The XAU/USD pair is on a corrective growth trajectory, with buyers increasing their activity in response to mixed economic signals and expectations of changes in global monetary policies.

Fundamental Analysis: Impact of Monetary Policies and Macroeconomic Data

Last week, gold faced pressure due to U.S. macroeconomic data that raised doubts about the Federal Reserve's willingness to ease monetary policy in September or November. According to the Chicago Mercantile Exchange's (CME) FedWatch Tool, the probability of a 25 basis point cut in the benchmark rate in September fell from 49.0% to 44.9%. Some analysts now expect adjustments only in December, depending on future inflation dynamics.

Last Friday, gold found support from U.S. economic data: durable goods orders

rose by 0.7% in April, surpassing analysts' negative expectations. Additionally, the University of Michigan consumer confidence index increased to 69.1 points in May, above the forecast of 67.5 points.

Gold prices are also influenced by expectations of policy changes from the European Central Bank (ECB) and the Bank of England, which may adjust their stances in June due to slowing inflation and signs of economic deceleration. Furthermore, persistent geopolitical risks in the Middle East and Eastern Europe and the growing demand for physical gold by central banks, such as the People's Bank of China and the Central Bank of Russia, support gold prices.

Technical Analysis: Support and Resistance Levels

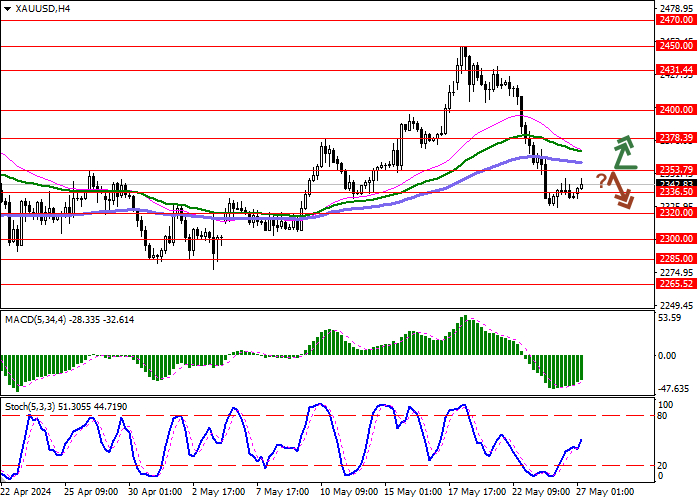

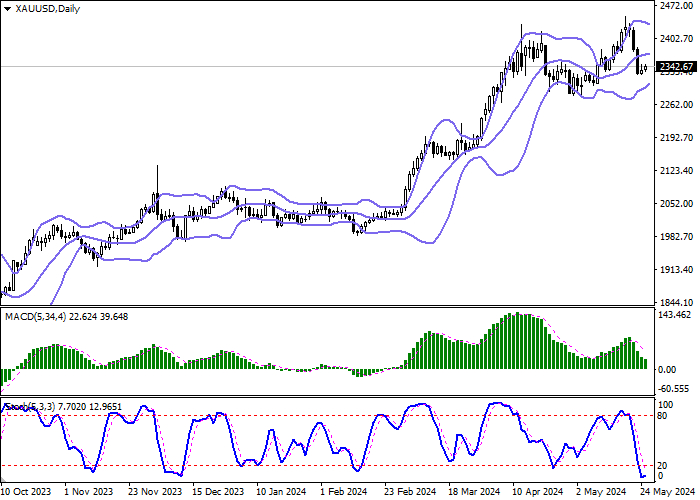

On the daily chart, the "Bollinger Bands" indicator bands show a horizontal reversal, reflecting a mixed market in the short term. The MACD is declining, indicating a firm sell signal, while the Stochastic, after reaching minimum values, has reversed upwards, signaling potential corrective growth.

Resistance Levels: 2353.79, 2378.39, 2400.00, 2431.44

Support Levels: 2336.50, 2320.00, 2300.00, 2285.00

Trading Strategies

Buy:

If the price breaks the 2353.79 level, open long positions targeting 2400.00 with a Stop Loss at 2336.50. Realization period: 2-3 days.

Sell:

If the price fails to break 2353.79 and falls below 2336.50, open short positions targeting 2300.00 with a Stop Loss at 2353.79.

Conclusion

The XAU/USD is at a critical moment, with buyers expecting a gold appreciation amid economic and geopolitical uncertainties. Adjust your strategies according to new information and stay alert to signals from central banks and macroeconomic data to maximize your gains.