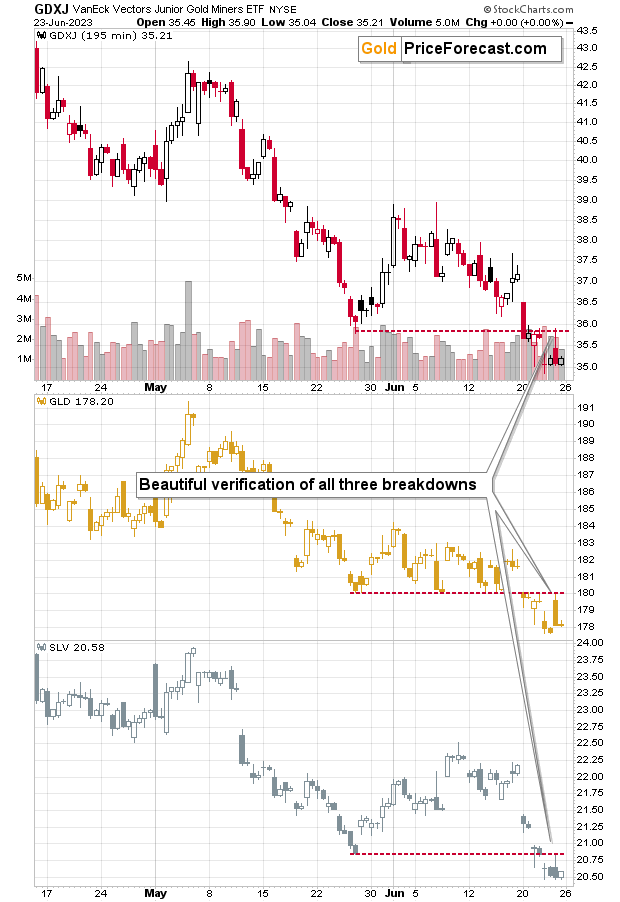

Classic. Informative. Just plain beautiful! That’s what the gold, silver, and mining stocks’ Friday’s verification looked like.

The rally that we saw early on Friday might have triggered some ‘bullish instincts’ among those that haven’t been looking at the trends and are not aware of even the basic technical rules.

Breakdowns are important, but verified breakdowns are critical!

Breakdowns and their Verifications

Consequently, just because we saw a rally during the first hours of the day didn’t make the short-term picture bullish. As always, the context matters.

And the context is that gold price, silver, and miners just broke below their May lows (precisely: the GLD (NYSE:GLD), SLV, and GDXJ ETFs).

It’s natural for the markets to move below certain levels and then test whether that move was true or not. If it fails, it means that the market was actually strong, and the decline was accidental or artificial. If the price fails to move back up and declines once again, it becomes obvious that the move lower was real, and it represented the true trend.

That’s all the early Friday rally was – a test. The fact that all three: GLD, SLV, and VanEck Junior Gold Miners ETF (NYSE:GDXJ), declined shortly thereafter confirms that the next short-term move is to the downside.

In today’s pre-market trading, gold and silver futures are moving higher once again (silver to a much greater extent), so we might see a second verification of the move, and it wouldn’t be odd either.

The important takeaway from Friday’s price action is that the bearish case for the short term got another confirmation.

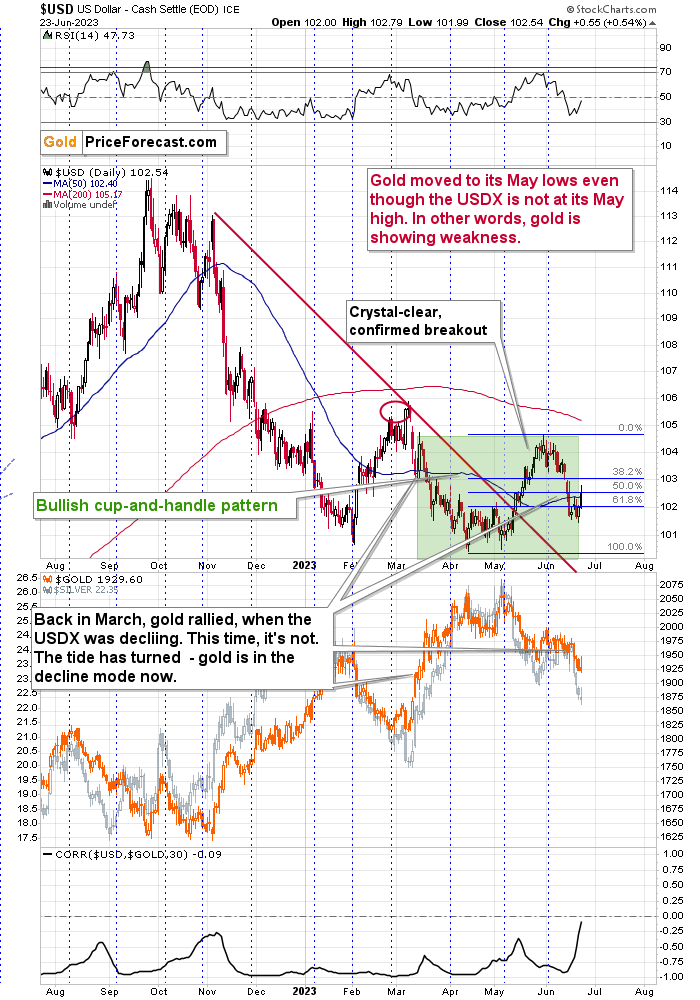

U.S. Dollar’s Strength

Please note that the USD Index also – finally – showed some strength, and it seems that it’s the very early part of a huge, medium-term upswing.

The key thing that’s visible on the above USD Index chart, though, is the fact that gold has been recently extremely weak compared to what the USDX has been doing.

Gold price just broke below its May lows, while the USD Index is not even close to its May high! Now that’s a weakness.

The precious metals sector just provided us with a bearish confirmation for the near term, and it’s likely to decline soon. However, we might see a short-term buying opportunity very soon – similar to the ones that we took advantage of in May and in July last year.