Gold spot bottomed exactly at first support at 1771/69. Longs worked perfectly on the bounce to 1779/81 as we look for a test of strong 100 day moving average resistance at 1796/98.

Silver spot holding below first resistance at 2685/95 but finding buyers every time we test first support at 2625/15.

WTI Crude JUNE Future tests 500 week moving average resistance at 6600/6620.

Today’s Analysis

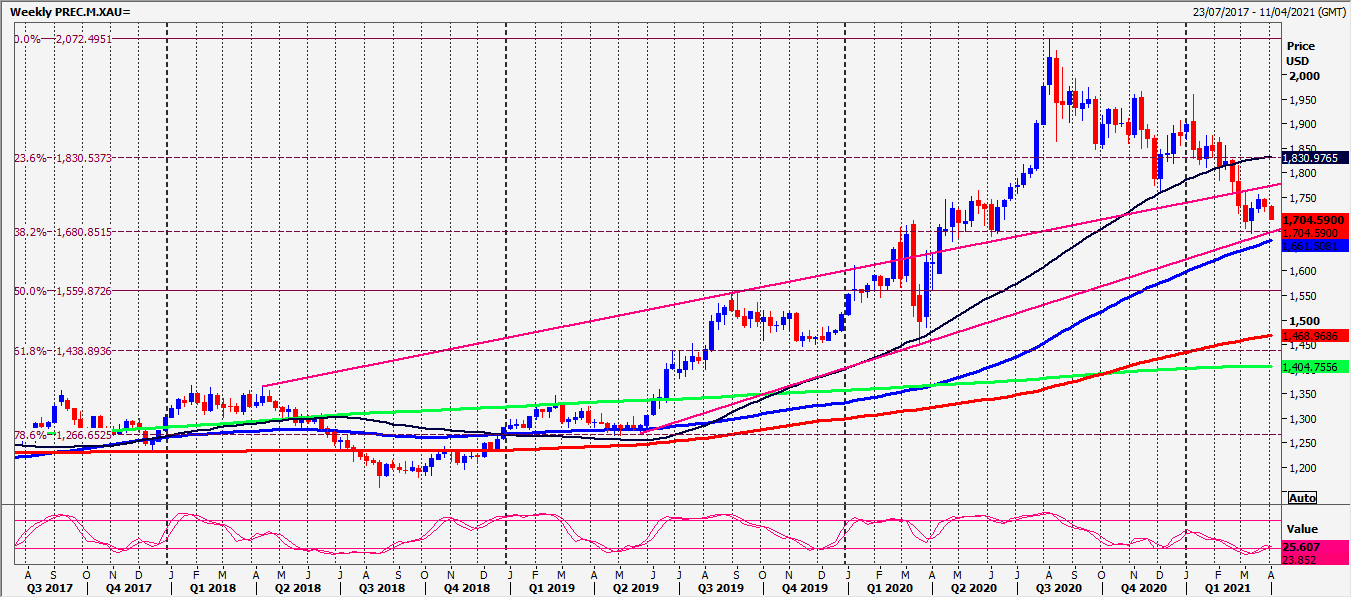

Gold shot higher to 1790 as I write this morning as we look for a test of 100 day moving average resistance at 1796/98. Further strong resistance at 1803/06. A break higher is a buy signal targeting 1815 and 1822/23, perhaps as far as 1830/35.

Holding strong resistance at 1796/98 in the 3 week sideways trend re-targets first support at 1780/78. A low for the day is certainly possible here. However further losses retest support at 1771/69. Longs need stops below 1766. A break lower targets 1760/58. A break below 1756 risks a slide to 1752/50 and support at 1746/44.

Silver very minor resistance at 2655/60 then strong resistance at 2685/95. A break above 2710 is the next buy signal initially targeting 2725 then 2770/80.

First support at 2625/15 holding well with buyers here being offered a 30 ticks scalp.

Longs need stops below 2605. A break lower targets 2585/75.

WTI Crude shot higher to strong 500 week moving average resistance at 6600/6620.

We try a break above here, hitting the next target of 6655/60 but collapsed quickly below 6600. Yesterday we hit the first downside target of 6520/10. Below 6580 today meets strong support at 6460/40. Below 6420 however risks a slide to 6370/60 with very strong support at 6320/00.

Strong resistance at 6600/20 but above here can target re-targets 6655/60. Above 6680 look for 6730/40 and resistance at 6790/6810.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.