There has been quite a bit of chatter related to precious metals lately. The rally in cryptos, particularly Bitcoin, and various other stocks have raised expectations that gold and silver have been overlooked as a true hedging instrument. As these rallies continue in various other stocks and sectors, gold and gilver have continued to trade sideways over the past 6+ months. When and how will it end?

Gold Support Nears $1,765 May Become New Launch Pad

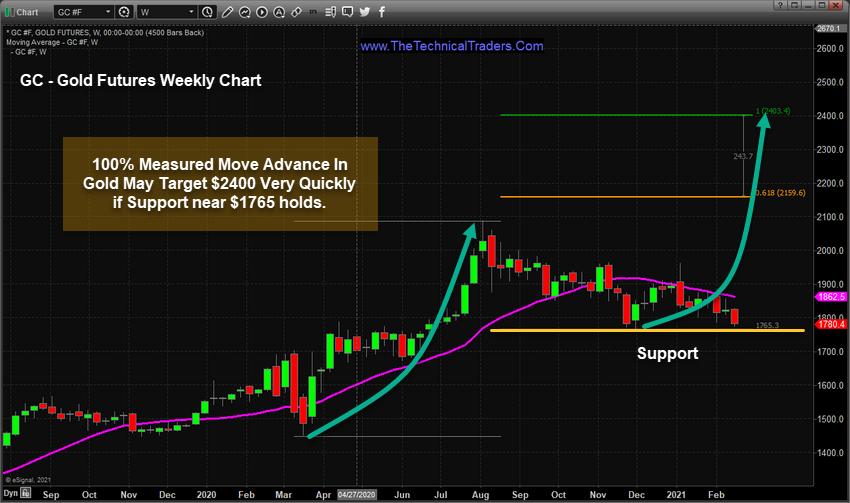

My research team and I believe the recent downside trend in gold has reached a support level, near $1,765, that will act as a launching pad for a potentially big upside price trend. This support level aligns with previous price highs (May 2020 through June 2020) after the COVID-19 price collapse, which we believe is an indication of a strong support level. As you can see from the gold futures weekly chart below, if gold price levels hold above $1,765 then we feel the next upside rally in metals could prompt a move targeting $2,160, then $2,400.

The February 2021 gold contract expires on Feb. 24 – only a few days away. The CME Delivery Report shows an incredible amount of contracts already giving notice of a “delivery request.” This suggests that on or near Feb. 25, a supply squeeze for gold and silver may become a very real component of price.

For example, there are 32,831 contracts requesting delivery for February 2021 COMEX 100 Gold Futures as of Feb. 16, 2021. That reflects a total delivery obligation of 3,283,100 ounces of gold. The silver contract deliveries are similar in size. As of Feb. 16, 2021, there are 1,865 February 2021 COMEX 5000 Silver contracts requesting delivery. That translates into over 9,325,000 ounces of silver.

We still have another five trading days to go before the February contract expires. How many more futures contract holders will pile into the Delivery cue at COMEX? And how will this translate into any potential price advance or decline?

Silver Trends Higher, Already Showing Strong Demand

Silver has already begun to move higher, while gold continues to wallow near recent lows. Our research team believes the next few days of trading in gold and silver could become very volatile as global traders suddenly realize the demand for deliveries may squeeze prices much higher. Traders should stay keenly aware of this dynamic in the precious metals markets as we may continue to see futures contract delivery requests out-pace supply as precious metals prices continues to move higher.

The 100% Fibonacci measured move technique we are showing on these charts helps us to understand where and how upside price targets become relevant. If support on these charts hold, and the Feb. 24, 2021, futures contracts expire with strong demand for physical deliveries, then we believe an upside price squeeze may setup fairly quickly (over the next five to 15+ days) in both gold and silver.

We need to watch how gold reacts near this support level and to pay attention to the delivery data from COMEX. If these levels continue to increase over the next few days, before the Feb. 24 expiration date, then we need to consider how and when the price will start to reflect this strong demand. Currently, gold price activity does not properly reflect what is happening in silver and platinum related to the demand for metals. We believe, over the next 30 to 60+ days, this will change as gold may enter a new bullish price phase – targeting $2,400. At this point, we believe the answer to this question will become known by Feb. 25 or so.

Precious metals, miners, rare earths and junior miners may set up some really interesting opportunities for traders. The entire metals/miners sector has been under moderate pressure recently and we believe that trend may be ending soon. This year is going to be full of these types of trend rotations and new market setups.