The anticipated gold rebound is under way, and the significant upper knot of yesterday‘s session isn't concerning – gold is not rolling over to the downside here. Let alone silver. I view yesterday‘s trading as consistent with a daily pause within an unfolding uptrend.

My open long position is growingly profitable, and I‘ve covered the bullish case in detail on Monday and Tuesday. Today's analysis will strengthen the story even more.

Given the dollar performance, I can't underline enough the importance of what we're witnessing.

On Monday, I said:

(…) The weak non-farm employment data certainly helped, sending the dollar bulls packing. It's my view that we're on the way to making another dollar top, after which much lower greenback values would follow. Given the still prevailing negative correlation between the fiat currency and its shiny nemesis, that would also take the short-term pressure of the monetary metal(s).

What would you expect given the $1.9T stimulus bill, infrastructure plans of similar price tag, and the 2020 debt to GDP oh so solidly over 108%? Inflation is roaring – red hot copper, base metals, corn, soybeans, lumber and oil, and Treasury holders are demanding higher yields especially on the long end (we‘re getting started here too). Apart from the key currency ingredient, I‘ll present today more than a few good reasons for the precious metals bull to come roaring back with vengeance before too long.

So, let‘s dive into the charts (all courtesy of www.stockcharts.com).

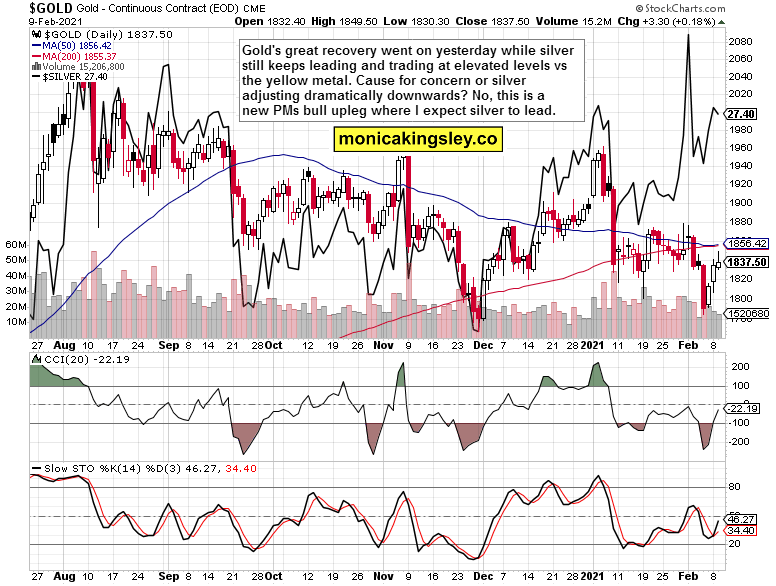

Gold And Silver

Let‘s overlay the gold chart with silver (black line). My comments yesterday are a good fit also today – the disconnect since the November low should be pretty obvious, and interpreted the silver bullish way I've been hammering for weeks already. Please also note that the white metal has been outperforming well before any silver squeeze caught everyone‘s attention.

The gold-to-silver ratio sends a similarly clear message – the coming precious metals upleg will be characterized by silver outperforming gold for a variety of reasons beyond the industrial demand and versatility ones. Silver's above ground stockpile isn‘t being added to at the same pace as gold's is, and its recycling is less feasible practically speaking. Solar panels are but one of the ever hungry industrial applications, making heavy demands on silver reserves

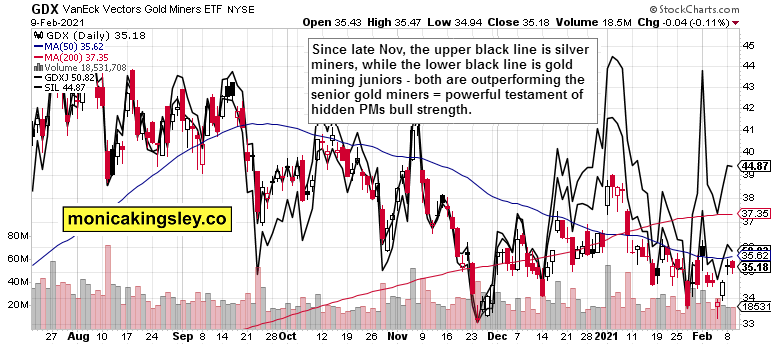

Let's overlay the senior gold miners chart with both junior mining stocks (also gold) and silver mining stocks. See the late November turning point, where silver miners started outperforming both the gold juniors and gold seniors. That's more proof of the precious metals bull waking up.

Summary

The gold and silver bulls are consolidating gains amid their return, and the bullish case for precious metals is growing stronger day by day. Crucially, it‘s not about the dollar here, but about the sectoral internals, and decoupling from rising Treasury yields. The new upleg is knocking on the door, and patience will be rewarded with stellar gains.