- Gold prices remain near record highs - is the rally overstretched?

- Yen hovers at multi-decade lows, FX intervention still on the radar

- Dollar inches lower, stocks trade sideways, RBNZ meeting next

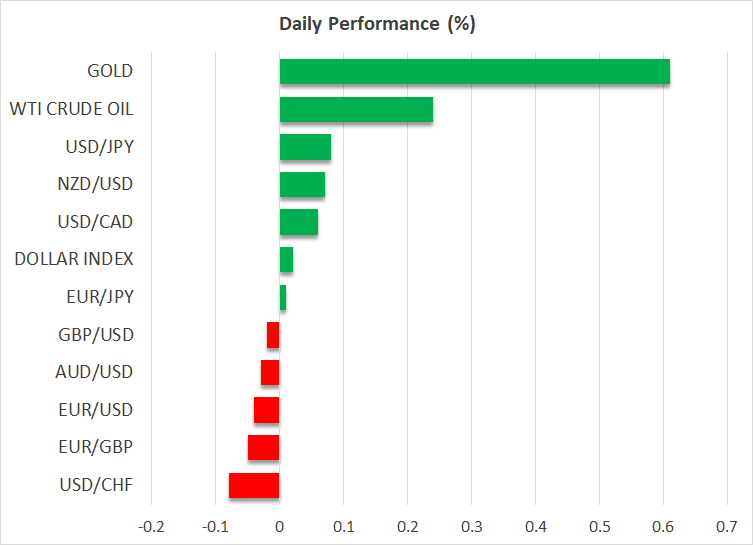

All that glitters is gold

The world’s oldest safe-haven asset has gone on a tear this year, rising more than 13% to reach consecutive new record highs, despite the negative pressure exerted by rising bond yields and a firmer US dollar.

Gold has been turbocharged by purchases from central banks, with China leading the charge as the nation seeks to reduce its dependence on the US dollar. Chinese consumers have also gone on a buying spree, searching for protection from the crash in local property and equity markets. Safe haven flows probably played a role too, amidst an unstable geopolitical landscape.

In the near term, the risk is that this rally has gone too far, too fast. Momentum oscillators detect extreme overbought conditions, warning of a potential pullback in gold prices.

But aside from the rally looking overstretched, the fundamentals still favor gold buyers. Gold represents only about 4% of China’s official foreign exchange reserves, so there is lots of scope for these purchases to continue. Similarly, gold can still benefit from falling yields as central banks begin to slash interest rates, particularly if the global economy loses steam.

Yen flirts with FX intervention threshold

In the FX arena, the Japanese yen continues to languish, trading within striking distance of its lowest levels in 34 years against the dollar. Despite the Bank of Japan’s symbolic rate increase last month, US-Japan yield differentials are still extremely wide, keeping the yen on the ropes.

Rising oil prices and the euphoria in stock markets have further suppressed demand for the safe-haven Japanese currency. To stop the bleeding, Tokyo has resorted to threatening another round of FX intervention, with finance minister Suzuki reiterating today that they “won’t rule out any options”.

Yet, Suzuki did not use language that would suggest he is ready to pull the intervention trigger, such as describing FX moves as “excessive” or “one-sided”. So even though the verbal warnings have intensified, it doesn’t seem like Tokyo will step in to defend the 152.00 region in USDJPY.

This view is shared by the options market, where implied FX volatility has remained fairly low, indicating that traders are not betting on any massive yen moves in the immediate future.

Instead, the real ‘danger zone’ for intervention might be closer to 155.00 - 156.00 in USDJPY, although the speed of any such move will be infinitely important. The faster the depreciation, the higher the risk of intervention.

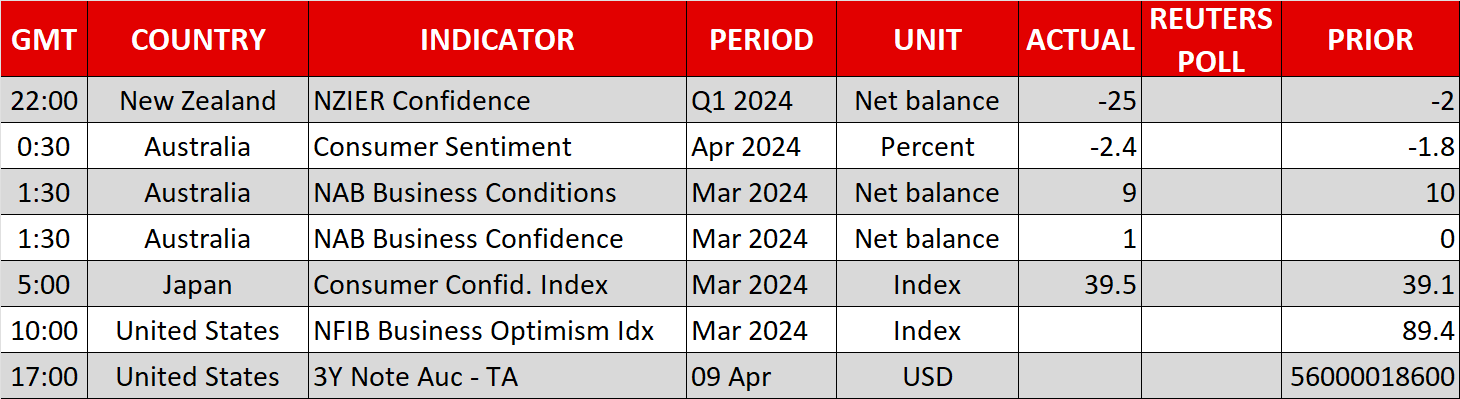

Dollar ticks down, stocks flat, RBNZ in focus

Meanwhile, the US dollar took a step back on Monday, without much news to speak of. Tomorrow’s CPI prints will be crucial for the greenback, as the persistence of inflationary pressures will go a long way in deciding whether the Fed will cut rates in June.

Shares on Wall Street traded sideways, waiting for fresh catalysts to drive the action, such as the upcoming CPI data and the earnings season.

Finally in New Zealand, the Reserve Bank will conclude its meeting early on Wednesday. No action is expected, so the kiwi dollar could remain at the mercy of China developments.