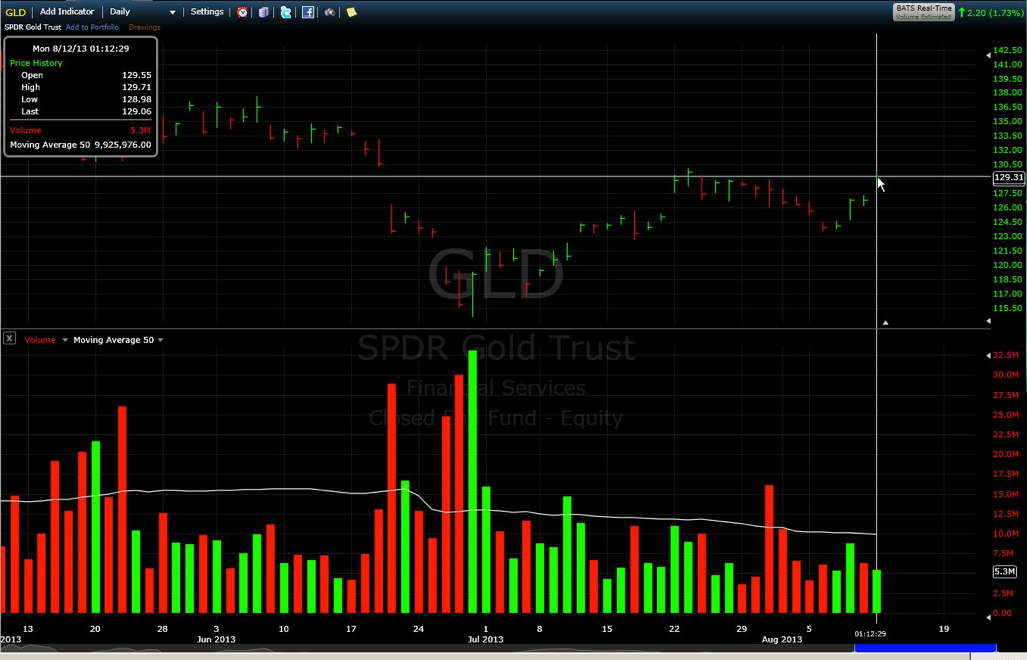

Last month I called a short-term top for gold. On July 23, SPDR Gold Trust (GLD) topped out at $130.14 and proceeded to fall to $124 by August 7. We are now testing $130 again on GLD as seen in the following chart.

Expect A Fall

As you can see from the chart, we are at a short-term double top and I do expect a fall from here for a couple reasons. One is that the volume is now that great. If we are breaking out to higher highs, you want the volume to be there and it simply isn’t. The second reason I don’t see gold moving higher over the short term is the dollar has bottomed out as seen in the following chart.

The Dollar Index chart shows that we just came close to the June low of the dollar, which would have given us a perfect short-term double bottom as today the dollar moved higher. The dollar fell quite quickly from the June highs where it came close to hitting 85 on the index.

Still Dollar Bullish

As many of you know, I have been dollar bullish since about September of 2011. This has not changed. I realize this goes against most people you read, especially those that sell gold like I do, but I have to call things like I see them and be able to look at both sides of an issue and the data to come to a conclusion as to what’s really going on. While some who sell gold talk of manipulation in the markets, I simply state that’s what Market Makers do. They love to tease investors and then switch on a dime.

The fact is that I think treasuries will get stronger from here as well and the Fed, with as much QE as they have thrown at the economy, can’t seem to get the data to where they want it. Their efforts of throwing QE out there are ineffective and they won’t be tapering anytime soon. This is actually bullish for stocks over the short term, but not mining stocks which have had a nice bounce up of late. The Fed is indeed stuck between a rock and a hard place and I don’t think will be doing anything soon except watch the markets. Bernanke did his job in spooking the stock market in May with his “talk” of tapering. But that’s not going to happen anytime soon as I said. It does show you that the market is trading based on what Bernanke or the Fed says and does, and not on valuations. This is not how markets are supposed to work, but for now, do pay attention to what the Fed says.

False Breakout In Gold

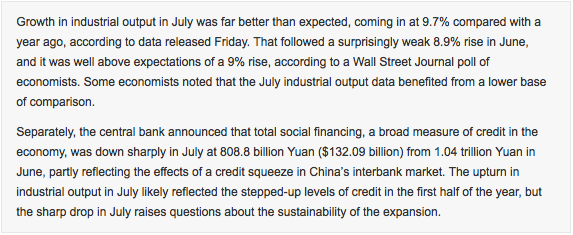

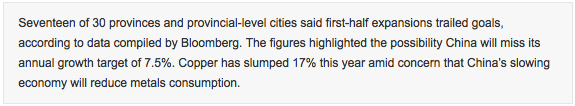

What I believe we are seeing occur over the last few days, and possibly for a day or two longer (but not if the dollar keeps rising), is a false breakout in gold, and especially silver. Some of this most recent euphoria stems from reports from China that industrial output was better than expected.

Wasn’t it just 10 days before that report that we were seeing China reporting tepid growth?

I do still think we will test the lows in the price of gold and silver in the weeks ahead, especially when the traders come back from there summer vacations. Keep an eye on the volume and be patient with your investment dollars. Dollar cost averaging into your allocation of gold and silver is still the way to go. As I have said multiple times, this is the tortoise vs. the hare approach that one should take with gold and silver. Once you are fully allocated into your position, then go about your daily lives and don’t watch the ups and downs of gold as one week you’ll be happy and the next week sad. Investing in physical gold is insurance for your portfolio. It’s the peace of mind knowing that no matter what happens in the economy, you have true wealth. You have purchasing power. You don’t need to go to a bank that’s closed to get dollars to spend, although I do feel it prudent to keep cash on hand as well.

For those that are new to buying gold and silver, dollar cost average into a position which is what many of my clients are doing. For those that have already allocated their position into gold and silver, see you on the other side of $2,000 gold and $40 silver (if not higher) in the next few years.

No other investment has as much potential as gold and silver and the prices you are buying at today, and hopefully lower tomorrow, takes the guessing game away from the equation. You aren’t going to catch the exact bottom. You know gold and silver are selling at a discount today from where they were. You know dollar cost averaging into a position will get you a better overall price.

Your hardest decision is “when to sell?” That, I can help you with in the future. It will be happy times for all who are invested in gold and silver.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Sees Double Top As The Dollar Rebounds

Published 08/12/2013, 02:21 PM

Updated 07/09/2023, 06:31 AM

Gold Sees Double Top As The Dollar Rebounds

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.