Gold spot shorts at the sell opportunity at 1895/1899 have worked perfectly all this week. Yesterday we bottomed exactly at first support at 1871/69 for a 25 point profit.

A weekly close tonight above 1903 is a buy signal for next week.

Silver spot stuck in a 1 month sideways trend, with first resistance at 2810/20 tested as I write this morning. Shorts need stops above 2835.

WTI Crude JULY Future crashed breaking 200 month moving average support at 6985/75 but bottomed exactly at good support at 6860/30 for a potential 200 tick profit on longs.

Today’s Analysis

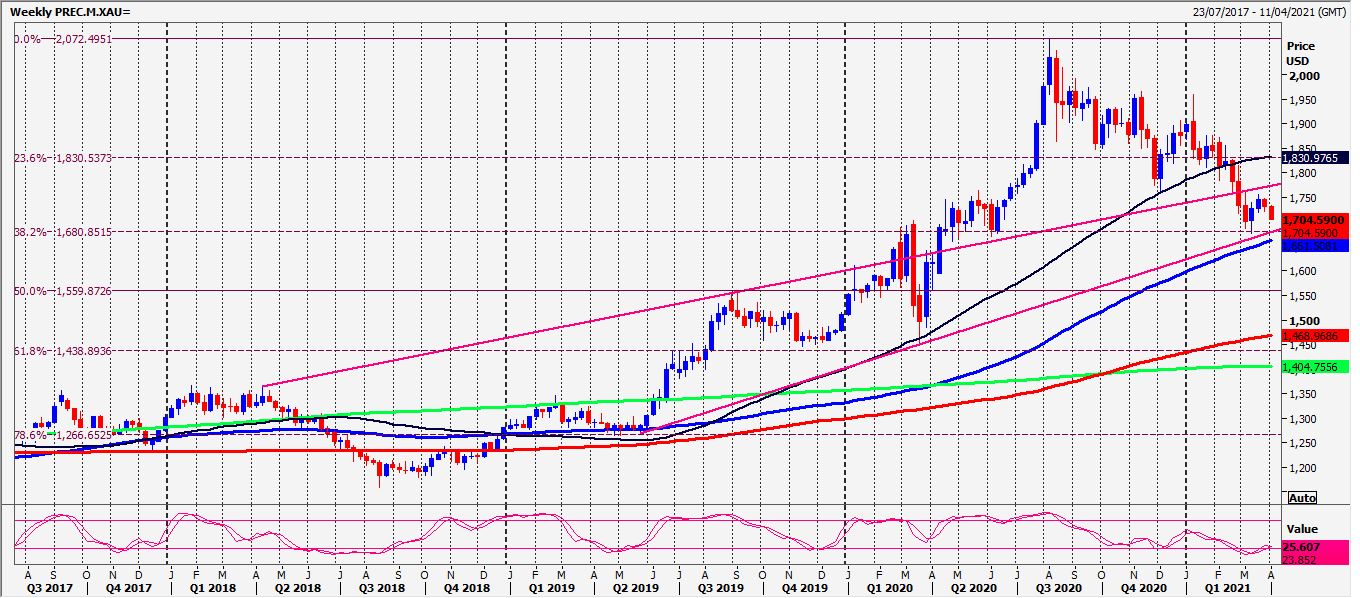

Gold sell opportunity at 1895/1899. Stop above 1903. (We topped exactly here yesterday). A break higher is a buy signal targeting 1912/16. Further gains this week look for 1925 & 10 month trend line resistance at 1935.

Shorts at the sell opportunity at 1895/1899 target 1885 (hit), minor support at 1880/78 today and perhaps as far as first support at 1871/69 for some profit taking.

Further losses test key support at 1859/56 with further important 10 month trend line and 200 day moving average support at 1845/40. Perhaps bulls can try to scale in to longs across this range.

Silver first resistance at 2810/20 tested as I write this morning. Shorts need stops above 2835. Further gains retest last week’s high at 2850/54.

First support at 2730/20 but below 2710 is a sell signal targeting 2690/80 before very strong support at 2650/45.

WTI Crude if you managed to buy in to longs at good support at 6860/30 (we bounced just 8 tick above) we shot higher to to 200 month moving average at 6985/75 and as far as 7000/20. On further gains look for 7050/60 then 7085/95 and 7135/55.

Disclaimer: Minor support at 6985/65, good support at 6860/30. Longs need stops below 6800. No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.