It’s 2008 all over again, only much worse. And just like back then, PMs are likely to slide very fast, very far and then recover in a big way. A lot of money is likely to be made by those, who are positioned correctly.

The precious metals market has been providing us with myriads of signs recently. Some come from gold, some come from silver and quite many come from the analysis of the mining stock sector. Those that we will show you in just a minute, will probably make you first think “No way!”, then “What if?”, and finally “I hope I still have the time”.

Still not convinced if it’s worth reading? What if we told you that the final bottom for the precious metals sector (but not for the stock market) could be seen as early as… next week?

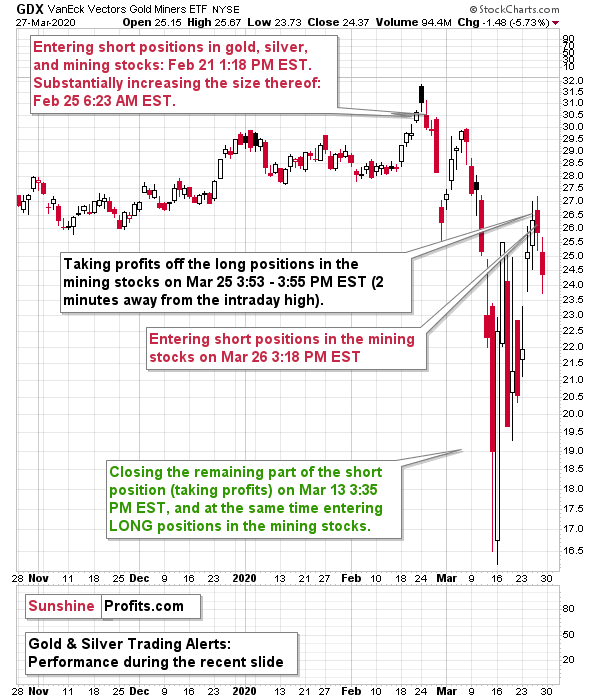

We prepared just one chart for you today (and also supplementary one which explains why you should treat the first chart seriously), but it’s of very big importance.

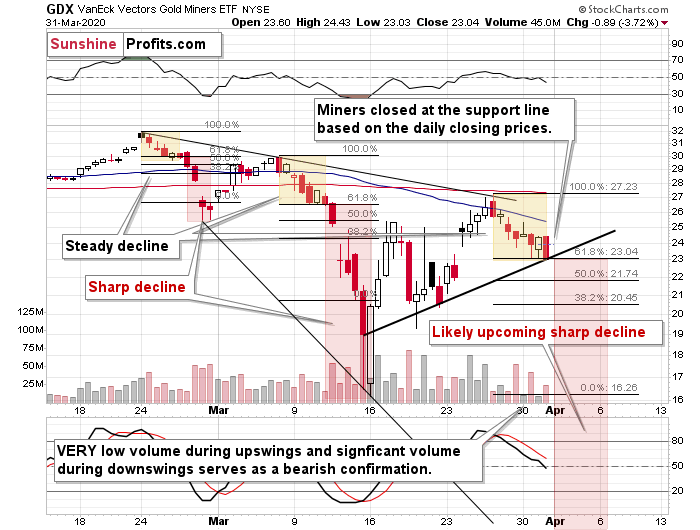

Let’s start with something relatively uninteresting, but still important. You might be wondering why didn’t the GDX ETF slide further yesterday, even though gold moved lower very visibly. The above chart provides two reasons for it.

The first reason is the rising support line that’s based on the previous closing prices. That’s where the GDX (NYSE:GDX) closed yesterday. This alone is a good reason for GDX not to decline more during yesterday’s session. Of course, when gold declines again, miners are likely to break below this support line and decline much more visibly.

The second reason is that a relatively steady decline should have been expected right now. That’s exactly how the two previous declines started. The important thing is that the steady part of the downswing is not likely to persist for much longer.

This brings us to the most interesting part of the above chart – examination of the previous declines with regard to their shape.

In late February, GDX declined steadily for 5 candlesticks (the above chart is based on 4-hourly candlesticks). Then it declined quickly for 3-4 candlesticks (there was a double bottom).

In mid-March, GDX declined steadily for 6 candlesticks. Then it declined quickly for 4-5 candlesticks (there was a double bottom).

Please note that there is a specific tendency for both: the base (steady decline) and the real move (quick decline). They were both slightly longer in the second case – each by 1 day. It’s also interesting that we saw a double bottom at the end of each.

Now, GDX has been declining steadily for 7 candlesticks, which seems to fit the above pattern very well. If the more volatile part starts today – and this seems quite likely – then based on the above analogy, we can expect it to continue for about 5-6 trading days. This means that the bottom would be likely to form on April 7th (Tuesday) or April 8th (Wednesday).

Based on yet another technique (the previous ones are the analogy between 2008 and 2020 in gold, and the one about miners’ reaching their declining support line that we outlined on Monday) it seems that we’ll see a major bottom in the precious metals market next week, likely close to April 7th.

It could be the case we’ll once again see a double bottom formation with one bottom on Tuesday, and one on Wednesday, but we have only one indication for it, so we wouldn’t bet the farm on this particular scenario.

We realize that these are very bold statements that we are making, and they might appear unrealistic, crazy or one might just want to laugh them off (especially while holding a long position in the precious metals market). Please remember that one of our “crazy” predictions about silver breaking below its 2015 lows was realized very recently. These are crazy times, and “crazy” could indeed take place.

Miners have already showed exceptional weakness by declining in the last few days despite a move higher in gold and in the general stock market – a combination that previously triggered substantial gains. It happened on March 26, when we were entering short positions in the miners. Miners didn’t move much recently, but it was relatively normal at this stage of the decline – we wouldn’t count on this pace of decline to continue. Conversely, it’s likely to accelerate shortly.

On February 19, we posted a free article entitled “Warning – That’s Not a Buying Opportunity in Gold” and we summarized it by writing “You have been warned.”.

Today, we are telling you:

You have been warned. Again.

Of course, we can’t guarantee any kind of performance and all trading is risky, but hopefully, this move will generate you substantial gains.