Gold

The correlation between the US Dollar and gold broke down this week with the yellow metal posting its third consecutive weekly gain despite the rally in USD. Much of this dynamic is explained through the continued slide in equity markets this week, fuelling a strong safe haven bid in gold. After rallying initially on the week, US equities slumped mid-week as the US Dollar gained traction again in response to the hawkish US FOMC minutes, which confirmed that the majority of FOMC members view further rate hikes as necessary given economic momentum.

The market is widely expecting a fourth .25% rate hike in December this year. The release of the latest economic data continued to support this view with the leading economic index rising 0.5% in September along with solid numbers in both initial jobless claims and the Philadelphia Fed business outlook. Despite the gains in USD though, it seems that while equities continue to display weakness, gold will retain a bid.

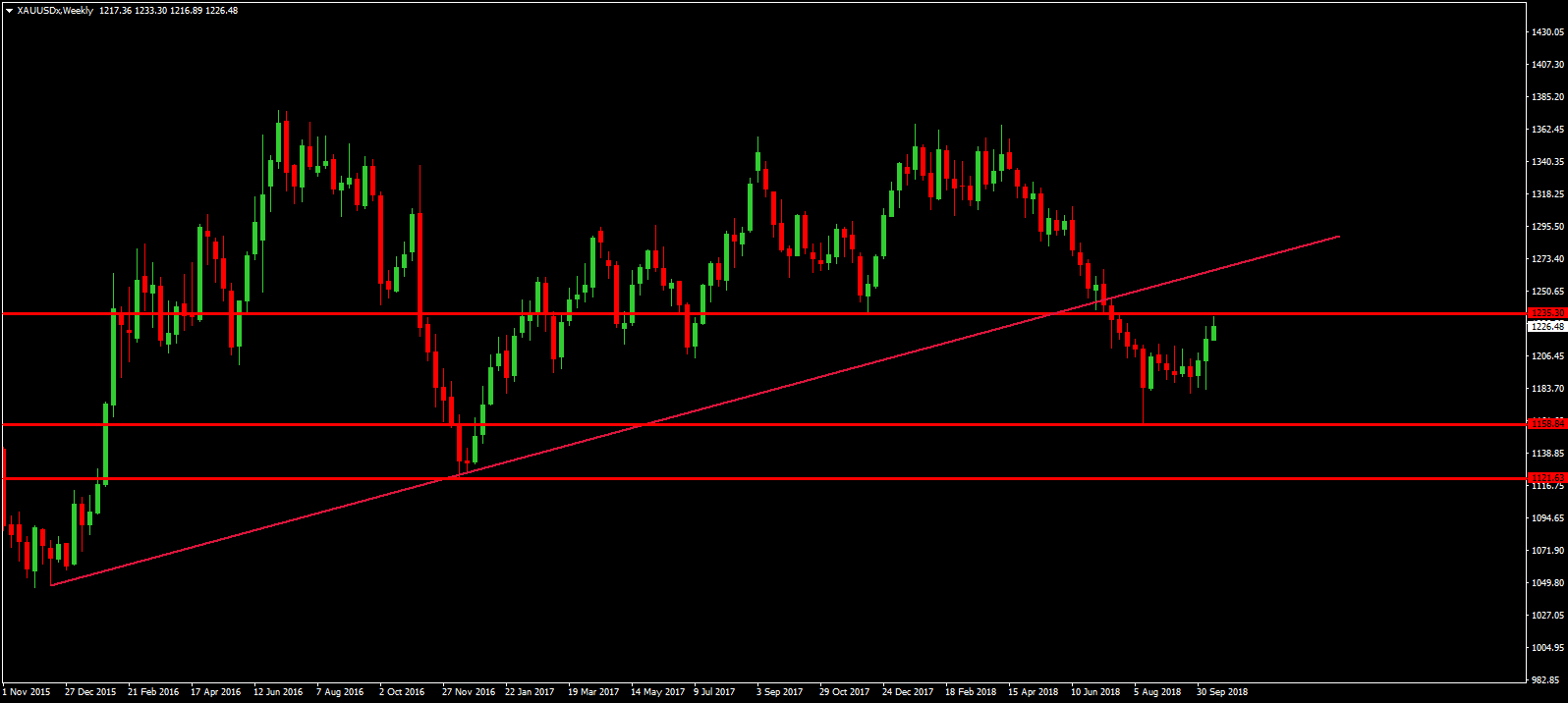

The rally in gold has taken price back up to retest the underside of the broken December 2017 low of 1235.30 which is holding as resistance for now. Above there and focus will be on a test of the broken rising trend line from 2015 lows. To the downside, the 2018 low of 1158.84 is the first key level with the late 2016 low of 1121.63 below that.

Silver

Silver prices were broadly unchanged on the week, giving up initial strength in response to the renewed slump in equity prices. Silver was hard hit last week on the drop in US equities given the metals industrial usage which often sees it trading in tandem with US equities, particularly the industrial average.

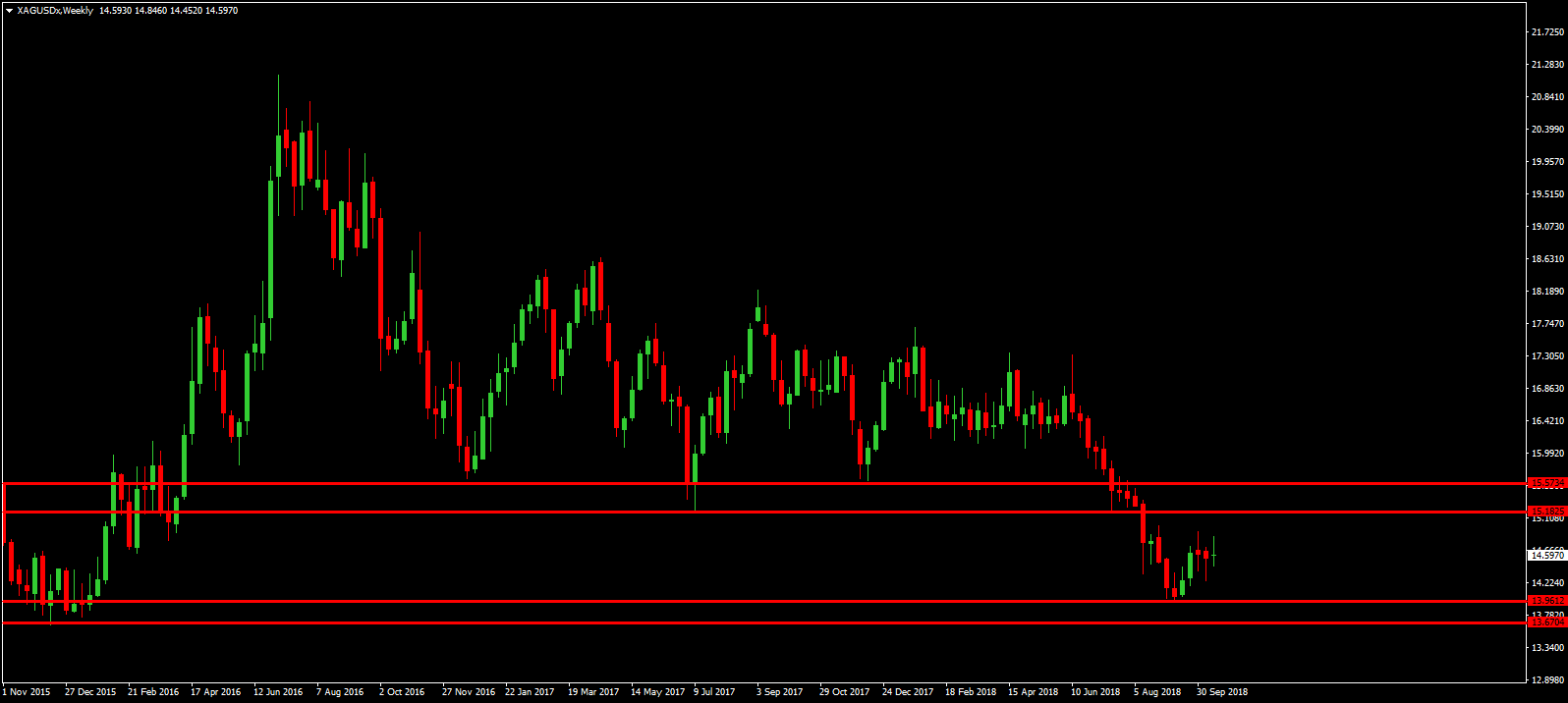

Silver prices remain sat just above the 13.6704 – 13.9612 level support which has stemmed the decline for now. However, unless the price makes it back above the 15.1825 – 15.5734 level, the focus will be on the further downside.

Copper

The red metal came under pressure once again this week given the reversal in risk appetite as equity markets retreated in light of a hawkish Fed. Copper was doubly hit by the continued slump in Chinese markets, with China being the biggest global consumer of copper. The persistent and growing threat of trade wars and fears of a slow down in China have seen investors moving out of Chinese assets, taking its toll on key commodity prices.

Copper prices are still fighting it out around the 2.764 level which has oscillated between being support and resistance over recent months. To the downside, we have further support along the local rising trend line from mid-2017 lows and 2018 lows. Below there we have the increasing long-term trend line from 2016 lows. Interestingly, it seems copper is forming a head and shoulders pattern currently which holds the potential for a larger reversal lower over the longer term.

Iron

Despite the moves seen across most of the rest of the metals complex, iron ore was once again stronger over the week. Iron has been supported recently by news of further steel capacity cuts in China. It was reported this week that several key steel mills including Jiangsu Yonggang Group have been ordered to slash production by as much as 50%, boosting steel prices in the face of reduced supply.

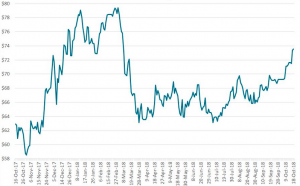

The rally in iron ore prices this week has taken price up to its highest level since March this year. Price is now challenging resistance around the $73 mark where we have a few big prior lows sitting as structural resistance. If we see any retracement lower from here, a retest of the $70 – $68 level is likely to act as support.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.