Gold Road (ELKMF) has identified 22 new high-priority gold targets from Airborne Sub-Audio Magnetic (SAM) survey within the Sumitomo JV tenements at the Breelya-Minnie Hill Gold Camp conducted in July 2013, adding to 13 new targets announced last week at the wholly owned Pacific Dunes-Corkwood Gold Camp north of the Central Bore deposit, which augurs well for the gold-producing potential of the broader tenement portfolio.

Sumitomo JV adds 22 new high-priority targets

The 22 gold targets were identified over an area spanning c 85km2 using the SAM survey in July 2013 by Gap Geophysics Australia, with almost all aligning with gold anomalies reported from previous sparse and widely spaced drilling. Follow-up drilling at Breelya-Minnie Hill is expected to commence by end-2013. Under the terms of the JV agreement, Sumitomo will spend a further c A$1.3m by December 2013, with a further c A$1.75m by 2014 to fund exploration of the JV tenements. The option to fund up to A$5m or $8m by December 2016 allows the JV partner to earn up to 30% or 50% interest respectively in the project.

Pacific Dunes-Corkwood Gold Camp adds 13 targets

On 15 August, Gold Road also announced it had identified 13 gold targets using the SAM survey at the Pacific Dunes – Corkwood Gold Camp, 65km north of the 100%-owned high-grade Central Bore deposit. Completion of the Central Bore project’s pre-feasibility study (PFS) is now expected by mid-November 2013.

Valuation: Shares at 81% discount

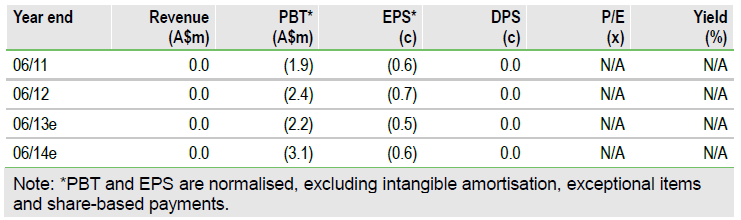

Our 37.4c/share sum-of-the-parts valuation, up from 33c/share, reflects both the impact of a lower AUD (previously US$/A$0.9979), coupled with the shorter time to assumed start of production underpinning our NPV calculation, whereby small-scale production commences at Central Bore by end-CY14. We have added 27.9c/share for the remaining resources, derived by benchmarking forecast residual levels against the global average EV/in situ values for measured, indicated and inferred ounces for the Australian market (see our sector report Gold: New benchmarks for old), which is then discounted back into current money terms. At 7c/share, the market is applying an 81% discount to Gold Road’s EV/in situ values for measured, indicated and inferred ounces compared to global average benchmarks, which, when applied, generates a valuation of 5.2c/share for the remaining resource and an overall sum-of-the-parts-valuation of 14.7c/share. Our revised forecasts reflect net cash of c A$8.9m at end-June 2013, pending the release of complete FY13 financials expected in September 2013.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Road Resources Shares At 81% Discount

Published 08/20/2013, 07:31 AM

Updated 07/09/2023, 06:31 AM

Gold Road Resources Shares At 81% Discount

New gold targets identified in South Yamarna

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.