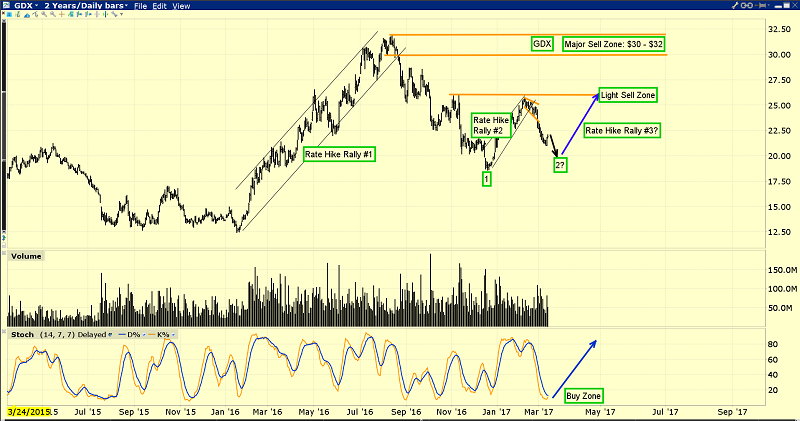

After Janet Yellen first hiked rates in late 2015, the precious metals market rallied in a big way in the first half of 2016. This is the GDX (NYSE:GDX) daily chart.

In late 2016 the Fed hiked again, but the metals market rally in 2017 has been more subdued. Why?

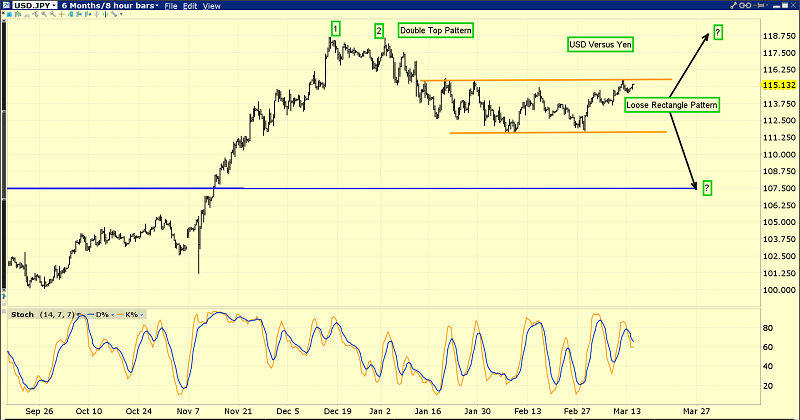

This is the dollar versus yen chart.

The bottom line is that the gold price has tremendous correlation to the price action of the dollar versus the yen. In 2016, the dollar collapsed against the yen. In 2017, the dollar has declined against the yen again, but only moderately.

Hence, the rally in gold and gold stocks has been less exciting than it was in 2016.

That’s a shorter term look at the dollar versus the yen. A loose rectangle is in play, and the next big move will almost certainly be determined by key fundamental news being reported this week.

On Wednesday, the Fed decides whether to raise rates, and the debt ceiling (which I call a floor) comes back into focus. There’s also a major election in the Netherlands. A populist win there could rock major markets. On Thursday, the Bank of Japan meets to decide its next major policy move.

Fundamentally, gold is well-supported, and the news this week is likely to be quite positive for gold and associated assets.

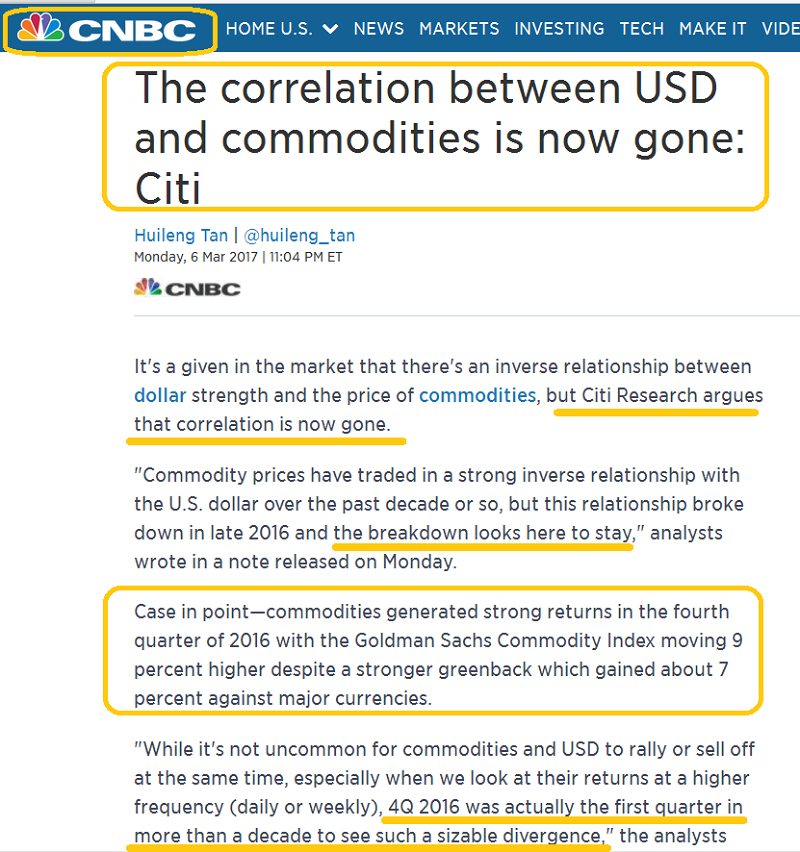

I’ve suggested quite emphatically that in a rising interest rate environment, both gold and the dollar can rally together, and top economists at CITI are now taking note of this fact.

That means their institutional clients are taking note of it, which adds more support to gold. Gold bugs clearly have nothing to fear from a higher dollar, and the dollar is floundering against the yen and the Swiss franc.

It may also be set to tumble against another key currency. After breaking a key uptrend line, the dollar seems poised to break down from a substantial double top pattern against the Indian rupee.

That would be good news for India’s current account, and increase the already-enormous gold buying power of Indian citizens. That’s because a surge in the rupee would chop the cost of gold in rupees, and Indians are obsessed with buying more gold when the price drops.

I’ve been adamant that investors need to fade the US stock market a bit (except for bank stocks which benefit from higher rates), and buy Chindian markets.

In a nutshell, the American empire is ending, and the Chindian empire is beginning. In the short term, the US business cycle is long in the tooth, and that’s when bank stocks and gold stocks are an investor’s best friend.

Rising rates will eventually crush the US stock market. India’s central bank chief appears to be little more than a government-appointed “yes man”. So, he’s unlikely to raise rates, even as the US hikes aggressively.

That’s going to create substantial institutional liquidity flows out of the US stock market and into India.

This is the spectacular Indian stock market ETF chart for INDA.

It’s blasting upside from a huge inverse head and shoulders bottom pattern. It’s a nice fantasy to believe that Donald Trump can cheerlead the US nation to “world leader forever” status. Horrifically, the reality of the US situation is far different from that wonderful fantasy.

Cheerleading works in a limited way when interest rates are low. When they rise and the yield curve inverts significantly, cheerleading doesn’t work at all.

That’s because institutional money managers don’t care what the top government cheerleader says or does when the yield curve inverts as rates soar. They just sell US stocks, and they do so… as a stampeding herd.

If Trump doesn’t renew Janet Yellen’s mandate to lead the Fed and appoints a government “yes man” in her place who leaves rates low, the banks will just keep their money at the Fed and the US economy will enter a state of significant deflation.

Trump is also beginning to pressure Japan to push the dollar lower against the yen. It’s likely a question of when, not if, Abe orders his central bank to kill the Japanese QE program. When that happens, the dollar could stage a dramatic collapse against the yen. If the dollar collapses against the yen, it will collapse in an even bigger way against gold.

The end of QE in Japan would create enormous liquidity flows out of government bonds and into the banking system. Inflation would surge, and Japanese citizens would be strong gold buyers and exporters of significant inflation to America.

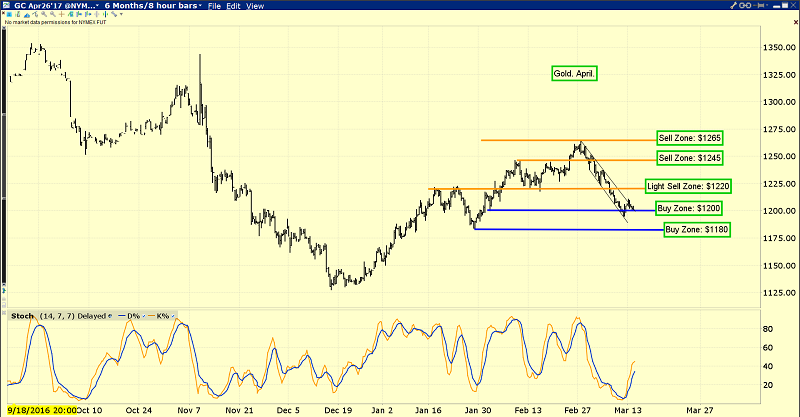

This is the important gold chart. The news events this week could easily send gold to my $1180 buy zone, and then to $1220 or even $1245. I’m a very happy gold stock buyer here in the $1200 area. It represents great value for enthusiastic gold market investors!

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?