- Gold rebounds and returns above uptrend line.

- A move above 2,720 could brighten the outlook.

- A dip below 2,530 could change the picture to bearish.

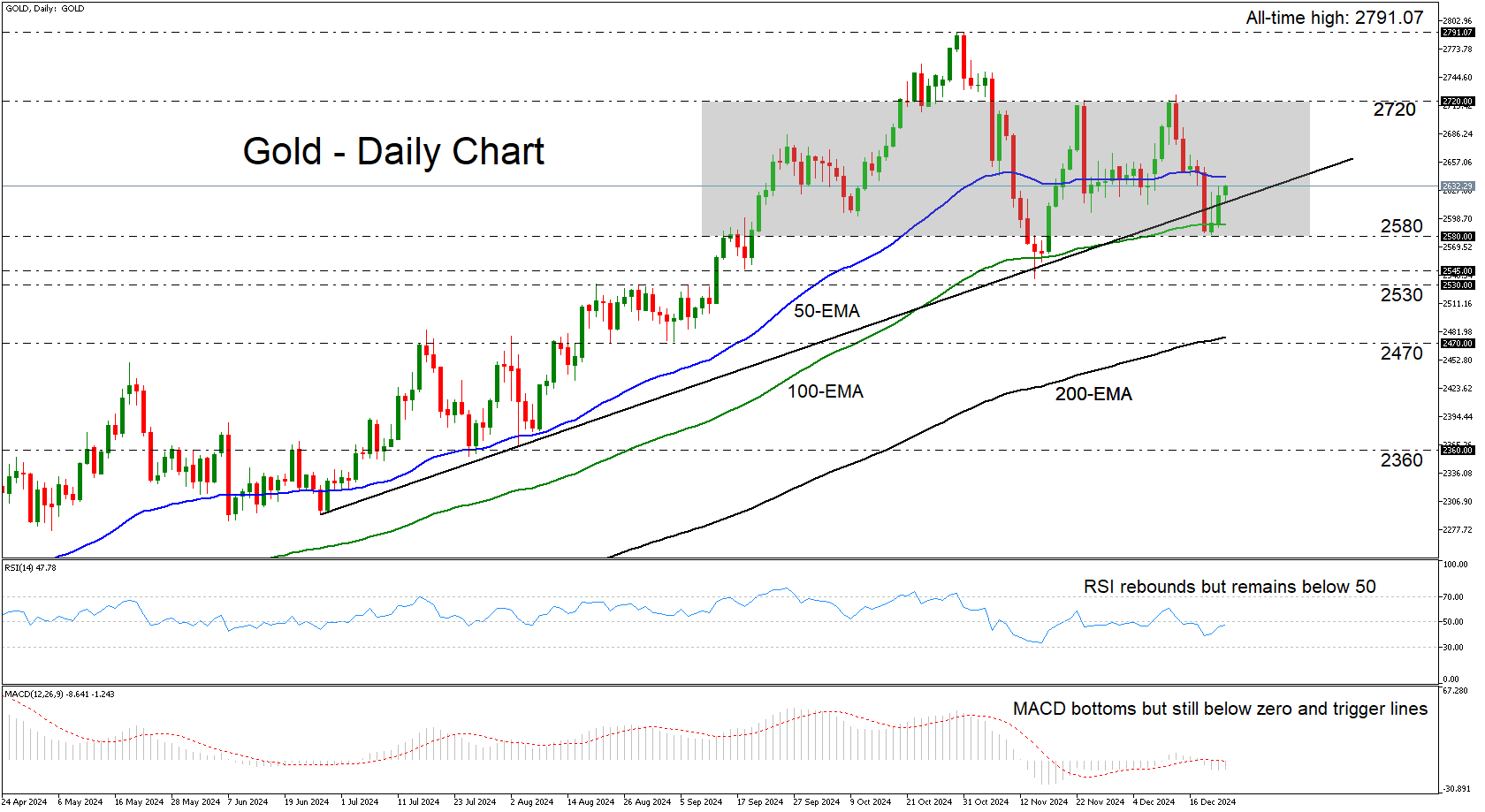

Gold moved higher after triggering some buy orders near the 2,580 zone on Thursday. On Friday, the price closed above the uptrend line drawn from the low of June 26, but even with the advance continuing today, the metal remains below the 50-day exponential moving average and still within the neutral zone between 2,580 and 2,720.

The neutral outlook is supported by the momentum indicators as well. The RSI rebounded but stayed below 50, while the MACD, although it also showed signs of bottoming, remains below both its zero and trigger lines. Both indicators point to slowing negative momentum, but nothing suggesting that the bulls have gained the upper hand.

For that to happen, gold enthusiasts need to drive the action all the way above the key resistance zone of 2,720. Such a move could pave the way towards the record high of 2791.07, or even allow traders to climb higher and explore uncharted territory. But before all that, the first battle the bulls may need to prepare to give is around the 50-day EMA.

On the downside, a dip below 2,580 would confirm the metal’s return below the uptrend line, but the move turning the picture negative may be a clear close below 2,530, a zone that acted as strong resistance between August 20 and September 11. After that, the bears may feel confident to dive all the way down to the low of September 4 at around 2,470.

To sum up, gold rebounded and returned above the uptrend line taken from the low of June 26. However, for the outlook to turn overly bullish again, traders may have to climb above the 2,720 resistance zone.