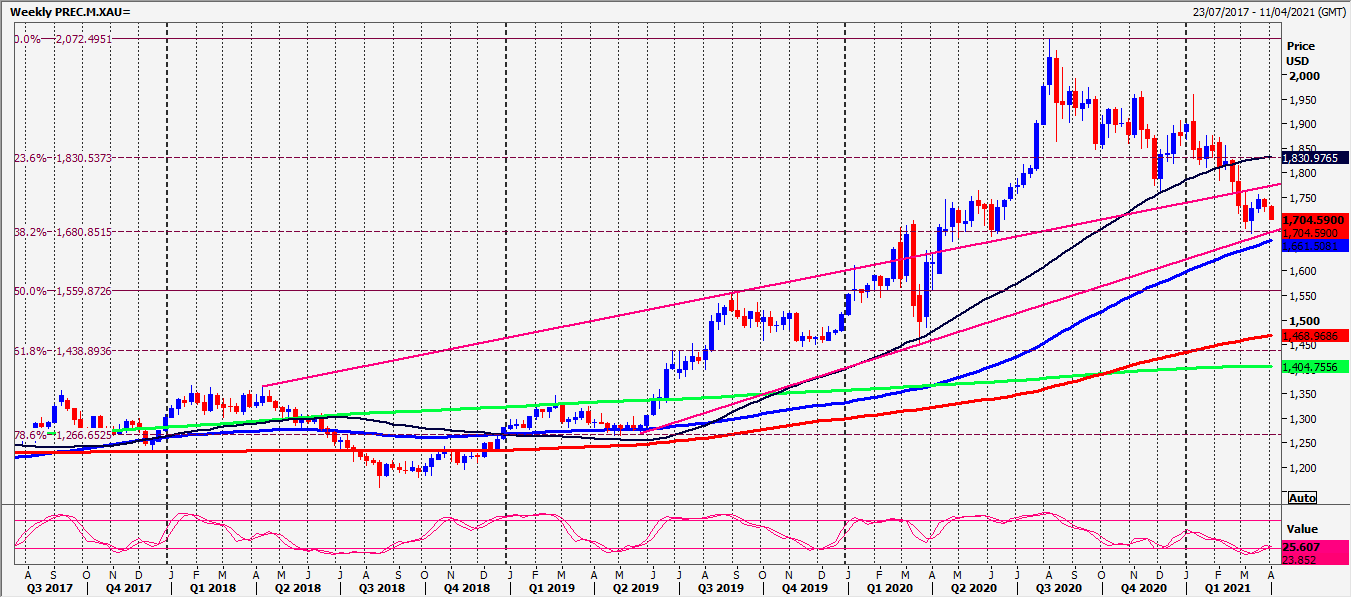

Gold spot we warned: the bearish engulfing candle on Tuesday perhaps signals the formation of the next bull flag in severely overbought conditions…outlook turns neutral after the negative signal. Longer term outlook remains positive.

Gold sees a correction after the negative signal at the start of this week. We broke second support at 1880/77 to hit the next target and support at 1859/56. THIS IS THE BEST CHANCE OF A LOW FOR THE WEEK.

NOTE THAT A WEEKLY CLOSE BELOW 1872 LEAVES A BEARISH ENGULFING CANDLE ON THE WEEKLY CHART FOR A MEDIUM TERM SELL SIGNAL.

Silver spot we wrote: shooting star and even a bearish engulfing candle signals we remain in a sideways trend.

Yesterday we broke our buying opportunity at 2760/40 for a sell signal in to the end of the week.

WTI Crude JULY Future holds the next target of 6950. Outlook remains positive.

Today’s Analysis

Gold meets key support at 1859/56. However there is further important 10 month trend line and 200 day moving average support at 1845/40. Perhaps bulls can try to scale in to longs across this range. A weekly close tonight below 1840 is a medium term sell signal.

A bounce from 1859/56 targets 1869/70, perhaps as far as quite strong resistance at 1878/80. A high for the morning is certainly possible if tested. Further gains meet a sell opportunity at 1895/1899. Stop above 1903.

Silver holding below 2755/75 is a sell signal for today targeting 2720/10 and 2690/80.

On further losses look for very strong support at 2650/45.

Bulls need a weekly close above 2790 if they are to be saved next week.

WTI Crude shot higher from support at 6790/70 targeting 6880/90, 6950 & 7000/20. If we continue higher look for 7050/60 & 7085/95. First support at 6815/05 with best support for today at 6760/50. Longs need stops below 6720.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.