Last week, I emphasized that silver’s outperformance was indicating a reversal. That’s exactly what we saw on Friday. Can you guess what’s next?

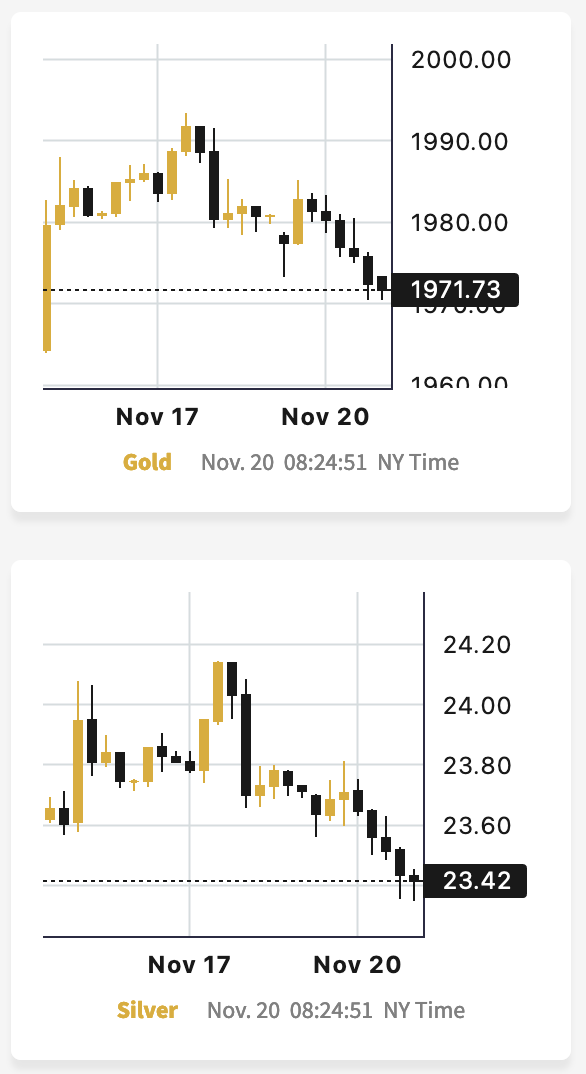

Well, nobody has to guess because today’s price action already provided a reply. Please take a look at the action so far today (chart courtesy of http://GoldPriceForecast.com).

Both precious metals are down. Silver price failed to hold above $24, and gold once again failed to move above $2,000. The surprises in the data and news can only push precious metals so far against their trends.

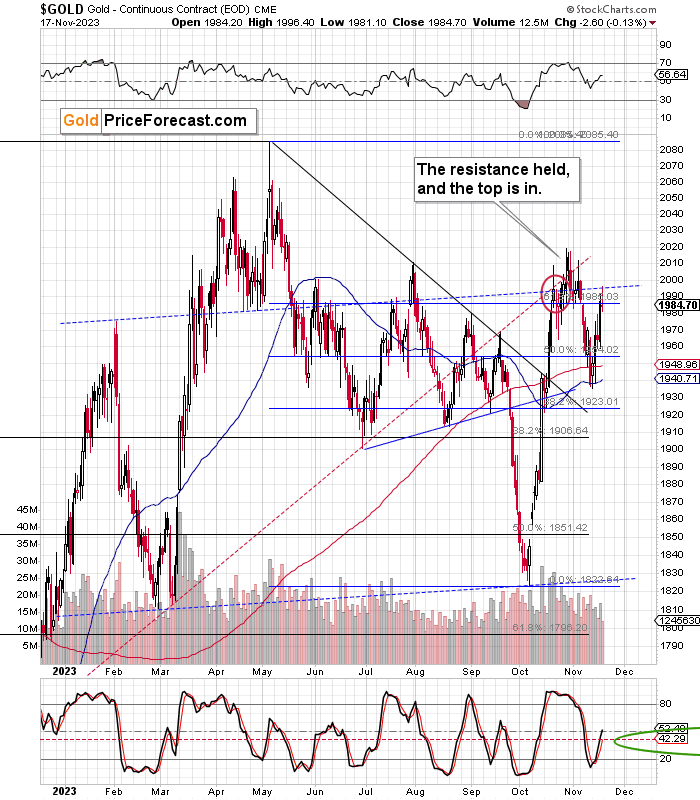

Let’s zoom out and focus on gold.

The analysis of gold at this moment is quite straightforward. It moved to the rising blue line once again, and it once again moved to the previous highs (approximately). Gold also moved to its 61.8% Fibonacci retracement based on the entire 2023 decline.

In other words, it seems that whatever bullish action was likely to take place in the immediate aftermath of last week’s surprises in economic numbers (e.g. initial jobless claims) already happened.

The price-volume action confirms it. During the last several days, the volume on which gold moved higher declined. We saw the same thing in the second half of August (and back then, gold even rallied to similar price levels!), and guess what happened next? Gold topped and then plunged by about $150.

Can it happen again? Of course.

Will it happen again? That’s very probable – and the odds are that the decline will be bigger.

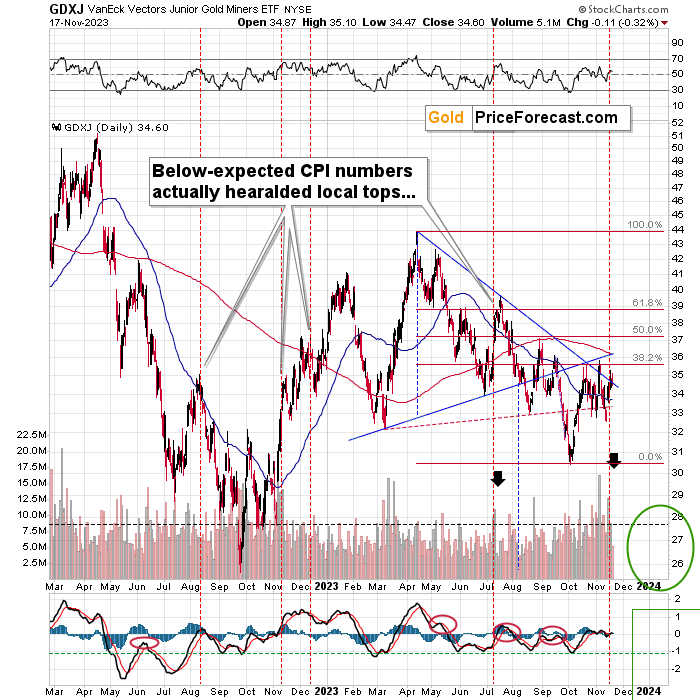

You know, when gold moves higher, but mining stocks lag, the odds are that the rally is fake.

Can you see where mining stocks currently are relative to their 2023 decline? Gold just moved to its 61.8% retracement, but miners didn’t even manage to move to their 38.2% retracement.

In other words, miners seriously underperformed gold – this is no “small stuff”. This is a major indication that the big trend remains down. And that what you see on the mining stocks chart – the medium-term decline – and not what you see on the gold chart (sideways trading) represents the real status of the situation in the precious metals market.

Now, mining stocks reversed on Friday while also failing to break above their declining blue resistance line, which is another piece of the bearish puzzle.

In other words, the post-positive-news-release story unfolds almost exactly as in the past. Even though the situation is different, the numbers are different, and the world is different. The way that people reacted to bullish surprise in the data within a bearish trend remained the same.

I marked the previous analogous cases – reaction to data – with red dashed lines. That was at or right before an important short-term top and given Friday’s reversal and today’s early-session decline, it seems that we saw a top once again.

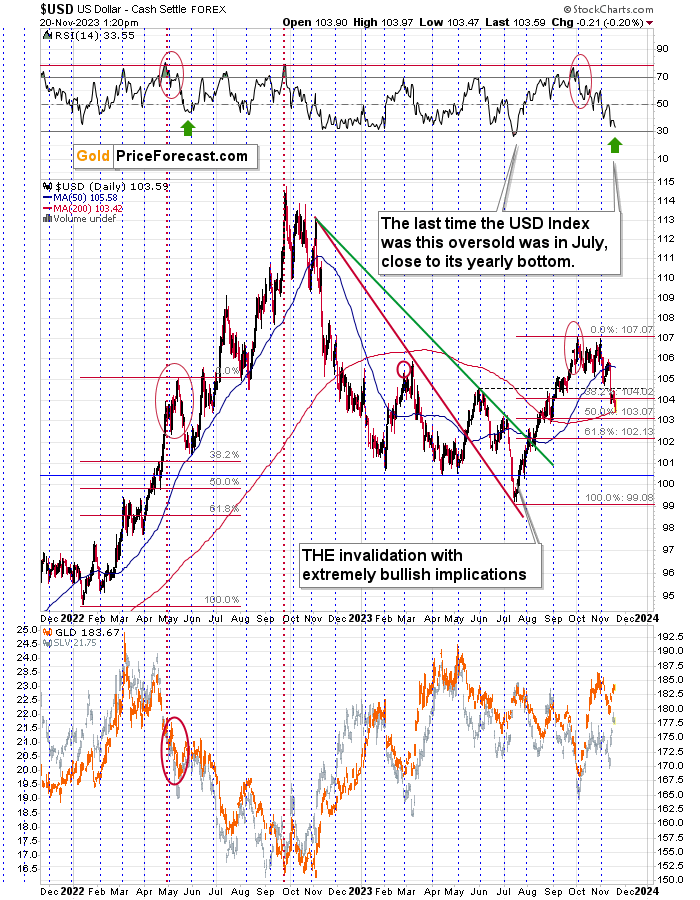

And you know what’s lurking in the bearish background? The link between all the above and the situation in the USD Index.

Can you see how the USDX is way below its October lows? Neither gold nor mining stocks are above their respective highs, despite the two markets (USDX and precious metals) being negatively correlated. The precious metals sector is simply ready for another move lower.

The USD Index is currently almost as oversold as it was at its 2023 bottom, suggesting that a reversal is coming. Remember – when everyone gets to one side of the boat, it’s usually good to be on the other side.

In today’s early trading, the USDX moved slightly down, and yet gold and silver declined anyway. This is the final confirmation that the current forecast for gold, silver, and mining stocks is bearish and that the profits on our short position in the mining stocks are likely to increase shortly.