In recent weeks we have commented on gold's 2016 performance from a number of perspectives.

Fundamentally, gold represents a vote of confidence against the competence of governments and central banks to continue to effectively manage their currencies, their budgets, and the growth of their economies. In a related function, gold is a currency with unique characteristics, much more difficult than fiat currencies for central banks to manipulate (although not impossible), and immune to dilution by money-printing. Finally, gold is also a commodity, and like other commodities, it tends to move in relation to the US dollar.

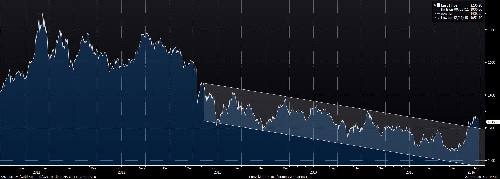

All three of these factors are in play in gold’s start to 2016.

Source: Bloomberg

We note that gold’s breakout above the multi-year downtrend highlighted above has afforded investors little opportunity to get onboard the rally. This buying has come even in the face of central bank liquidations -- some public (such as Canada’s) and some less than public (according to some reports, the central banks of some oil producing countries are quietly liquidating gold through private dealers).

The robustness of gold’s rally can also be seen in the relative performance of gold miners; significant outperformance of miners typically signals strong performance of gold itself. The graph below shows the ratio of the HUI Gold Bugs Index (which tracks gold miners) to the spot gold price; in January this ratio broke out above a multi-year trend line.

Source: Bloomberg

Technical analysts we follow believe that gold has bottomed and has begun a large-degree countertrend rally, and after some consolidation of the recent move, have big picture targets of $1472 and $1572.

Investment implications: Many converging analyses, both technical and fundamental, suggest that a rally in gold is now developing which could see a major move from December’s $1046 low. Indeed, we believe that the bottom of gold’s multi-year bear market is in, and if the world’s political and economic trends continue to develop as they are at present, we may be seeing the unfolding of something even more significant. We are buyers of gold on weakness, and recommend the accumulation gold shares or gold share ETFs along with gold bullion or gold bullion ETFs with a target weight of 10 percent of an investor’s portfolio. We will keep you apprised of trends in gold and suggest times to add to positions or take partial profits.