Gold has had a bit of a fall after last week's non-farm payroll result which was much stronger than expected coming in at 321k (228k). This in turn is a strong result and another month of strong results could see the Fed spurred into action about the possibility of raising interest rates in the market – or at least discussing the reality of when it would likely happen.

So gold is about to feel pressure—and pressure like no other—when US interest rate rises finally come about, but for now it’s all about the technical aspect of trading and gold has found a bearish trend line that is too strong for the current market to crash through.

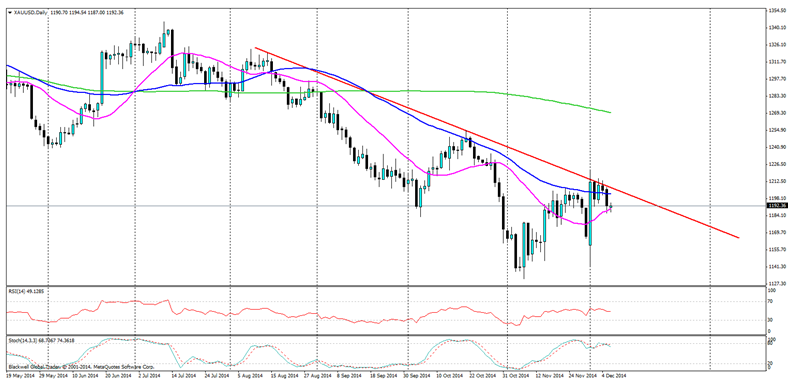

On the current charts we can see that gold has come under heavy pressure on the trend line and the market for the most part has looked to obey the trend line in control. With the current market pressure we can also see that the 200 and 50 day moving average are trending downwards as well. The 20 day MA is currently acting as support on the chart when there is no market news about to provide pressure or at least breakthrough.

With the market looking more and more volatile when it comes to commodities we could be on the point of a breakout at some point. However, with the global economy chugging along (especially the USA) it would seem likely that the trend line would hold, and the market will look to play gold lower.

So if you’re looking to trade gold this week, look for it to head lower. However, if you’re looking for a good entry point a pullback to the trend line seems to be the most solid option for metal traders at the moment.