2800/oz.

Silver broke out from 4-year resistance and recently reached an 11-year high, touching $35/oz.

However, the ongoing secular bull market in US Stocks and the emerging bubble in cryptocurrency have stolen its shine.

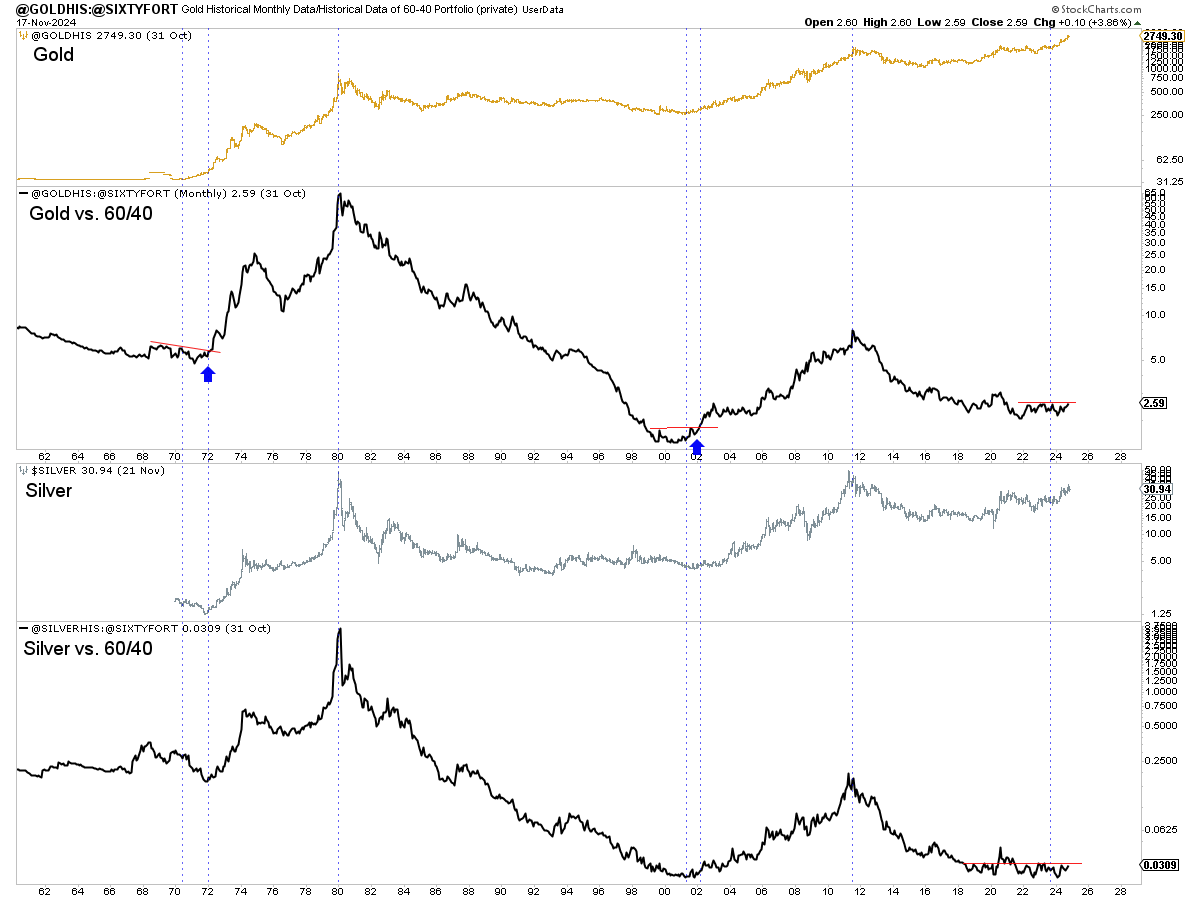

In nominal terms, Gold and Silver have made higher highs and are in a bull market.

But in real terms, Gold and Silver have barely moved off the ground floor.

Gold and Silver have yet to make progress against the conventional investment portfolio (the 60/40 portfolio) in the last 6 years.

They have yet to make a higher high since the secular bear market began at the end of 2011.

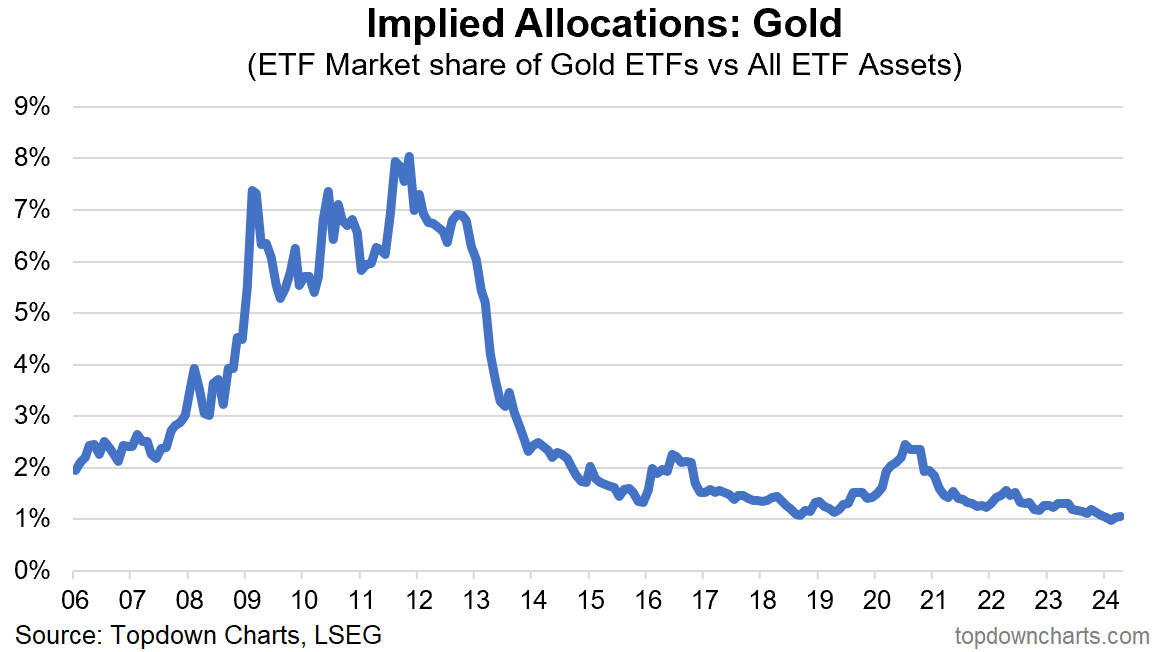

Near the end of 2011, the share of Gold ETFs against all ETF assets was 8%.

A few months ago, the share was barely 1%.

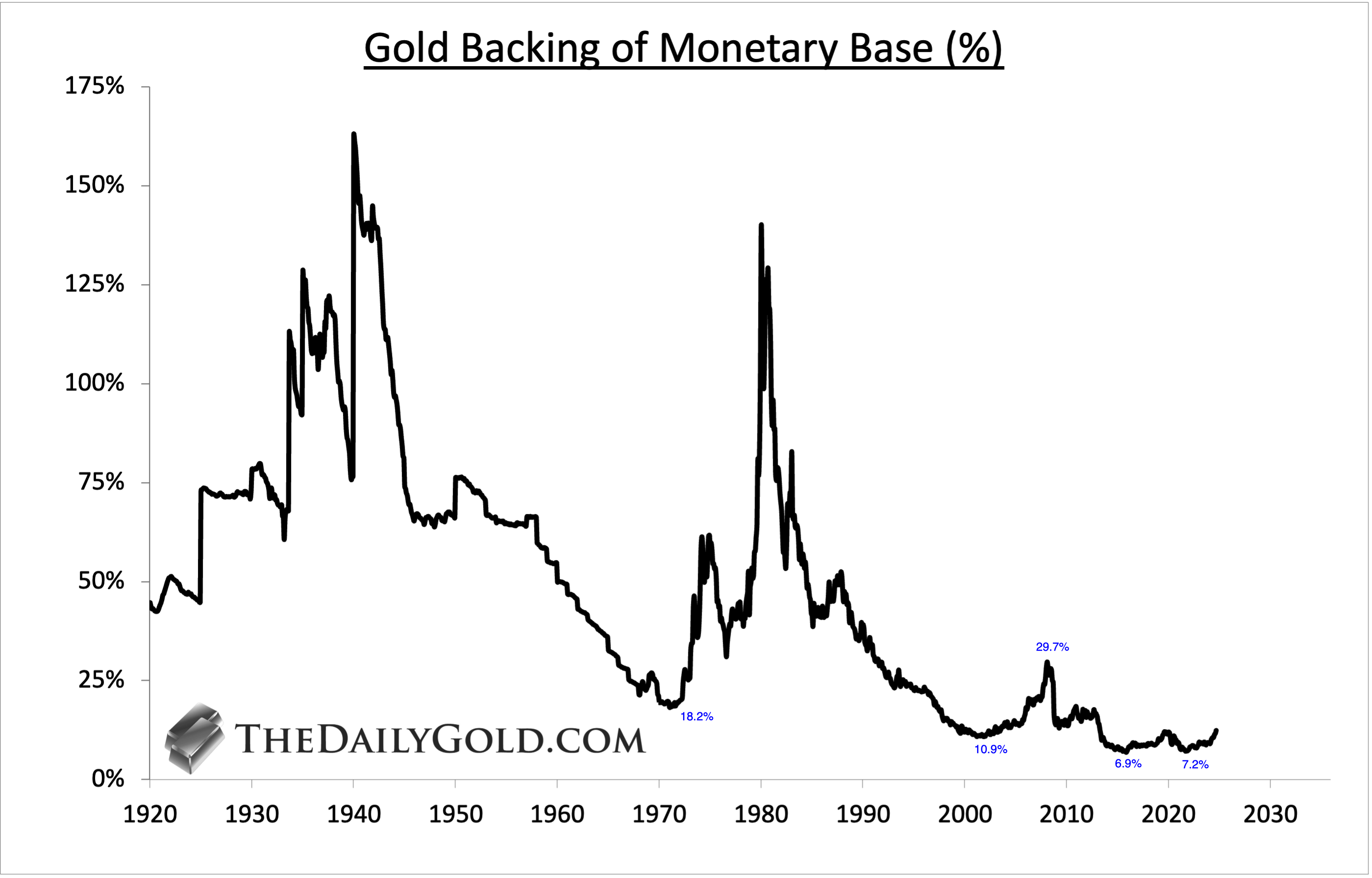

The last two secular bull markets in Gold peaked with Gold backing well over 100% of the monetary base. The legal mandate under the Federal Reserve Act of 1913 was 40% backing.

Backing has increased from an all-time low of 7% a few years ago to 12.4% today. Reaching the 2008 peak of nearly 30% would put the Gold price at almost $6,500/oz.

Gold and Silver have advanced quite a bit in recent years but remain cheap in real terms.

Relative to the stock market and the 60/40 portfolio especially, Gold and Silver remain on ground floor territory. The same can be said for their allocation relative to equities and their value against the monetary base.

The secular bull market in precious metals has barely started.

When Gold begins to outperform the 60/40 portfolio and stock market in earnest, Gold and precious metals will have moved beyond the ground floor.

Until then, one can position in quality junior companies that will lead the next leg higher.