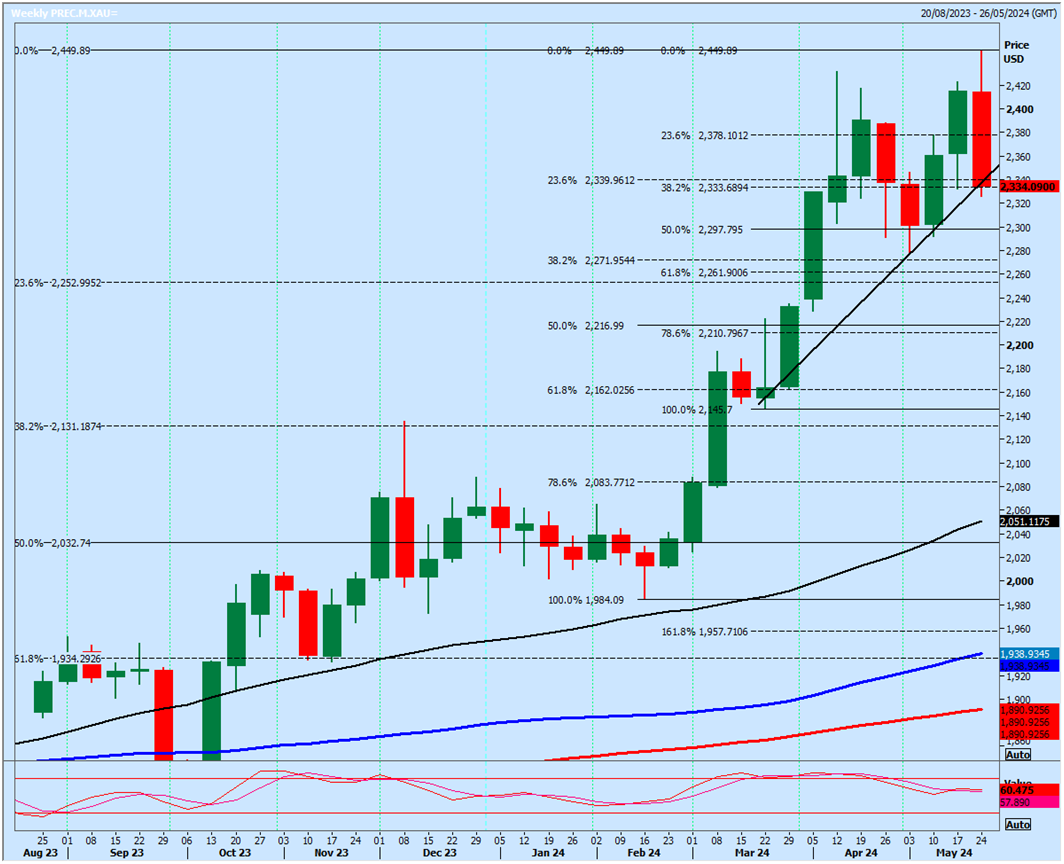

Gold (XAU/USD) collapsed through strong support at 2381/77 and if you managed to get into a short position in time, Gold headed straight for the next downside target of 2340/35 as predicted. We should have found good support here in the bull trend but longs needed stops below 2330 and we overran as far as 2326.

Gold is oversold in the short term and although it does not feel like it this week, we are still in a longer-term bull trend of course. Looking back at the charts this week, there was no indication that I can see, that we would reverse so dramatically and wipe out last week's gains. But we have.

If we close this week below last week's low of 2332, we have an important bearish engulfing candle on the weekly chart. (When a new all-time high is reached and the price then collapses below the previous candle low, creating a bull trap, when longs are holding losing positions).

Although I will not take this as an immediate sell signal, it would be a warning to bulls that the bull run may be over at this stage. It could mean we consolidate in a sideways channel, it does not necessarily mean prices are about to collapse. I then need to see what pattern develops.

Just 1 thing to note, I think this week's high is too far above the April high for a double-top pattern to be relevant. So it's not as negative as it could have been.

We are attempting to recover as I write, trading at 2333. I still favor a move higher from here, but we need to see prices holding above last week's low of 2332 and then start to move above 2340 for this to materialize. We should then target 2350 and 2355.

Gains could be limited, with nervous short-term bulls trapped in some losses, so a high for the day around 2350/55 is possible. However, I think it is too risky to try a short position.

Just be aware that if we continue higher we should target 2362 and 2372.

A break below yesterday's low means all hope is lost for the bulls for today at least and signals further losses, probably as far as the 2315-2310 area and even 2300/2296 is possible. In fact I would not rule out these targets being hit before the close if we start to move lower, with increasing volatility in the last 2 weeks.

Silver

- Silver (XAG/USD) collapsed through my buying opportunity at 3100/3080 with stops triggered below 3050.

The break lower signaled a slide as far as a buying opportunity at 3010/3000.

This target was quickly achieved with a low for the day exactly here.

Longs need stops below 2970. - Targets for our longs are 3055/60 and even 3095/99 is possible.

- However, a break below 2970 is a sell signal for today, targeting 2930/25, perhaps as far as strong support at 2900/2890.

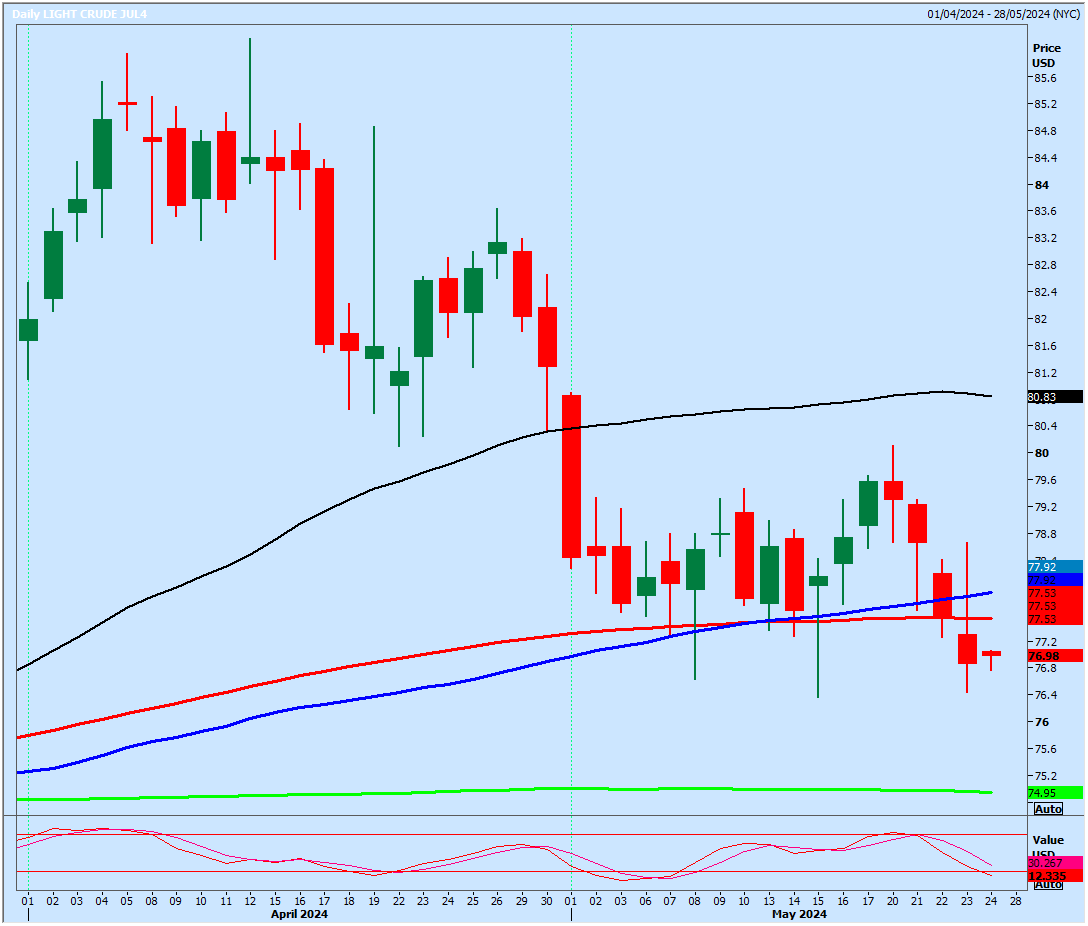

WTI Crude JULY Future

- WTI Crude July I must wait for a signal, pattern, or trend. Unfortunately for now there is nothing to go on as we jump about randomly and erratically in a sideways channel. I must wait for a breakout, pattern or signal.

- We are trading down towards recent lows at 7663/36, with a low for the day exactly here yesterday in fact we may bounce before this area but as we have only traded sideways throughout May I am struggling now to find levels.

A weekly close below 7600 could be a sell signal for the start of next week.