Gold pushed above $3,000 an ounce last Friday and has continued to drive higher.

A lot of mainstream analysts forecast $3,000 gold for this year, but the pace of gold’s climb has been faster than most expected.

The price of gold hit new highs 40 times in 2024. This year, the yellow metal has already broken 14 records.

That Was Fast!

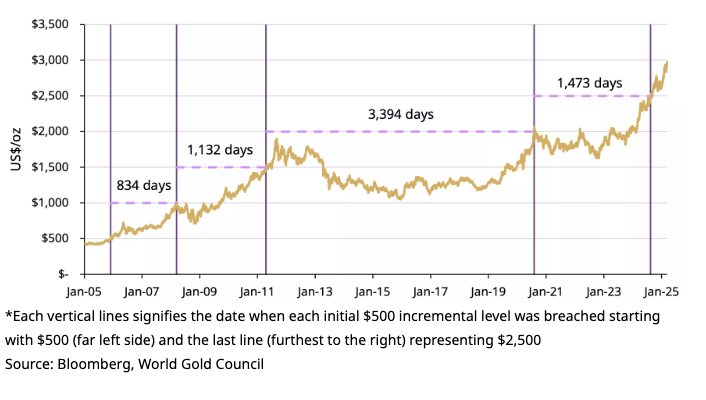

Gold's meteoric rise is unprecedented. It drove from $2,500 to $3,000 in just 210 days.

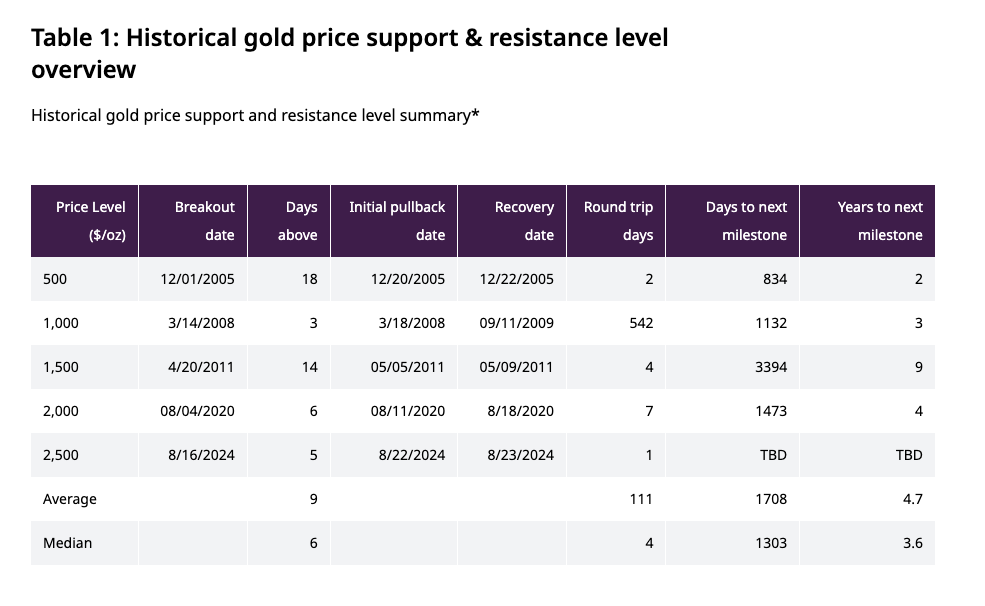

To put that into historical context, gold has taken an average of 1,700 days to reach previous $500 milestones.

Of course, each $500 price gain represents a smaller percentage increase. The price had to double to move from $500 to $1,000, while the most recent surge from $2,500 to $3,000 was a 20 percent gain.

Still, the pace of this bull run is impressive. Consider that the price of gold has increased sixfold since it first hit $500 an ounce in 2005. That annualizes to a 9.7 percent yearly rise. Meanwhile, the S&P 500 spot index is up 8.2 percent during that same period.

The speed of gold's rally is also reflected by the 200-day moving average (200DMA). The recent surge has pushed the price gains three deviations above the 200DMA. The last time we saw this kind of extreme divergence was during the pandemic when gold crossed $2,000 an ounce and then again right before the move above $2,500.

Can Gold Maintain This Momentum?

It wouldn’t be shocking to see some consolidation in the next weeks, given the speed gold overtook $3,000. It’s like a sprinter. She needs a little time to catch her breath before the next race.

Historically, gold has held above previous multiples of $500 for an average of nine days before pulling back and consolidating. However, those periods of consolidation tend to be short-lived. Four out of five times, gold has rebounded to recover those previous highs within a few days four out of five times.

The World Gold Council pointed out that if gold holds $3,000 over the next couple of weeks, it would likely trigger additional buying from derivative contracts.

"For example, we estimate there is roughly $8 billion in net delta-adjusted notional in options contracts from US gold ETFs that expire Friday 21 March, 4 and $16 billion in options on futures that expire on 26 March. While this may create a slingshot effect, it could also trigger short-term-profit taking."

The World Gold Council speculates that the higher price will continue to create headwinds in the jewelry market, but investment demand should remain robust.

“In view of the speed of gold’s latest move, it would not be surprising to see some price consolidation. But despite potential short-term volatility, the most important determinant for gold’s next move is whether fundamentals can provide long-term support to its trend. As we discussed in our recent Gold Demand Trends, while price strength will likely create headwinds for gold jewelry demand, push recycling up and motivate some profit taking, there are many reasons to believe that investment demand will continue to be supported by a combination of geopolitical and geoeconomic uncertainty, rising inflation, lower rates and a weaker U.S. dollar.”

Most significantly, the fundamentals supporting this gold rally remain in place. It is likely uncertainty and market volatility stirred up by the trade war will continue. Despite some optimistic February CPI data, price inflation remains elevated and the Federal Reserve is still caught in a Catch-22. There are growing recession worries. There is no sign that central bank gold buying will slow any time soon. And most significantly, we still haven’t reckoned with the consequences of monetary malfeasance that began in the wake of the 2008 financial crisis and went on steroids during the pandemic.

Originally Published on Money Metals.