Since the last hawkish move by the Federal Reserve on Jun 13-14, Gold Futures witnessed a sell-off after facing stiff resistance at $1,970 and continued to slide to hit a low at $1,900 on June 29, 2023.

Some odds and hopes for a reversal were in support of the bulls at this low, resulting in a pullback, but once again, futures are facing stiff resistance at $1,939.58.

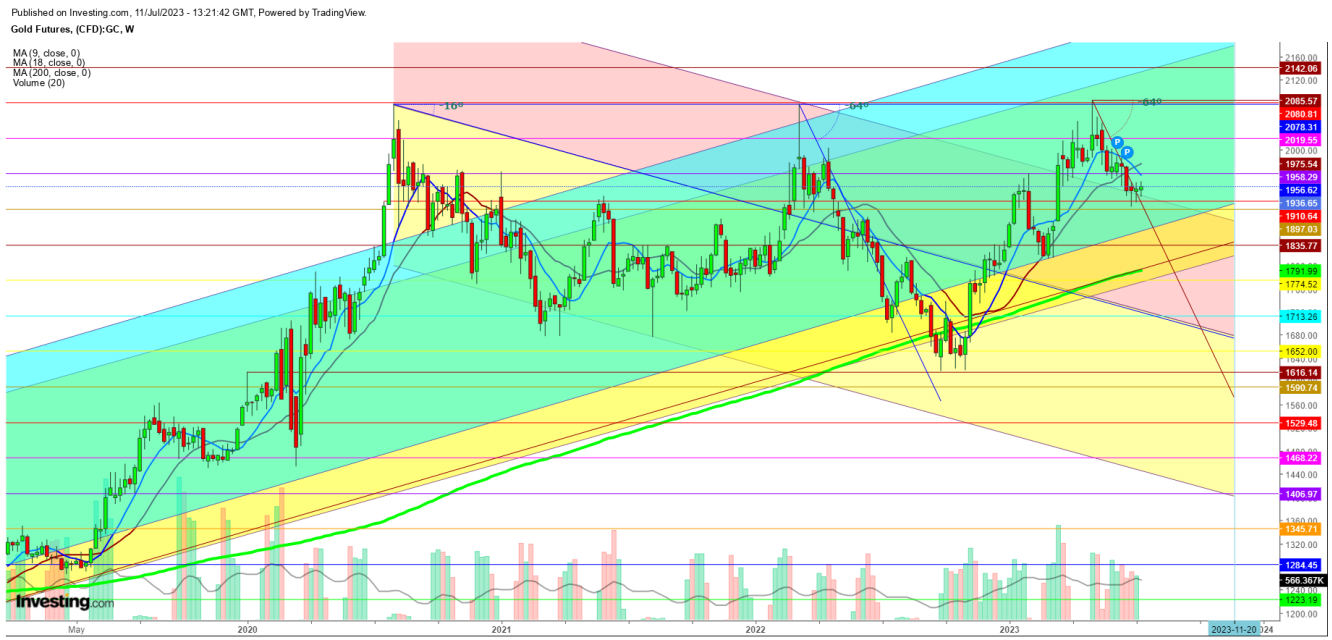

In the weekly chart, gold futures are trying to hold above the immediate support at $1,918 and the second support at $1,902, but constantly facing stiff resistance above $1,958 for the last two weeks - which suggests a selling spree is likely to start soon as the 9 DMA crosses 18 DMA with a down move, resulting in the formation of a bearish crossover.

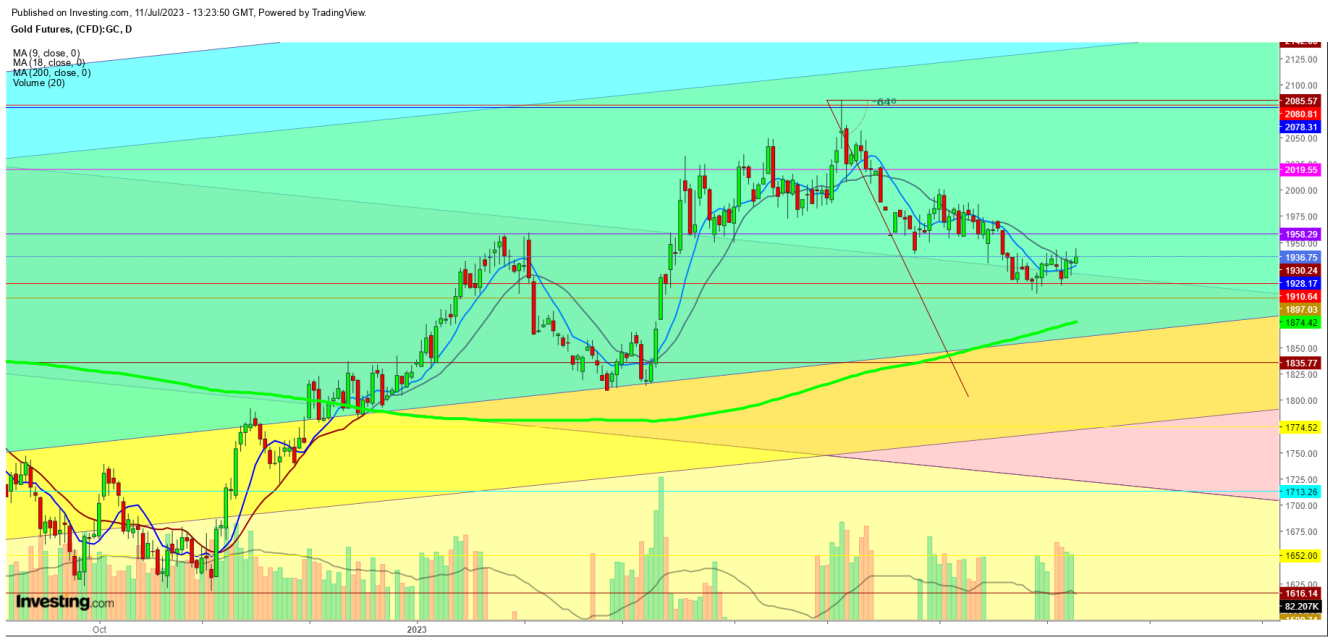

In the daily chart, futures are showing some strength in expectation of positive steps by the Federal Reserve in its upcoming meeting this month.

Futures could remain a little volatile for some more time before a breakdown starts below $1,939. On the other hand, a bullish crossover could complete its formation if futures sustain above $1,948 during this week, which could result in some bouncing moves.

Finally, I conclude if a sudden selling spree pushes the price up to the 200 DMA in the daily chart, which is at $1,874, it will provide an opportunity to go long. On the other hand, any upward swing above $1,962 will attract bears to come forward. Gold futures are likely to wobble in a narrow range up to the Federal Reserve meeting on July 25-26, 2023.

Disclaimer: The author of this analysis does not have any position in Gold futures. All the readers are advised to take any position at their own risk.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold: Selling Spree Awaits Fed’s July Move

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.